[ad_1]

Writing for Market Watch Tuesday, Aaron Hankin asserts that Bitcoin’s price plunge along with the NASDAQ and other equities benchmarks in Q4 2018 proves Bitcoin is more like a tech stock than digital gold as some Bitcoin proponents have characterized it.

Typically when soft assets like stocks and bonds are in free fall, investors’ money flees into hard assets like precious metals for shelter from the market turbulence.

That’s exactly what happened with gold in Q4 2018. As Wall Street crashed and burned, the spot price of gold was buoyed by investors looking for relief from the hemorrhaging.

If Bitcoin is like a digital version of gold as many of its most high-profile proponents (like the Winklevoss brothers or Peter Thiel) have suggested, then it stands to reason, Hankin argues, that the same thing should have happened to the price of Bitcoin last quarter.

The Market Watch piece cites a report from the World Gold Council, a U.K-based market development organization for the gold industry, which says:

In Q4 2018, as global stock markets experienced their worst quarter since 2009, cryptocurrencies had a prime opportunity to demonstrate qualities associated with havens like gold. However, cryptocurrencies, such as bitcoin, behaved like risky assets and fell while gold rallied.

Really Nice One Data Point You Got There

Hankin and the World Gold Council are saying that just because Bitcoin didn’t track gold’s price movements perfectly for one quarter— in the still-very-early stages of the cryptocurrency’s development and global market adoption— that it can’t possibly belong to the same asset class as precious metals.

But Bitcoin isn’t an SPDR Gold Share ETF, and no one has ever claimed it would precisely or approximately track gold’s movements in any given quarter of trading.

Bitcoin didn’t follow a similar trajectory to gold’s price, for an entire quarter? Let’s make conclusion. | Source: Shutterstock

We can expect the gold industry to argue that Bitcoin does not simulate the properties of gold and to take a victory lap this month, flush with profits from a good quarter, but it’s a massive overreach to suggest this proves that Bitcoin is unlike gold.

The important thing to bear in mind with regard to this discussion is that Bitcoin for all its revolutionary possibilities and all the disruption it has wrought, is still a relatively small bank stretched out over the entire global economy.

Remember: Bitcoin is Only Ten Years Old

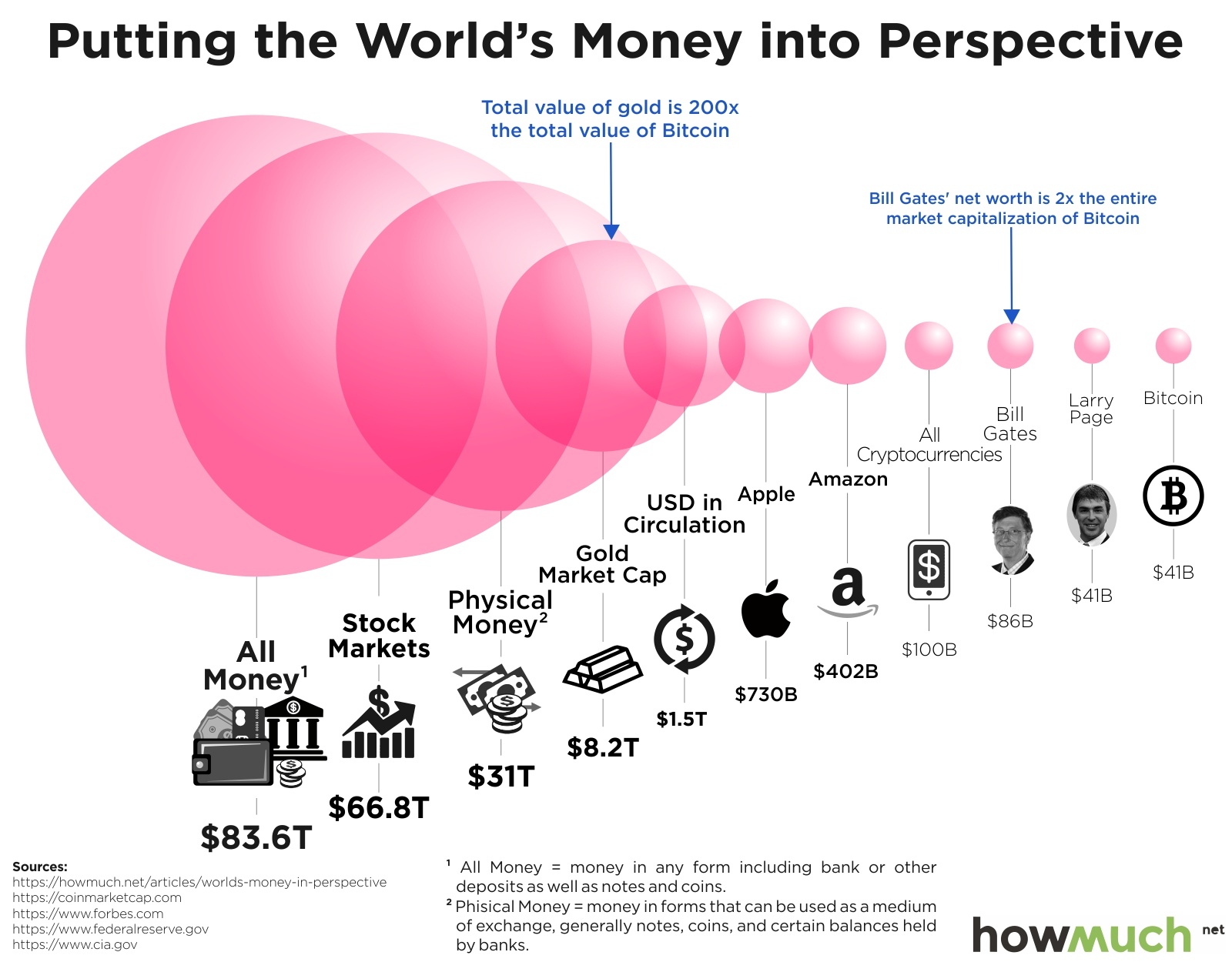

As a point of reference, check out this graph by HowMuch.net, which displays the relative sizes of the world’s various monies (with a couple tech billionaires’ net worth amounts included as well for a sense of scale).

All the gold that has ever been mined is currently worth hundreds of times more than the total value of Bitcoin by market capitalization:

The reality is that gold has thousands of years up on Bitcoin, which has only been around since 2009, and represents an entire paradigm shift in how we think of banking and money, one that will not be overcome without difficulty.

Although it has already held the distinction of best investment in the history of the world at the tender age of eight, Bitcoin is still not a mature currency, and its advocates are not under any illusions that it is, although it would appear that its critics are.

When you’re a boat as comparatively small as Bitcoin, it’s going to be a bumpy ride when the waters of global finance markets are turbulent.

Especially when there are bubbles of speculative investment by people hoping to get rich quick from cryptocurrency even though they don’t fully understand what Bitcoin is and what problems it solves.

These people are not true believers, and when the markets are stressed as critically as they were in Q4 2018, they panic and sell to some other fool or to a true believer who’s hodling for the long run the way many investors hodl gold to protect their savings.

How Bitcoin is Like Gold

In a quarter selected at random from between January 2009 and January 2019, you may see Bitcoin moving opposite of gold, but as the Bitcoin economy grows its volatility index has steadily shrunk since its inception in 2009, and when it becomes a mature currency, it’s hard to miss the salient ways in which it is like gold.

Gold exists in a finite amount, and the supply cannot be arbitrarily increased by central banks or anyone. The same is true of Bitcoin. This makes them both deflationary assets.

Gold is easily divisible (more so than any other metal) into units of any size. The same is true of Bitcoin. This makes them suitable as units of exchange and account.

[ad_2]

Source link