[ad_1]

After a long and arduous winter, green shoots of a crypto market recovery have begun to emerge. Perhaps the only ones left out are the haters. Economist Nouriel Roubini comes to mind.

If you ask market strategists at Fundstrat, they might say Roubini is in for a bumpy ride. The latest Fundstrat report is entitled: “Increasing evidence [the] worst [is] behind us for crypto.” Not only that but the firm is going out on a limb, saying the “skeptics are on the wrong side of history.”

That means you, Nouriel.

Bitcoin Is Surging Again. Just Ignore It

https://t.co/8ZXc8zwuZb— Nouriel Roubini (@Nouriel) April 3, 2019

Prescient Fundstrat Panel Agrees the Worst Is Behind Crypto

Fundstrat in recent days hosted what they describe as a “rockstar panel” discussion at the Texas CFA Summit in San Antonio.

Incidentally, the event was held prior to the bitcoin price‘s stratospheric rise over the past couple of days. Yet, the panelists, who included CasaHODL’s Jameson Lopp, Adamant Capital’s Tuur Demeester, and Fidelity Investments’ Josh Deems, already seemed to know what was coming around the corner.

Last Friday, the panelists observed that the worst is behind for the crypto market, according to the Fundstrat report. They got the feeling that capitulation happened at year-end 2018, which led Fundstrat to conclude “2019 would not see new lows for bitcoin.”

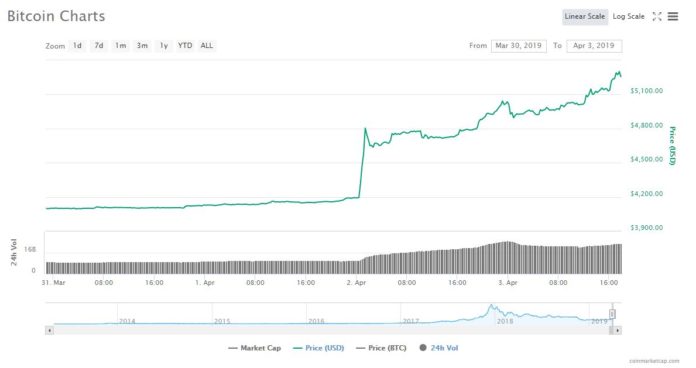

The bitcoin price soared, shortly after the Fundstrat panel predicted it would do just that. | Source: CoinMarketCap

It’s not like the panel came to the conclusion after it became obvious; they were early. Consider that Fundstrat also conducted a recent poll in which they canvassed crypto Twitter about whether the market had bottomed. Unlike the panel, half of those responses were bearish in nature.

As for the rockstar panel, Fundstrat points out:

“Tuur was noting that his analysis of the blockchain shows whales…are accumulating bitcoin now.”

The fact that he was able to discern that crypto whales were accumulating BTC prior to the rally adds even more heft to the prediction that the worst is over.

Institutional Investors Remain Skeptical

Incidentally, Fundstrat’s panel discussion was up against a tough crowd.

The audience was filled with institutional investors who came in largely skeptical about crypto. Only 16% of those in attendance had “positive inclinations” toward crypto while a mere 2%-3% own digital currencies. Based on audience engagement, their concerns stem from the stigmas that “bitcoin is for money launderers and banks will kill crypto.” Perhaps they have a change in heart now that bitcoin’s value is ballooning.

Just an observation, this crypto move should be respected. Based on convos seem fueled by “dry powder” of crypto folks.

Way more “dry powder” from new to crypto and if Bitcoin can sustain this move, the arguments of “allocate 1% to crypto” become magnetic.

Evidence bottom is in

— Thomas Lee (@fundstrat) April 3, 2019

2019 = Positive Risk/Reward for Bitcoin Speculators

While many in crypto land are speculating about the catalysts behind the bitcoin price rally, the panel identified “accelerated progress.”

“So many things are being built both to make BTC more useful and to facilitate institutional investor access,” said Fidelity’s Deems.

They pointed to progress on second-layer technology such as the Lightning Network as well as “smart contract protocols that should see [security token offerings] issued on the Bitcoin blockchain.”

The session wouldn’t have been complete without price predictions, and they didn’t disappoint. Thanks to a positive supply dynamic as a result of an upcoming halving event, the bitcoin price “will surpass $20,000.” Bitcoin has a history of strength leading into and after supply halving events, and Fundstrat sees no reason why “2020 is any different.” And now that the bitcoin price has surpassed the 200-day moving average technical hurdle, Fundstrat sees 2019 “as positive risk/reward.”

[ad_2]

Source link