[ad_1]

Litecoin (LTC), one of the earliest Bitcoin forks, is only 100 days away from a block reward reduction event that plans to make it harder for the tokens to be mined—which could make the circulating supply of LTC more valuable.

The Halving Event

Much like bitcoin, from time to time Litecoin goes through a fixed process called halving that reduces the rewards miners get for mining a block, which in turn reduces its rate of issuance. Every time 840,000 LTC blocks are mined the coin reward is cut in half. This event is scheduled to happen every 4 years since the current block generation time is set to approximately 2.5 minutes, producing 576 blocks per day.

Around Aug. 6, 2019, at exactly block 1,680,000, miners who are currently being awarded 25 new LTC for every block they solve will only be rewarded with 12.5 LTC per block. The inflation rate of this cryptocurrency will also be impacted for an extended period of time as the reduction in future supply increases.

This event will continue to happen until the total supply of 84,000,000 LTC are mined. While it is unknown when the last few coins will be mined, it is expected to be around 2142 based on the current rewards schedule. By then, approximately 0.00000672 LTC will be mined each day until eventually, all the tokens are in circulation.

Past Halving Events

Litecoin has only had one halving event since it went live on Oct. 13, 2011. The first block reward reduction took place on Aug. 26, 2015, at a block height of 840,000. At the time, the mining reward dropped from 50 LTC per block to 25 LTC. The event had a great impact on the market valuation of this cryptocurrency, which was perceived before and after it occurred.

Following a consolidation phase that lasted more than a month, from Apr. 13 to May 21, 2015, where LTC was trading between $1.35 and $1.5, the price finally broke out on May 22, 2015. In a matter of 48 days, Litecoin skyrocketed from $1.48 to $8.97, which represented a 506.08 percent move.

After reaching its peak on July 9, 2015, one and a half months prior the halving, LTC went back down 76.24 percent to trade at $2.4 just one day before the event. Litecoin more or less spent the following months staggered between $2.87 and $3.24 until the bull run started on Mar. 30, 2017, which took it as high as $370.78.

Buy the Rumor Sell the News

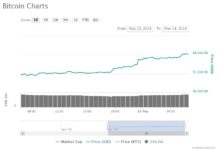

As history tends to repeat itself, the market valuation of Litecoin began experiencing a steady rise since the low of Dec. 7, 2018, when it was worth $22.54. So far this cryptocurrency has gone up as high as $99.43, which represents a 341.13 percent move.

Just as it happened in the previous halving, a lot of speculation seems to surround the event, but by the time it takes place most investors could have taken profits dragging the price down. Even though there could still be more room to go up, it is possible that the halving has already been priced in. Thus, venturing into a long position at this time just because the block rewards are decreasing could be extremely risky.

It’s worth noting that despite the price volatility that Litecoin may experience before or after the halving, it has been able to hold its own against other cryptos over the past eight years. This is one of the most solid projects in the industry that has managed to preserve a spot in the top 10 cryptocurrencies since 2013.

As Charlie Lee, the creator of Litecoin pointed out in a tweet:

Watch Litecoin surviving the test of time. It’s not easy fighting off all the shitcoins and scamcoins to stay in the top 10. 😀 https://t.co/7wWhBbxkKE

— Charlie Lee [LTC⚡] (@SatoshiLite) April 24, 2019

Litecoin, currently ranked #5 by market cap, is up 0.62% over the past 24 hours. LTC has a market cap of $4.49B with a 24 hour volume of $2.63B.

Chart by CryptoCompare

Litecoin is up 0.62% over the past 24 hours.

Filed Under: Litecoin, Price Watch

Disclaimer: Our writers’ opinions are solely their own and do not reflect the opinion of CryptoSlate. None of the information you read on CryptoSlate should be taken as investment advice, nor does CryptoSlate endorse any project that may be mentioned or linked to in this article. Buying and trading cryptocurrencies should be considered a high-risk activity. Please do your own due diligence before taking any action related to content within this article. Finally, CryptoSlate takes no responsibility should you lose money trading cryptocurrencies.

[ad_2]

Source link