[ad_1]

Market movements can be unpredictable, and the stop loss is one of the few mechanisms that traders have to protect against excessive losses in the forex market. Stop losses in forex come in different forms and methods of application. This article will outline these various forms including static stops and trailing stops, as well as highlighting the importance of stop losses in forex trading.

What is a stop loss?

A forex stop loss is a function offered by brokers to limit losses in volatile markets moving in a contrary direction to the initial trade. This function is implemented by setting a stop loss level, a specified amount of pips away from the entry price. A stop loss can be attached to long or short trades making it a useful tool for any forex trading strategy.

Why is a stop loss order important?

Stops are critical for a multitude of reasons, but it can really be boiled down to one thing: we can never see the future. Regardless of how strong the setup might be, or how much information might be pointing in the same direction – future currency prices are unknown to the market, and each trade is a risk.

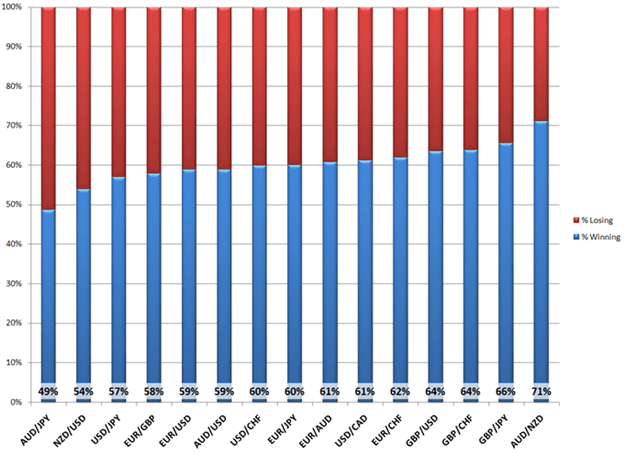

In the DailyFX Traits of Successful Traders research, this was a key finding – traders actually do win in many currency pairs the majority of the time. The chart below shows some of the more common pairings.

As you can see, traders were successfully winning more than half the time in most of the common pairings, but because their money management was often bad they were still losing money on balance.

Traders lost much more when they were wrong (in red) than they made when they were right (blue)

In the article Why do Many Traders Lose Money, David Rodriguez explains that traders can look to address this problem simply by looking for a profit target at least as far away as the stop-loss. That is, if a trader opens a position with a 50 pip stop, look for – as a minimum – a 50 pip profit target.

This way, if a trader wins more than half the time, they stand a good chance at being profitable. If the trader is able to win 51% of their trades, they could potentially begin to generate a net profit – a strong step towards most traders’ goals.

Forex stop loss strategies

Below are five strategies to apply in your forex trading when placing stop loss orders:

1. Setting Static Stops

Traders can set forex stops at a static price with the anticipation of allocating the stop-loss, and not moving or changing the stop until the trade either hits the stop or limit price. The ease of this stop mechanism is its simplicity, and the ability for traders to ensure that they are looking for a minimum one-to-one risk-to-reward ratio.

For example, let’s consider a swing-trader in California that is initiating positions during the Asian session; with the anticipation that volatility during the European or US sessions would be affecting their trades the most.

This trader wants to give their trades enough room to work, without giving up too much equity in the event that they are wrong, so they set a static stop of 50 pips on every position that they trigger. They want to set a profit target at least as large as the stop distance, so every limit order is set for a minimum of 50 pips. If the trader wanted to set a one-to-two risk-to-reward ratio on every entry, they can simply set a static stop at 50 pips, and a static limit at 100 pips for every trade that they initiate.

2. Static Stops based on Indicators

Some traders take static stops a step further, and they base the static stop distance on an indicator such as Average True Range. The primary benefit behind this is that traders are using actual market information to assist in setting that stop.

So, if a trader is setting a static 50 pip stop loss with a static 100 pip limit as in the previous example – what does that 50 pip stop mean in a volatile market, and what does that 50 pip stop mean in a quiet market?

If the market is quiet, 50 pips can be a large move and if the market is volatile, those same 50 pips can be looked at as a small move. Using an indicator like average true range, or pivot points, or price swings can allow traders to use recent market information to more accurately analyze their risk management options.

Average True Range can assist traders in setting stops using recent market information

We walk through such a mechanism in our article on Managing Risk with ATR (Average True Range).

3. Manual Trailing Stops

For traders that want the upmost control, forex stops can be moved manually by the trader as the position moves in their favor.

The chart below highlights the movement of stops on a short position. As the position moves further in favor of the trade (lower), the trader subsequently moves the stop level lower. When the trend eventually reverses (and new highs are made), the position is then stopped out.

Trader adjusting stops to lower swing-highs in a strong down-trend

Take a look at Trading Trends by Trailing Stops with Price Swings for more information on how to implement the trailing stop.

4. Trailing Stops

It is important to note that some jurisdictions allow brokers to enforce the trailing stop function

Static stop losses can bring vast improvement to a new trader’s approach, but other traders use stops in a different way to further maximize their money management.Trailing stops are stops that will be adjusted as the trade moves in the trader’s favor, in an attempt to further mitigate the downside risk of being incorrect in a trade.

Let’s say, for instance, that a trader took a long position on EUR/USD at 1.1720, with a 167 pip stop at 1.1553. If the trade moves up to 1.1720, the trader may look at adjusting their stop up to 1.1720 from the initial stop value of 1.1553 (see image below).

This does a few things for the trader: It moves the stop to their entry price, also known as ‘break-even’ so that if EUR/USD reverses and moves against the trader, at least they won’t be faced with a loss as the stop is set to their initial entry price.

This break-even stop allows the trader to remove their initial risk in the trade.After which, the trader can look to place that risk in another trade opportunity, or simply keep that risk amount off the table and enjoy a protected position in their long EUR/USD trade.

Break-even stops can assist traders in removing their initial risk from the trade

5. Fixed Trailing Stops

Traders can also set trailing stops so that the stop will adjust incrementally. For example, traders can set stops to adjust for every 10 pip movement in their favor.

Using an example of a trader buying EUR/USD at 1.3100 with an initial stop at 1.3050 – after EUR/USD moves up to 1.3110, the stop adjusts up 10 pips to 1.3060. After another 10 pip movement higher on EUR/USD to 1.3120, the stop will once again adjust another 10 pips to 1.3070. This process will continue until such time as the stop level is hit or the trader manually closes the trade.

Fixed Trailing stops adjust in increments set by the trader

If the trade reverses from that point, the trader is stopped out at 1.3070 as opposed to the initial stop of 1.3050; a savings of 20 pips had the stop not adjusted.

Further reading to improve your forex trading skills and confidence

- Trading the forex market allows for the use of various other order types which can benefit the trader. Spend time getting to grips with these to feel more confident managing your trades.

- Traders often look to retail client sentiment when trading popular FX markets. DailyFX provides such data, based on IG client sentiment.

- DailyFX hosts multiple webinars throughout the day, covering a number of topics related to the forex market like central bank movements, currency news, and technical chart patterns being followed.

- To get involved in the large and exciting world of forex check out our forex for beginners trading guide.

[ad_2]

Source link