[ad_1]

Yes, there is a correlation between Bitcoin—and crypto assets in general—and hash rate. It’s more like the cause-effect scenario, a chicken and an egg comparison. Which came first? Well, we know the difficulty of the network begun at one and after the mining of the genesis block, the first 50 BTCs were released and a sent to Hal Finney, one of the first adopters of the revolutionary technology.

Well, it seems like hash rate can also be a measure of the market sentiment and at the moment, Bitcoin bulls are back meaning the demand of the coin is up, driving prices higher.

Of Prices and Hash Rate

Because of higher prices, more miners are flocking, bulwarking

the network and as such, a user notes that the network’s hash rate is up 39

percent in 2019 testing highs of 54.86 EH/s on May 2, 2019 when Bitcoin prices

surged above $6,000 in BitFinex revealing underlying sentiment for Bitcoin.

Even so, the network’s computing power is down 12 EH/s in

the last three days at 42.33 EH/s at the time of press.

Here’s what David Sapper, Chief Operating Officer of Blockbid, an Australian cryptocurrency exchange said:

“The increased hash rate means people are here for the long-term because they’re happy to just accumulate what they have, potentially even run at a loss. At the same time, they do sometimes have to clear house and dump.”

Hash Rate Drop 22 Percent in Four Days

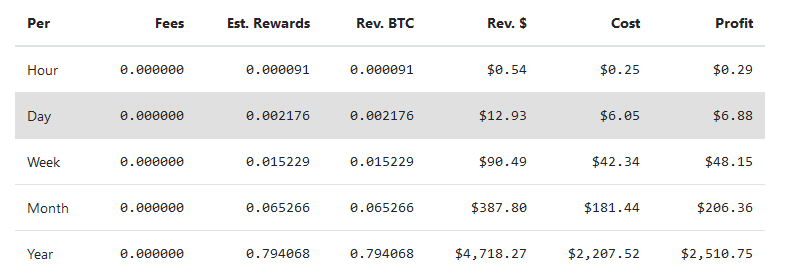

All the same, the question in everybody’s mind is: Is this 22 percent drop an indicator of what to expect in days ahead? Or are miners switching off their mining power and channeling them to other SHA-256 networks like Bitcoin Cash or SV? From what is publicly available, miners are back to green. Drawing price statistics from Bittrex, a miner will earn $6.88 from a single Bitmain Antminer S17 Pro 50Th with a 50.00 Th/s consuming 1975W with zero pool fees and electricity charges of 10 cents per KWH.

On entry of efficient miners, here’s what Christopher

Bendiksen and Samuel Gibbons, researchers at Coinshare said:

“The efficiency of the hardware is rapidly increasing and costs are coming down. Miners are securing access to highly competitive sources of electricity, often ones that would otherwise lie idle, and show high degrees of mobility.”

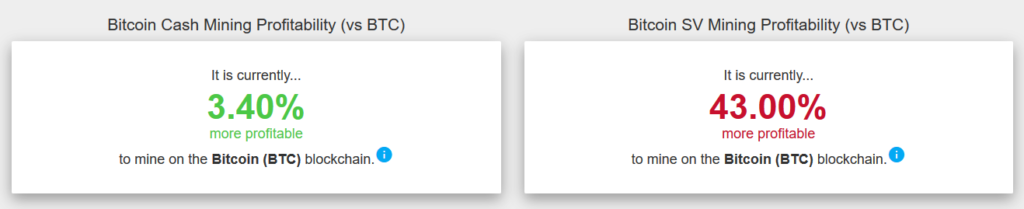

Perhaps it is the anticipation of lower BTC prices that is driving hash rates lower because even at spot rates, mining Bitcoin is 3.4 percent more profitable than shifting camps to Bitcoin Cash and even far better than doing so in the Bitcoin SV network. But it is not only profitability where Bitcoin seems to be outperforming peers. Price wise, Bitcoin is the top performing asset in the top-10.

It is Profitable to mine Bitcoin

In another angle, the media transaction value of Bitcoin is better than Bitcoin SV and 13700X than Bitcoin Cash. According to data from BitInfoCharts, the media transactional value of Bitcoin on May-5 stood at $138 while Bitcoin Cash and SV transaction values stood at $0.01 and $0.30 respectively. It paints a grim picture on Bitcoin Cash utility possible indicating dropping use because the only time BCH median transaction value was better than Bitcoin and SV came on Dec 31, 2018 when it registered $127 against $105 (BTC) and $51 (BSV).

[ad_2]

Source link