[ad_1]

News wires buzzed this week when the National Association of Securities Dealers Automated Quotations (Nasdaq) announced its pending purchase of Swedish crypto-friendly stock exchange Cinnober. Nasdaq made “an USD 190m all cash recommended public offer” to the exchange, which it terms a major “financial technology provider to brokers, exchanges and clearing houses worldwide.” It could also be a significant first step for the $10 trillion Nasdaq into the world of crypto.

Also read: Robinhood Accused of Taking from Younger Investors to Benefit Wall Street Traders

Nasdaq to Acquire Crypto-Friendly Swedish Stock Exchange Cinnober

Adena Friedman, President and CEO, Nasdaq explained, “The combined intellectual capital, technology competence and capabilities of Cinnober and our Market Technology business will expand the breadth and depth of our fastest growing division at Nasdaq.”

From Stockholm, Sweden this week came a public announcement Nasdaq had made a $190 million offer to gobble up Swedish crypto-friendly stock exchange Cinnober. The acquisition “would strengthen its position as one of the world’s leading market infrastructure technology providers,” Nasdaq claimed.

“Not only have the global capital markets continued to evolve rapidly,” Ms. Friedman, 49, continued, “new marketplaces in various industries are demanding market technology infrastructure that enables rapid growth and scale as well as access to tools to promote market integrity. This acquisition will enhance our ability to serve market infrastructure operators worldwide, and will accelerate our ability to expand into new growth segments.”

Based in the New York City, USA, Nasdaq is the second largest exchange in the world by market capitalization, valued at some $10 trillion. It is nearly 50 years old, and is known as the first electronic, automated stock market. Touted as what was to come in the retail brokerage industry, Nasdaq’s emphasis on digital production meant a lowering of that critical difference between the bid and ask price of a stock. It was thought to be a model of price discovery efficiency.

Could be a Tentative First Step Toward More Cryptocurrency Interaction

Nils-Robert Persson, co-founder and Chairman of the Board of Directors of Cinnober, added, “Since co-founding Cinnober in 1998, Cinnober has been on an exciting journey and has become a leading supplier of financial technology providing services to exchanges and trading houses worldwide.”

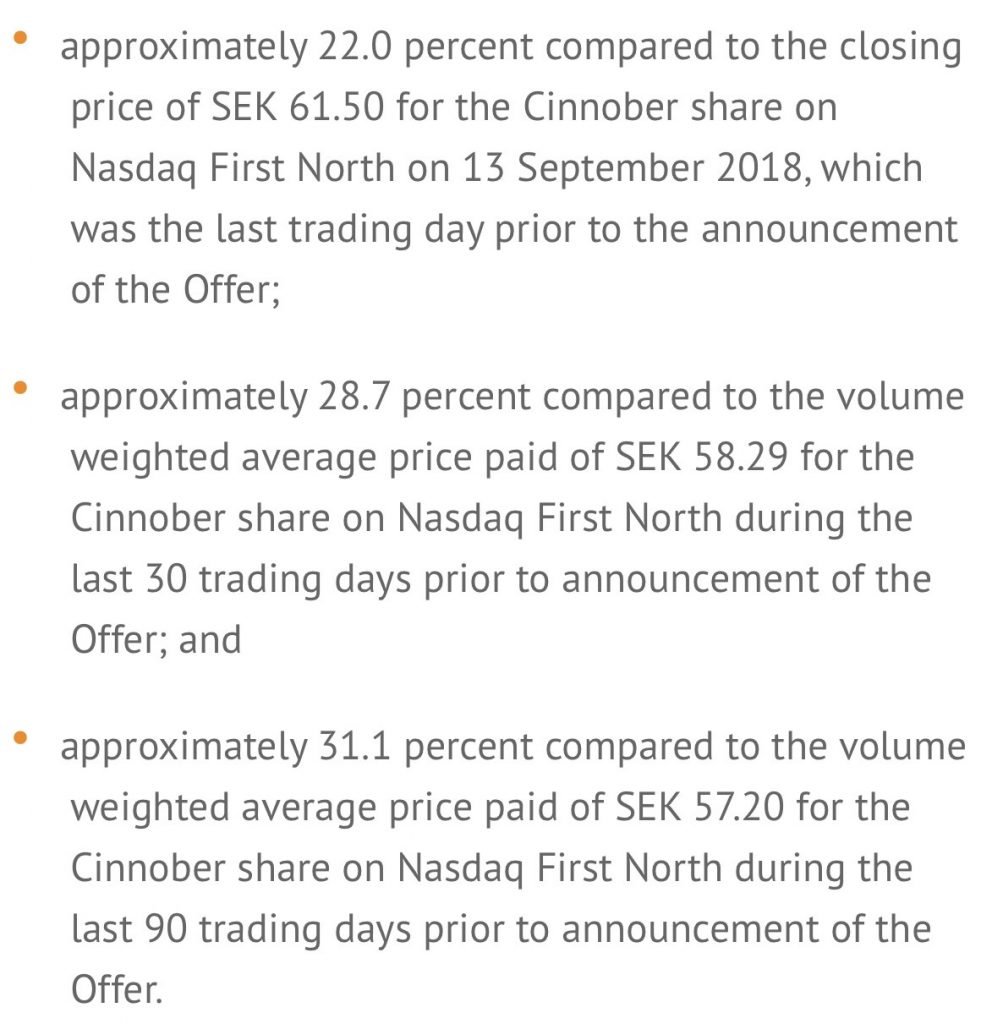

For its part, according to the press release on the matter, Nasdaq “has offered to acquire all outstanding shares and warrants in Cinnober at a price of SEK 75 per share and SEK 85 per warrant. The transaction represents an offer value of approximately SEK 1,702m (appr. USD 190m). The Board of Directors of Cinnober has unanimously recommended that shareholders and warrant holders accept the offer. The acceptance period of the public tender offer is expected to close during the fourth quarter of 2018, subject to certain conditions customary in Swedish public tender offers (e.g. that Nasdaq becomes owner of more than 90% of the shares in Cinnober and review by relevant competition authorities).”

“I see the offer as the next step in Cinnober’s development,” Mr. Persson, 62, elaborated, “as it will enable Cinnober and its highly talented employees to be even more successful in serving customers as well as expanding its technology and offering to even more customers and segments. I really believe in the strategic logic of combining Cinnober and Nasdaq’s Market Technology business also as it reinforces the strong technology foundation in Sweden. As the largest shareholder of Cinnober, I am supportive of the offer and intend to accept the offer.”

The Swedish exchange is well known in the ecosystem for favoring digital currencies, especially as they relate to making it easier for more established investors to toe-dip. Custodial services have long been thought to be a giant concern for legacy banks when it comes to crypto, as hacks and their headlines have spooked big money. Cinnober partnered with Bitgo, for example, to attempt at mitigating custodial issues. Bitgo has a stellar reputation for custody in both worlds, with its multi-sig solution and having acquired Kingdom Trust, not to mention teaming up with Korbit, a Korean exchange – all of these factors have given Cinnober major street cred in the ecosystem.

What are you thoughts about Nasdaq getting into crypto, albeit sideways? Let us know in the comments below.

Images courtesy of Shutterstock, Nasdaq, Cinnober.

At Bitcoin.com there’s a bunch of free helpful services. For instance, have you seen our Tools page? You can even look up the exchange rate for a transaction in the past. Or calculate the value of your current holdings. Or create a paper wallet. And much more.

[ad_2]

Source link