[ad_1]

Customers of Wells Fargo, the 13th largest bank in the world, have been unable to gain access to online banking, ATMs, and in some cases credit cards, showing the merit of digital assets like Bitcoin.

My card acting funny, can’t get access to the app, and customer service doesn’t seem to be answering the phone. What’s going on #WellsFargo?? It’s too early for this nonsense!

— Austin⚡️ (@austin3000__) February 7, 2019

On February 7, Wells Fargo officially confirmed the outage of its mobile application and ATMs, apologizing to its customers.

The outage is said to have occurred in early U.S. morning and Wells Fargo is in process of recovering its services nationwide.

We’re experiencing a systems issue that is causing intermittent outages, and we’re working to restore services as soon as possible. We apologize for the inconvenience.

— Wells Fargo (@WellsFargo) February 7, 2019

Customers Not Happy, Investor Cites Importance of Bitcoin

While Wells Fargo responded speedily to the complaints of its customers, the affected services remain inaccessible after more than 2 hours the bank confirmed an outage.

A Fox Business report revealed that some clients were experiencing difficulties in accessing the bank’s system as early as Wednesday.

An increasing number of customers have started to demand reimbursement for the period in which individual users were not able to utilize the Wells Fargo mobile app and online banking platform.

The bank has been unable to identify exactly how many of its customers were affected by the outage, which was reportedly caused by a systems issue originating from its core infrastructure.

Wells Fargo’s Hilary O’Byrne confirmed to NBC that the bank has acknowledged the issue and is currently implementing a solution.

Following the incident, Anthony Pompliano, a partner at Morgan Creek Digital, reaffirmed the advantage Bitcoin has over the existing banking infrastructure.

Wells Fargo’s system is shut down right now.

Bitcoin never shuts down. pic.twitter.com/bJss6667MC

— Pomp 🌪 (@APompliano) February 7, 2019

Any server, platform, or application that is connected to the internet and is hosted from a central infrastructure is vulnerable to downtime, outage, and security breach.

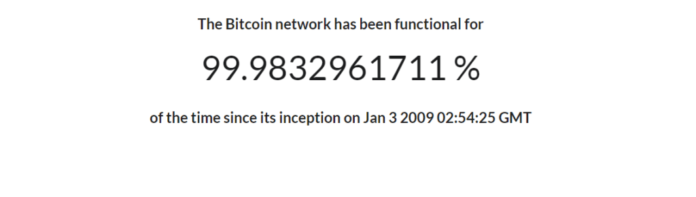

According to BitcoinUptime.com, the Bitcoin blockchain network has been up for more than 99.983 percent since it has been live more than ten years ago.

While it is possible for exchanges and third-party service providers that support the Bitcoin blockchain network to suffer downtime, the network itself hardly faces any downtime.

In 2010, less than one year after the Bitcoin network launched, it suffered a vulnerability called “CVE-2010-5139” which created many BTC in two different addresses.

The community, which includes the open-source community of developers, miners, and node operators executed a fork or a network upgrade to fix the issue.

Apart from the CVE-2010-5139 vulnerability, Bitcoin has suffered virtually no downtime as seen in the 99.9832961843 percent figure presented by BitcoinUptime.com.

Nick Saponaro, an executive at a blockchain project, said:

Wells Fargo being down is the perfect example of why taking ownership of your funds should be a priority. When it’s in their bank, it’s their money. If their system fails, so does your ability to access funds as we’ve seen today. This can’t happen with crypto.

Second Outage in 1 Week

On February 1, San Francisco Chronicle reported that Wells Fargo was facing a systems issue, a similar technical problem that caused the outage on February 7.

“We are currently experiencing a systems issue, and as a result some customers are unable to log into mobile and online banking. Our branch and contact center team members are able to assist customers while we resolve this issue as quickly as possible. We apologize for any inconvenience,” the bank said last week.

In a large-scale infrastructure, when a systems issue emerges and affects the entire platform, it is typically challenging to immediately address the issue and find a permanent fix.

It is possible that a similar systems issue triggered its most recent outage and based on the company’s previous dealing with the same problem, it could require a significant systems update to address it.

In the past several hours, some users suggested that the issue is not exclusive to the bank’s online banking platform and mobile app.

“Direct deposits have been rejected people say, and on social media people are not able to use their cards. Wells Fargo has message to call for support or visit an ATM but those two are down. Branches cannot access accounts either. It’s not just the online banking/mobile app,” one user claimed.

[ad_2]

Source link