[ad_1]

The money

remittance business has proven to be extremely lucrative, especially in recent

years where fintechs have proven their ability to offer solutions that are much

more efficient and cost-effective than traditional money transfers through

banks.

However, the use of blockchain technologies could lead to the evolution of the payments business as a whole. And it’s not just a motto for enthusiasts: A report published by BlockData, revealed that cryptocurrencies are way better for money transfers now than any other financial service available in the market.

The

research explored the characteristics of the most important money transfer

services worldwide, and compared them to the features of 7 blockchains a)

focused on payment processing or b) have massively adopted cryptocurrencies.

The results were overwhelming:

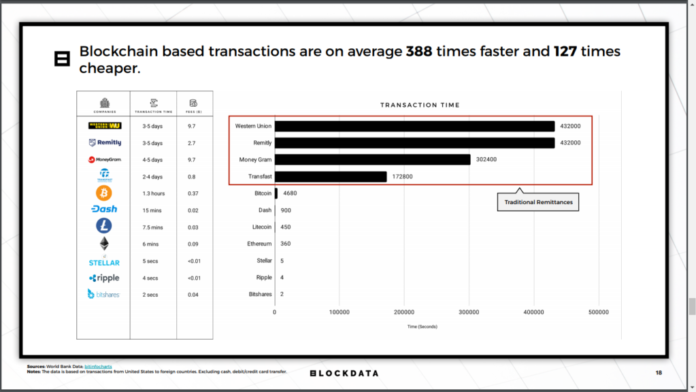

“Blockchain based transactions are on average 388 times faster and 127 times cheaper than traditional remittances …

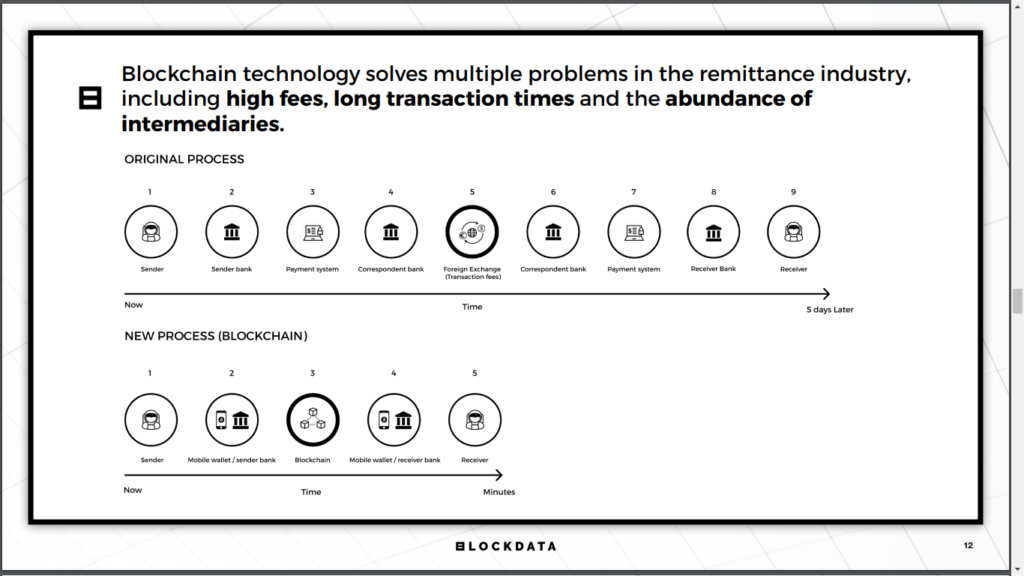

Blockchain technology solves multiple problems in the remittance industry, including high fees, long transaction times and the abundance of intermediaries.”

XRP, XLM and Bitshares: The Best options for Money Remittances

BlockData chose Bitcoin (BTC), Dash, Litecoin (LTC), Ether (ETH), Stellar Lumens (XLM), Ripple’s XRP and Bitshares (BTS) and compared them with services such as Western Union, MoneyGram, Transfast, Remitly, Ria, Transferwise, among others. The slowest blockchain of all (Bitcoin) proved to be hundreds of times faster than the most efficient remittance service of the chosen group. While traditional services need days and hours to process a payment, in the case of cryptocurrencies users speak of seconds to get the same results.

“Blockchain solutions and businesses are developing but are still relatively small,” the study says; However, the researchers were emphatic in pointing out that “Disruption can statistically meet the needs of over 3 billion people in low income countries”.

The report notes that the success of blockchain technologies is so evident that traditional payment processing services are evaluating the use of DLTs to improve their services, however instead of developing their own products, most rely on robust solutions such as XRP and XLM.

“Big corporations are looking to partner with blockchain startups to empower the evolution of remittances.

A number

of companies are using blockchain to innovate remittances. Core services

include global settlement systems, multi-use payment and storage applications,

crypto billing, lending, FX transfer, and credit scoring.”

The development of blockchain technologies has grown considerably despite the bearish trend in the cryptocurrency markets. According to statements of several important personalities from crypto-verse, it is very possible that 2019 will be one of the most important in the history of these technologies.

[ad_2]

Source link