[ad_1]

The battered US stock market enters the week’s final trading session with little hope of patching its previous-day wounds. Rather, trade war pessimism looks poised to deal further blows to the Dow and its peers, which are currently steeling themselves for major opening bell losses. The mood is slightly more positive in the cryptocurrency market where the bitcoin price has made a slight recovery.

Dow Preps for [Another] Triple-Digit Decline

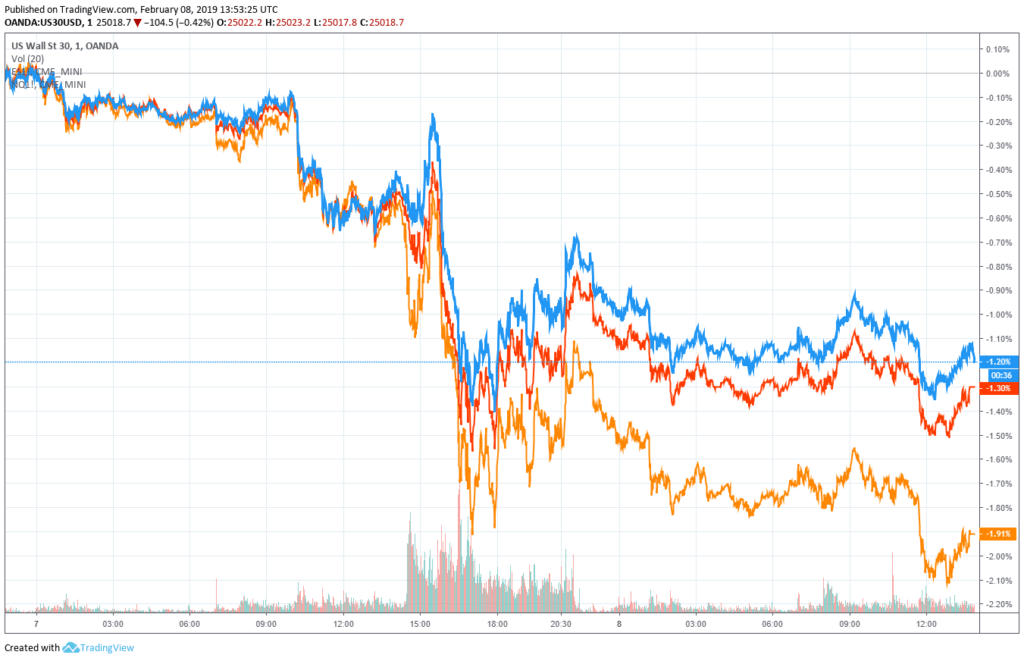

Futures tracking the Dow Jones Industrial Average (blue), S&P 500 (red), and Nasdaq (orange) endured sharp losses on Friday.

As of 8:55 am ET, Dow Jones Industrial Average futures had declined 97 points or 0.39 percent, implying an opening bell drop of 102.53 points. Dow futures had traded lower earlier in the day but trended up ahead of the market open. S&P 500 futures and Nasdaq futures also traded in the red, with the former down 0.44 percent and the latter losing 0.7 percent.

On Thursday, the stock market took steep losses following several reports that suggested the United States and China would not arrive at a new trade agreement before hefty tariffs kick in at the beginning of March. The Dow ended the day at 25,169.53, down 220.77 points or 0.87 percent after trading more than 350 points in the red earlier in the day. The S&P 500 declined by 0.94 percent, while the Nasdaq plunged by 1.18 percent.

US-China Trade War Rattles Stock Market

On Friday, the US-China trade war continued to rattle the pre-bell futures markets. Most troubling was that US President Donald Trump confirmed that he would not meet with Chinese President Xi Jinping before the trade deal deadline on March 1.

Previously, Trump said he would not sign a deal until he and Xi had ironed out several “difficult” sticking points between the two countries. Instead, Trump will focus his attention on preparing for a second summit with North Korean dictator Kim Jong Un, which will take place from February 27-28.

According to the Wall Street Journal, the US and China haven’t even compiled a draft agreement that outlines areas of agreement and disagreement, despite the fact that US Trade Representative Robert Lighthizer and Treasury Secretary Steven Mnuchin are just days away from heading to China for a new round of negotiations.

Given the near-constant stream of White House optimism regarding the trade war, it appears the stock market had already priced in an amicable conclusion that now seems less likely to materialize — at least before the new tariffs take effect, anyway.

Perma-Bear: Dow Rally Just a Dead Cat Bounce

Meanwhile, perma-bear David Tice continues to warn that the stock market’s recent recovery is just a “dead cat bounce.”

He believes that the Dow and its peers could faces losses as steep as 30 percent before the end of 2019, which is why he is encouraging investors to hoard gold.

Of course, Tice has been wrong before, having issued gloomy forecasts in 2012, 2014, and 2017 while the stock market continued to bask in the warmth of sunny skies — and a historic bull run.

Bitcoin Price ‘Historically Oversold’

Friday brought welcome, if muted, gains to the cryptocurrency market where bulls continue to grapple with what various technical factors mean for the near-term movement of the bitcoin price.

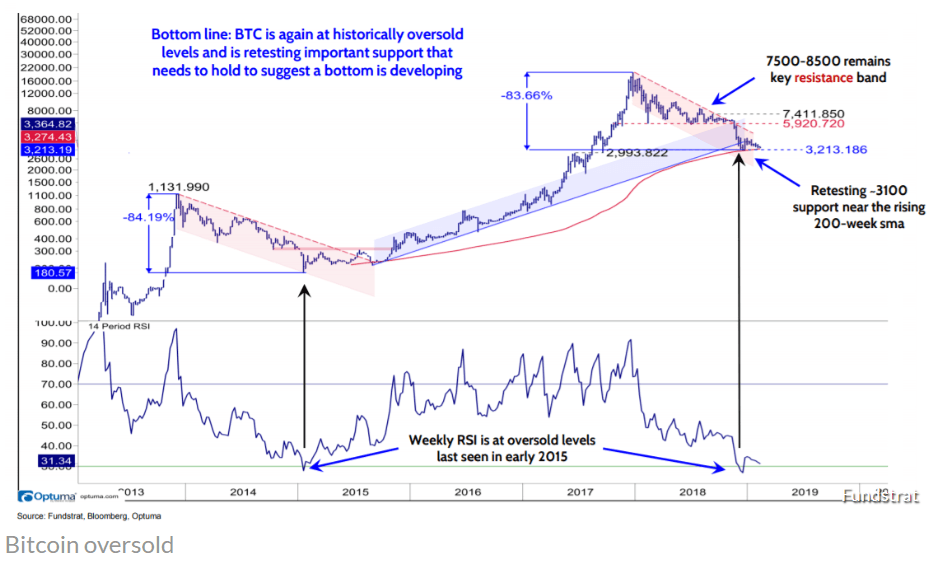

Fundstrat: Bitcoin RSI at Historically Low Level

Earlier, CCN had reported that Wall Street strategy firm Fundstrat had said that the short-term outlook for bitcoin and the wider cryptocurrency market “remains weak.” Unless the bitcoin price can hold above $3,100, technical analyst Robert Sluymer wrote in a recent note to clients, it will likely slide as low as $2,270 before the pain is over.

Notably, that gloomy forecast aligns closely with the short-term forecast published by crypto brokerage BitOoda who set a $2,400 price target.

However, Sluymer’s analysis also noted that the bitcoin price is “historically oversold,” suggesting that it is trading below its true value. Now at sub-30 levels on a scale of 0 to 100, bitcoin’s Relative Strength Index is at its lowest mark since January 2015.

The good news is that, if history serves as a capable guide, this means bitcoin could be on the cusp of establishing a firm bottom following more than a year of hodler heartbreak.

The bad news is that even though RSI reached oversold levels in January 2015, the bitcoin price did not mount a sustained rally until the end of the year. That suggests that even if the crypto market does put a definitive end to the sell-off, it could enter a period of sustained apathy rather than immediately begin grinding higher.

Even worse: bitcoin’s other technical indicators remain ugly, so it’s possible that the cryptocurrency’s RSI could crater even further before the bears run out of steam.

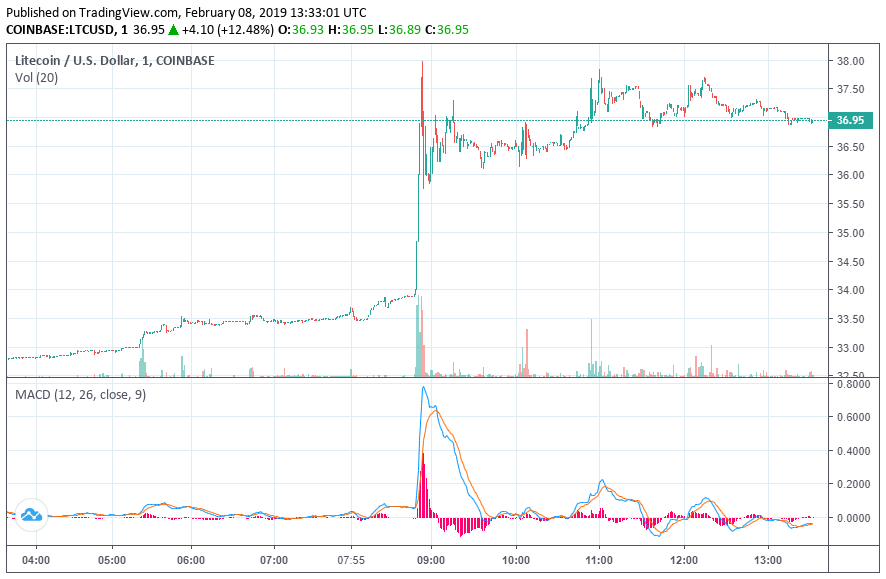

Litecoin Leapfrogs EOS

On Friday, though, the cryptocurrency market swam in a sea of green, even if most assets only saw minor gains from their previous-day levels.

The lone exception to that trend was litecoin, whose price inexplicably rallied 12.62 percent to vault the cryptocurrency into fourth in the market cap rankings, surpassing EOS.

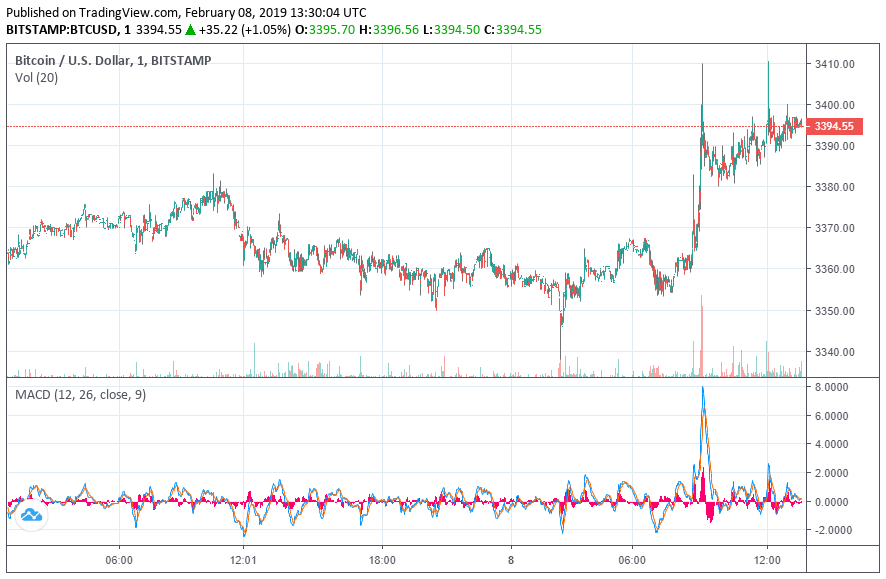

As for bitcoin, its price stood at $3,395 on Bitstamp as of the time of writing, representing a single-day increase of 1.13 percent.

Altogether, the cryptocurrency market cap added around $2.3 billion to reach a present value of $114.1 billion.

Featured Image from Fred DUFOUR / AFP. Price Charts from TradingView.

[ad_2]

Source link