[ad_1]

Latest Tron (TRX) News

There is a synergy between Binance Coin (BNB), Tron (TRX) and BitTorrent (BTT). The genesis of the underlying bull momentum—and positive correlation– seem to stem from the events before and after the launch of the peer to peer, file sharing platform, BitTorrent. In 18 minutes, the ICO was complete and as BNB or TRX was needed to purchase the coin—BTT, TRX and Binance Coin were pumping as investors raced to buy the incentivizing coin–BTT.

Read: Institutional Custody Service Provider BitGo to Support Tron (TRX)

Although few got what they wanted—blame it on a technical glitch on Binance’s part—purchases off the secondary market has been nothing more than profitable. BTT is vibrant and so is BNB. On the other hand, Tron (TRX) is under-performing and many are now pointing to the inadequacies of DLTs and Tron platform in particular.

While BNB is registering double digit gains mainly because of a successful public test-net of Binance DEX where rewards and fees will be paid in BNB, TRX is dumping because rewards of BitTorrent seeders will be paid in BTT. And for some reasons, there is nothing that can be done about it.

Also Read: Cryptocurrency Prices, Adoption Off to Strong Start for 2019

BitTorrent is heavy and demands from the platform require high through put—maybe 100 times of Tron’s peak TPS and that means for a seamless experience, BitTorrent remains off chain and BTT is technically a centralized token working off a decentralized platform—which is Tron.

TRX/USD Price Analysis

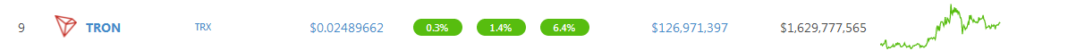

At the time of press, TRX is up 6.4 percent in the last week but steady in the last 24 hours. If anything, the 6.4 percent gain is nothing considering the coin often fluctuates by wide margins. That means the coin is consolidating and a closer look on the chart points to liquidation and a general feel of a flat-lining momentum where bulls can’t muster enough momentum to retest or clear minor liquidation levels. All the same, we are net bullish and as long as prices are trending above 2.5 cents, buyers stand a chance to rally and break above 3.1 cents as laid out in our last TRX/USD price analysis.

Trend and Candlestick Arrangement: Bullish, Breakout Pattern

Technically—and when we analyze price action from a top-down approach, TRX prices are consolidating. The accumulation (or distribution) follows the strong, high-volume bear breakdown of Q2 2018. This means, albeit our optimism, there should be convincing break and close above 4 cents—the break out level, as buyers signal a shift of trend from bearish to bullish as the bear breakout pattern is nullified. Odds are, that will be the case. However, for that to print out, prices must find support at 2.5 cents; build on the three-bar bullish pattern of Feb 14 through to 18 and rally from 2.5 cents to 4 cents at the back of high volumes exceeding those of Feb 4—42 million.

Volumes: Mixed

If prices fail to break above 4 cents and instead collapse below 2.5 cents, then the conspicuous Jan 9 bear bar will define price action of the next few weeks. However, in the short-term, Feb 4 bull bar—42 million, anchors our analysis. All we need is a bull bar with high volumes—excess of 42 million, rocketing off 2.5 cents as TRX prices rally above Jan 27 highs of 3.1 cents to 6 cents as the bear break out pattern of Q2 2018 is invalidated.

All charts courtesy of Trading View—BitFinex

This is not investment advice. Do your research

[ad_2]

Source link