[ad_1]

Founded in 2013, Huobi is a Singapore-based global cryptocurrency exchange that has perhaps evolved more than any other major exchange in its time in the market.

Meaning “currency” in Mandarin, Huobi today still consistently ranks as one of the world’s top 10 largest exchanges by trade volume. Yet, at times in its history, Huobi was among the very top exchanges in terms of volume, liquidity, and prestige.

As part of China’s vaunted “Big 3” crypto exchanges (along with OKCoin and BTCC), the group of companies accounted for nearly 90 percent of bitcoin trading prior to regulatory crackdowns in the country, formerly the industry’s largest and most active market.

Not to be deterred, Huobi has shifted its business model to enable more crypto-to-crypto trading, launched services in the U.S. and abroad and is innovating with newer decentralized and peer-to-peer exchange trading models.

While it does serve an international clientele, Huobi has a focus on Asian markets, with offices in Japan, Korea, and Hong Kong as well as a head office in Singapore.

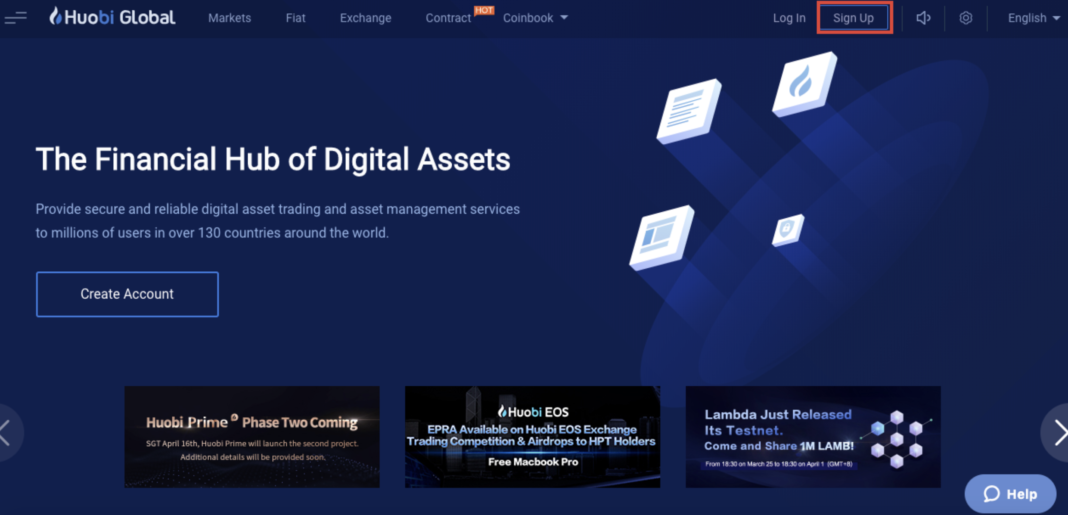

Signing up

To begin, head over to the Huobi Global website and click on “Sign Up” in the top right corner of the screen. Next, run through the process of entering your basic information such as your email address, nationality and desired password then await the verification email.

Note: Be sure to enter your correct nationality as you will be unable to change this later on.

Before you send funds to your account and begin trading, it is important to set up your security to ensure against potential hacks.

Security

The exchange features a User Protection Fund Initiative with 20 percent of its net revenue from yearly trades going toward funding the buyback of Huobi Tokens (the exchange’s native cryptocurrency).

It also has a service called Huobi Security Reserve. As part of this, the exchange plans to store 20,000 BTC for insurance. This preventative measure is intended to help Huobi reimburse users in the case of any future hacks.

In the top-right corner of your screen, you will see a person icon, highlight it and select “Account & Security” from the dropdown menu. On this page, you’ll find information relating to your account including your unique ID and login history.

Scroll down to where it says “Two-factor Authentication” (2FA) and choose to link your mobile number to the account first.

You’ll need to verify through an SMS message and then an email code in order to finalize the process.

Do the same for the Google Authenticator link as well and follow the instructions on the screen.

You’re now ready to send yourself some crypto.

Depositing Funds

In the top-right corner of your screen, you will see a tab labeled “Balances.” Hover over that and select “Deposit and Withdraw”.

From here, you can choose from a list of digital assets in which you will send and receive a particular coin. In our case, we decided to send over 10 tethers (USDT) to play with by selecting “deposit” along the same line where the asset is listed.

You will notice your “Deposit Address” consisting of a string of numbers and letters, you will use that to input into another exchange that offers fiat on-ramping unless of course, you wish to proceed with “Over-The-Counter” (OTC) trades and purchase bitcoin directly using PayPal or Alipay.

Note: If you decide to send cryptocurrency to your Huobi deposit address make sure you are sending the exact same asset from one exchange to another or risk losing all your funds.

Trading on the exchange

Click on “Exchange” in the top-left corner of the screen, which will then take you to the markets page featuring an order book, price chart as well as the various buy/sell/stop limit options.

Since we already had 10 USDT sent over we only needed to make a spot price purchase.

Select “Market” in the buy/sell section and then select “100%” this will ensure that you hold 100 percent of your funds (USDT) in bitcoin.

Other ways of using this may include dollar cost averaging whereby you purchase a portion, say 25 percent, over a periodic regular schedule or when it passes above or below key price levels as defined by yourself and your research.

Withdrawals

When you’ve decided its time to take profit and send your funds to a suitable off-ramp exchange locate “Balances” in the top-right hand corner of the screen and click “Deposit and Withdraw”.

Highlight the coin you wish to send from the list and select “Withdraw” along the same line as the name of the coin.

Enter your desired wallet address and amount then select “Withdraw” at the bottom of the page.

Note: Transfers between addresses can take up to 24 hours but usually completes within 5-30 minutes depending on the crypto asset

Pros and Cons

Pros

- A bountiful amount of supported cryptocurrency markets (over 400 at the time of writing)

- User-friendly interface for both novice and more experienced traders

- Has a native exchange token, Huobi Token, which can be used to supplement trading fees as well as a boost for Huobi’s overall liquidity

- Fiat trading available for BTC, ETH, and XRP

Cons

- Tether (USDT) is the only supported stablecoin

- Limited trading options including no leveraged trading or instruments to support a market short.

- While it used to be considered a “Top 5” global exchange by volume and prestige, that image has since declined slightly with an oversaturation of global crypto exchange options in 2019.

[ad_2]

Source link