[ad_1]

Neither the Dow nor the bitcoin price looked keen on making a bold entry into February early Friday morning, as both the US stock market and cryptocurrency sector reflected on their uneven performances in January. However, positive economic data has begun to help the Dow turn a corner.

Dow Eyes Higher Opening on Bullish Jobs Numbers

As of 8:49 am ET, Dow Jones Industrial Average futures had gained 71 points or 0.28 percent, implying a rise of 96.33 points at the open. Dow futures had traded lower earlier in the day but rallied after Labor Department statistics demonstrated that the government shutdown had not adversely affected employment.

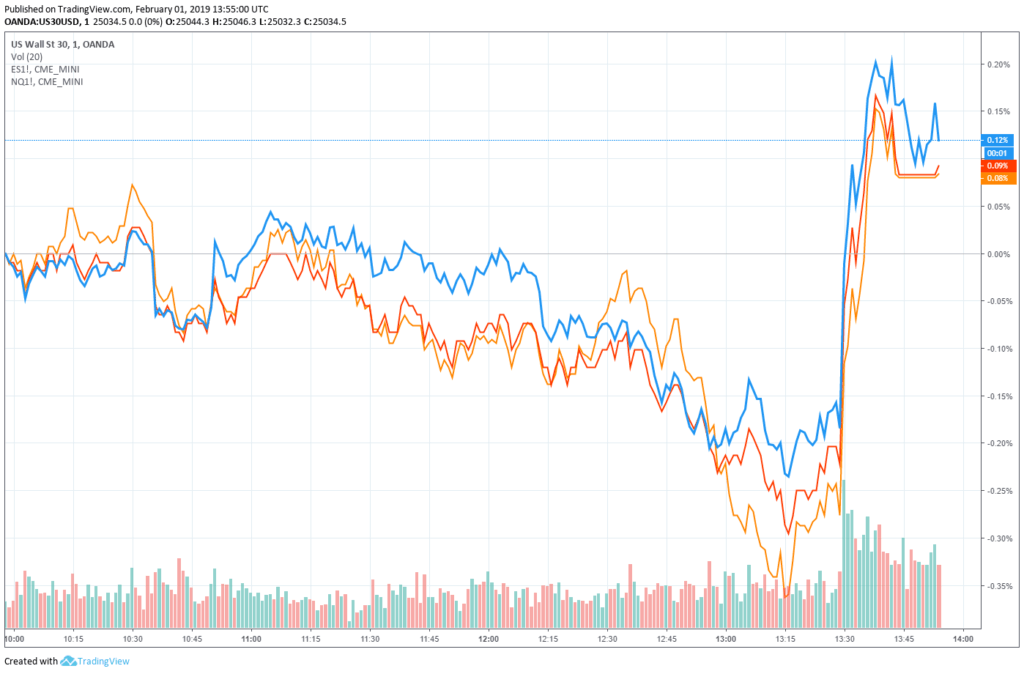

Dow Jones Industrial Average (blue), S&P 500 (red), and Nasdaq (orange) futures all popped shortly before 9 am ET after trading lower earlier in the day.

S&P 500 and Nasdaq futures were less positive heading into the US trading session, with the former rising 0.13 percent and the latter flashing a decline of 0.28 percent.

The S&P 500 and Nasdaq closed January firmly in the green, rising 0.86 percent and 1.37 percent, respectively, on Thursday. The Dow, though, lost 15.19 points or 0.06 percent for the day, dropping the index to a closing bell value of 24,999.67.

For the S&P 500, Thursday’s rally put the cherry on top of the broad consumer index’s best January since 1987 — just one month after the US stock market endured its worst December since the Great Depression.

That may be a positive omen, if history’s any guide. Data from the Stock Trader’s Almanac indicates that January’s performance has been predictive of the stock market’s total-year return in 87 percent of the years since 1950. One of its rare misses was last year when a fourth-quarter sell-off snapped the wind out of the market’s sails.

Amazon Beats Earnings, But Throws Cold Water on Forecast

On Friday, Wall Street continues to wrestle with the fallout from Amazon’s earnings report.

The Jeff Bezos-led conglomerate beat analyst estimates by a full $0.40 per share, but the company warned that this was partially the result of lower-than-usual spending during 2018.

The firm expects expenses to rise back to regular levels, which could drag on earnings throughout the remainder of 2019. Amazon’s stock price was down more than 4.6 percent during pre-market trading.

Job Numbers Defy Government Shutdown

BREAKING: U.S. economy added 304,000 jobs in January vs. +170,000 est., unemployment rate ticks up to 4% https://t.co/PN8eJqrnLy pic.twitter.com/C3RZVBXoKC

— CNBC Now (@CNBCnow) February 1, 2019

However, the stock market could benefit from bullish jobs numbers, which shattered estimates despite the lingering effects of the partial US government shutdown.

According to Labor Department statistics released Friday, nonfarm payrolls rose by 304,000 in January, nearly doubling analyst estimates of 165,000.

The Labor Department said that the shutdown had “no discernible impacts” on national employment figures, which could be a good sign for the economy as the federal government creeps toward a second shutdown that Moody’s has warned could have a sharper impact on investors.

Bitcoin Recovers from Sub-$3,400 Drop

The cryptocurrency market entered the US trading session on a moderate incline, with the overall market cap adding about $600 million during the 24-hour period.

Bitcoin ETF: Resurrection

Yesterday brought some significant news for institutional cryptocurrency adoption, as CBOE and VanEck re-filed their bitcoin ETF application with the US Securities and Exchange Commission (SEC).

VanEck Resurrects Bitcoin ETF Bid, But Don’t Hold Your Breath https://t.co/IFVQIbHntx

— CCN.com (@CryptoCoinsNews) February 1, 2019

That’s just the first step in a long process, and the SEC will likely use every single one of the 240 days they have to review the application before they ultimately approve or deny it (the clock won’t start running until the filing is included in the Federal Register). However, it’s likely the crypto industry’s best bet to see an ETF approved in the US, and it’s one of several developments laying the groundwork for an eventual rally once bitcoin emerges from its longest-ever bear market.

Fidelity Placing Finishing Touches on Crypto Custody Product

Earlier, Bloomberg had reported that Fidelity planned to launch its institutional cryptocurrency custody service as early as March.

While not directly confirming that specific timeline, Fidelity did publish a blog post on Thursday indicating the service is in its “final testing and process refinement periods.” The firm also revealed that it is already working with a “select set of eligible clients as we continue to build our initial solutions.”

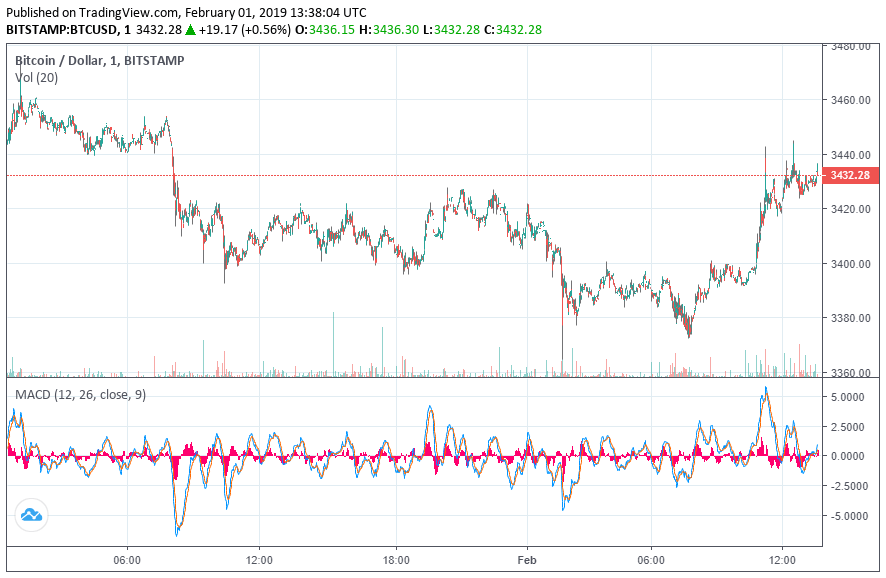

Both of those developments gave the bulls something to chew on, and they may have contributed to bitcoin’s minor advance heading into the US trading session.

As of the time of writing, the bitcoin price was trading at $3,432 on Bitstamp, up from an intraday low of $3,364. Crucially, though, bitcoin continues to trade below $3,500. According to several technical analysts, the longer it remains below this level, the more likely that it will test a critical support level at $3,000. A drop below that mark would catalyze at least one more major sell-off.

Large-cap altcoins more or less tracked the performance of the bitcoin price on Friday. Every major cryptocurrency was in the green, though bold movements were few and far between. One exception was binance coin, the 12th-largest cryptocurrency, which rose 7.84 percent to $6.60.

Featured Image from AP Photo / Richard Drew. Price Charts from TradingView.

[ad_2]

Source link