[ad_1]

Bitcoin Mercantile Exchange (BitMEX) is a “crypto-products trading platform” founded in 2014 by a group of former bankers behind HDR Global Trading Limited and is currently operating in Hong Kong while being registered in Seychelles.

BitMEX is probably best known for its margin lending capabilities, which allow its users to conduct a leveraged trade as high as 100 times, significantly amplifying the profit potential as well as potential losses.

With large daily trading volumes (usually between $500 million – $1 billion) and over 10 million users accessing the site every month, it’s safe to say BitMEX is one of the most liquid cryptocurrency trading platforms on earth.

There are no trading limits on BitMEX aside from an over 18 years age restriction, however, users should also be aware that BitMEX does not currently offer support or registration for U.S citizens due to ongoing legal compliances.

See below for a step-by-step guide on how to place a trade on BitMex

Signing up

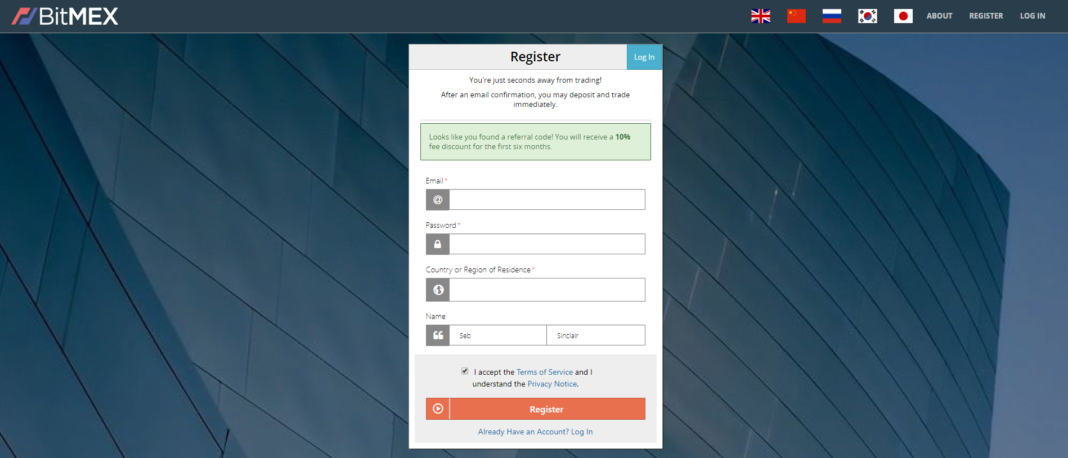

Users will need to register with the website in order to create an account and provide a genuine email address to start the registration process.

In the top right corner click on ‘register’ and fill in the blanks including your email, desired password, country of residence and name, select “I accept the terms and conditions” and click register.

Open up your email and click on “verify email,” the process should take you from your email application to a webpage that opens onto the exchange (we will come back to this shortly).

Instead of diving straight into trading, let us first assess your security and deposit funds into your account so that you may begin doing so.

Security

In the top left corner, select “account” and then navigate to the left window pane and select “my account,” this will bring you to a new page with the ability to now setup your Two-Factor Authentication (2FA).

In the section labelled “security”, you will see a dropdown menu providing you with an option to scan the barcode using an application of your choice, select “Google Authenticator.”

This barcode provides you with a unique code specific to your account for you to use via Google Authenticator.

Note: On this page, you can also select to change/update your password should you so choose in the future.

You will then be signed out and forced to re-enter your login details except for this time you will need your 2FA security key as well.

Depositing Funds

Once your security has been configured, head over to the “Deposit” page located in the lefthand window pane under “Wallet.” If you aren’t sure where that is located, click on the tab labeled “Account” then check your left window pane and it should be located to the top left.

BitMEX does not charge for withdrawals or deposits, instead, it charges a network fee based on the size of the transaction, but take note that the exchange only accepts deposits in bitcoin (BTC) and serves as collateral regardless of whether or not the trade includes BTC.

Warning: Do not send Litecoin, Bitcoin Cash, or Tether to this address. Any unsupported coins sent here will be lost.

On the ‘Deposit’ page you will notice a code at the bottom (marked black), use that as your default BTC deposit address where you will send funds from another wallet to this one.

Placing a Trade

The “Trade” tab in the top left corner brings you to the exchange page from which you can conduct your trades. Directly underneath that tab, there is a list of coins ranging from left to right representing the available tokens for trade on the exchange.

The order book shows three columns – the bid value for the underlying asset, the quantity of the order, and the total USD value of all orders, both short and long.

While on the far left you have a choice to either long, a particular asset or short it, for now, you should concern yourself with the spot price of assets rather than dabbling in any leveraged trades or futures markets.

Directly under the BitMEX logo on the trading page, you will see a tab named “market” click on that in order to perform a trade on the spot market. In our example, we had bitcoin selected and set our buy order at $1 USD for a spot position and executed the trade, at the time of writing we received back 0.0002 BTC.

Congratulations! You’ve now successfully purchased your first bitcoin on the BitMEX exchange, to sell simply input the same amount of BTC you received when you first bought it.

There is also an option to modify the window panes to display information that’s relevant to you.

By choosing to remove certain windows you can streamline your information flow to increase the quality and relevance of the data you are receiving.

Intro to Leverage trading

BitMEX allows its users to leverage their position and presents the ability to place orders that are bigger than the users’ existing balance.

This could lead to a higher profit in comparison when placing an order with only the wallet balance this is known as “margin trading.” The platform allows users to set their leverage level by using the leverage slider with a maximum leverage of 1:100 being available for bitcoin and bitcoin cash SV only.

Note: BitMEX fees are much higher than on conventional exchanges because the fee applies to the entire leveraged position. So, a $1,000 trade on 100x leverage could end up costing more than $100 in fees.

Withdrawals

So, now you’ve made a trade and taken profit and want to transfer those funds to another wallet or exchange to cash in.

Click on the “Account” tab located in the home bar and select “Withdraw” highlighted in blue.

Here you will find the option to send to a particular wallet address, the specific amount in bitcoin (XBT) as well as the desired network fee.

Enter your 2-FA code we setup earlier and click “Submit” located at the bottom of the page.

Bitcoin transactions are prioritized on the network by fee meaning the higher the fee the faster the withdrawal process takes to complete.

Note: BitMEX recommends a minimum fee of 0.001 and requires at least 0.0009.

Futures contracts and perpetual swaps

A futures contract is an agreement to buy or sell a given asset in the future at a predetermined price. On BitMEX, users can leverage up to 100x on certain contracts.

Perpetual swaps are similar to futures, except that there is no expiry date for them and no settlement. They also tend to trade close to the underlying index price, unlike futures, which may diverge substantially from the index price.

BitMEX can, therefore, be complex and difficult to navigate at times if you are uncertain how these financial instruments operate but also possesses the potential to maximize your earnings through futures markets, leveraged trading and perpetual swaps.

Just be sure you know what you are doing.

Pros and Cons

Pros

- A Highly liquid platform, well within the top 10 exchanges by reported global derivative volume.

- Best known for its leverage trade option as high as 100 times, which can act as a risk management tool and amplifier for potential profit

- Limited ID verification required to begin trading immediately.

Cons

- Due to ongoing legal compliances BitMEX does not currently offer support or registration for U.S citizens.

- BitMEX can be complex and difficult to navigate at times if you are uncertain how futures markets or particular financial instruments operate.

- Leveraged trades can incur considerable risk, especially to those less experienced and should not be approached lightly.

[ad_2]

Source link