[ad_1]

Latest Bitcoin (BTC) News

There are specific advantages of Bitcoin over other traditional systems. Talk of immutability, efficiency and elimination of expensive third parties are some of them. Over and above everything else, Bitcoin is a freedom coin.

Read: Nasdaq’s Tokenizing Platform In Trial, Product Manager Confirms

As a coin holder, you have full control of your assets and whatever you do with your “hard earned” digital money depends on how secure your private keys are. It is what we get for efficiency and other attractive benefits not available in legacy fiat systems. With backing from the government—that formulate rules via its legislative arm—fiat is susceptible, may collapse in seconds due to local as well as international factors.

Meanwhile, the global and decentralized nature of Bitcoin means it is now serving a duo-role as a reliable settlement layer as well as a medium of exchange. As the adoption wave kicks in, Casual Hoteles, an award-winning Spanish hotel chain now accepts Bitcoin.

Also Read: Crypto Analysts Take Bet: Will Bitcoin (BTC) Hit $1,500 Or $6,500 First?

Like Bitcoin, the hotel describes itself as an abode for nomads and travelers from all over the world can now pay in BTC—without the inconvenience of huge spreads as they convert to Euros. Casual Hoteles has presence in eight Spanish cities and in days ahead, all BTC payments will be processed via BitPay.

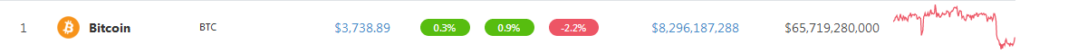

BTC/USD Price Analysis

Overly, market participants are upbeat expecting prices to edge past vital resistance levels at $4,500 and later $6,000. However, as positive as we may, bulls are yet to overcome these stumbling blocks.

Because of this, risk-off traders have an opportunity to load up on pull backs as long as prices steady above $3,800 in a minor bullish breakout pattern. If our optimism is met by a re-invigoration of Bitcoin (BTC) price action sparking a sharp rise above $4,500, bulls would easily pump BTC towards $6,000.

Trend and Candlestick Formation: Bullish, Minor bull Breakout

Despite liquidation of Feb 24, sellers have an upper hand. Our reference bar is based on Feb 18 breakout bull bar. Complete with above average volumes, Feb 18 is a reflection of bullish actions of late Dec-2018, early Jan and late Feb 2019. While Feb 18 bull bar is trend defining at least in the short-term, Bitcoin (BTC) buyers are technically consolidation days after clearing $3,800 with decent participation levels.

On a top down approach, BTC is technically bearish but the re-test phase will be marked by a retest of $6,000 and that means bulls must close above $4,500 as streams from price action invalidate the bear breakout of mid-Nov 2018. As a result of this, we expect a surge above $4,000 and $4,500 with this position being null if prices sink below $3,500—data from BitFinex.

Volumes: Bullish

As mentioned, Feb 18 anchors our analysis. It has high trade volumes—37k but with Feb 24 sell off threatening to cause a dump down, the only bull trend confirmation is if prices edge past the 38.2 percent Fibonacci retracement level of Dec 2018 high low at $4,000 and recent consolidation complete with high trade volumes exceeding 37k of Feb 18. Only then will aggressive traders ramp up on dips with targets at $4,500.

All charts courtesy of Trading View—BitFinex

This is not investment advice. Do your research.

[ad_2]

Source link