[ad_1]

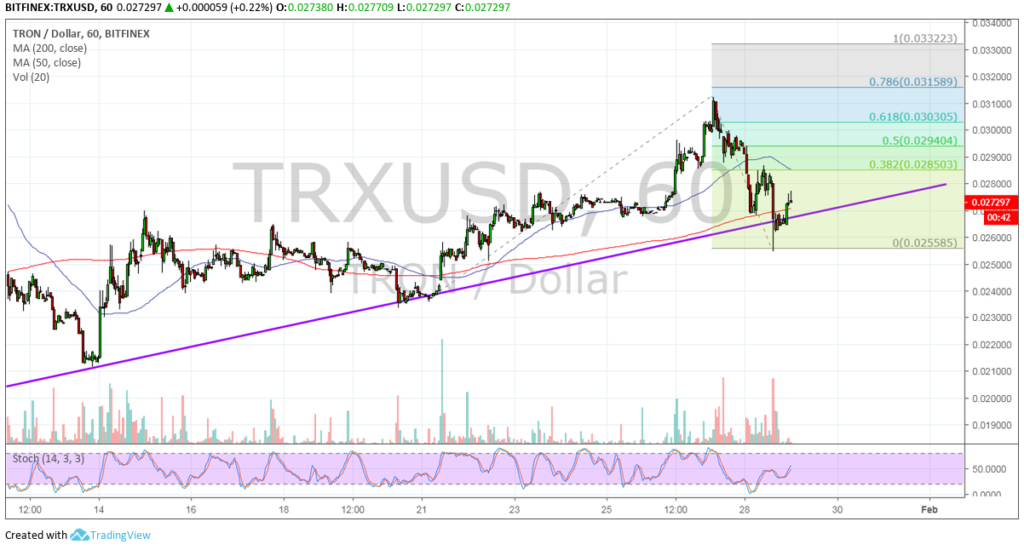

Tron has formed higher lows to trade above a newly-formed rising trend line visible on its 1-hour chart. Price also completed its pullback as the area of interest at the trend line and 200 SMA is holding as support.

Applying the Fibonacci extension tool shows the next potential upside targets. The 38.2% level is close by and in line with the 100 SMA dynamic inflection point. The 78.6% level lines up with the swing high and might be the first take-profit point for buyers. Stronger bullish momentum could take Tron all the way up to the full extension at 0.0332.

The 100 SMA is above the longer-term 200 SMA to confirm that the path of least resistance is to the upside. In other words, the uptrend is more likely to continue than to reverse. Price is below the 100 SMA, though, so there may be a bit of selling pressure in play.

Still, stochastic is pointing up after recently pulling out of the oversold region, indicating that buyers are regaining the upper hand. The oscillator has plenty of room to climb before hitting the overbought zone, which means that buyers could stay in the game for a bit longer.

Volume is also higher, confirming that bullish interest has picked up as Tron tested the trend line support. When sustained, this could also allow the rally to gain more traction.

Tron has been one of the better-performing coins these days as anticipation for the BTT coin is keeping price supported. The launch sale is set to last until February 3 and Tron holders are also expecting to receive BTT in an airdrop later this month.

Founder Justin Sun continues to grab market attention through his tweets, which explains the increased volumes as well. This is widely expected to bring Tron closer to mainstream adoption since BitTorrent has millions of active users.

[ad_2]

Source link