[ad_1]

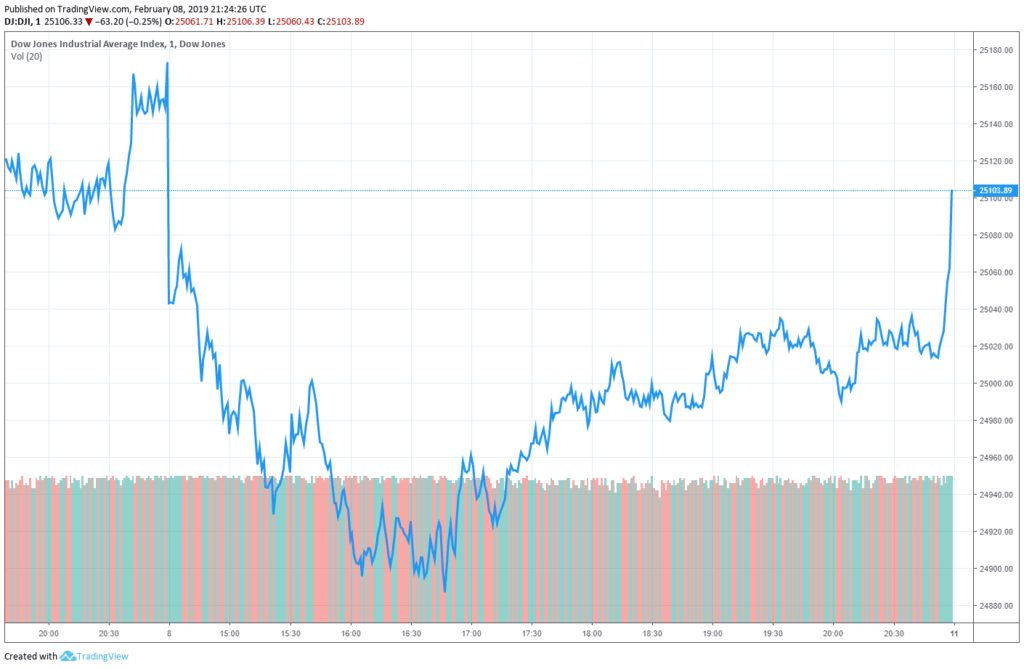

Friday started off badly for the Dow Jones industrial average, with all major stock indexes trading markedly lower right out of the gate Friday morning.

Nike (NKE) defied gravity at the start of the session after an analyst price-target hike, but got dragged back down to earth with Apple (AAPL), Chevron (CVX), Exxon Mobil (XOM), and the rest of the beleaguered market by the Dow’s 25,106.33 close (-0.25%) at the end of the day.

Donald Trump’s Trade War Is Devastating Business

These results extend the stock market’s losses to a third straight day amid increasing worries that the U.S. and China will not figure out a trade agreement before the deadline in 21 days:

“Doubts rebounded regarding progress in the U.S.-China trade war on news late Thursday that President Trump would refuse to meet with China’s President Xi Jinping later this month. U.S. Trade Representative Robert Lighthizer and Treasury Secretary Steven Mnuchin plan to lead a delegation to China in order to further talks next week.”

The looming deadline appears more likely to elapse with no trade agreement.

If that happens, Donald Trump’s current tax on goods imported from China (worth a market value estimated at $200 billion annually) will increase from 10% to 25%.

China’s Revenge Tariffs Have Cost Billions Already

China has already enacted retaliatory tariffs that have cost American exporters and their supply chains billions of dollars (which Trump has tried to patch over with an $11 billion federal bailout for devastated farmers with taxpayers’ money).

And if Trump raises taxes even higher on Americans who buy Chinese imports, or goods made from Chinese imports (because tax increases inevitably get passed along to other businesses and consumers in the form of higher prices), China vows to raise theirs too.

Which seems kind of MAD (Mutually Assured Destruction) to me.

In fact, you’d have to be mad as a MAGA hatter to support a trade war.

It’s saying something like: “If you raise taxes on your citizens when they buy from our citizens. We’ll raise taxes on our own citizens so high it’ll make your head spin!”

Make A Great Depression Again

Donald Trump’s trade war with China is bad for business.

Actually, all trade wars are bad for business.

As we should have learned by now. There is a consensus among economists that the Smoot-Hawley Tariffs of 1930 helped make the Great Depression worse.

In fact all wars are bad for business. And raising taxes on your citizens, which is all a tariff is— whether you’re raising them for a failed War on Drugs, or a failed War on Terror, or a failed War on Poverty, or a failed War on Trade— is simply bad for business.

Donald Trump has been unusually aggressive with his intonations on U.S. monetary policy for a U.S. president, putting unrelenting pressure on the Federal Reserve.

He wants the Fed to politicize monetary policy and just BTFD for him to keep stock prices high by holding interests rates artificially low and expanding its balance sheet.

So he can win again in 2020.

But that’s asking all of us to eat the damage he’s doing to equity markets with his extraordinary political intrusion into the business of the free market.

And by eat the damage, I mean eat less food, or less quality food because it keeps costing more every year that the Federal Reserve continues the U.S. Dollar’s 79-year slide down the slippery slope of infinite liquidity to monetary cataclysm.

Trump Is Feeding Wall Street’s Lunch to The Swamp

Donald Trump promised he’d drain the swamp.

But his SNAFU “trade war” with China is just raising taxes on American businesses to fill the swamp’s coffers with more money from the private sector, while asking the Federal Reserve to spread the losses out by monetizing them and driving up the price of the dollar.

It’s no wonder that when predicting a dead cat bounce David Tice said:

“I’m a believer that gold represents true money. We are in a fiat money world, and it’s dangerous not to have some gold in your portfolio.”

Even a Dead Cat Bounces

So the saying goes.

Proving financiers like to kill cats in thought experiments as much as quantum physicists.

Well the proverb is true.

Even a dead cat will bounce when it hits the ground.

(Don’t ask me how I know this.)

But if the cat is dead and merely bounced last month (as prognosticated earlier in the week, and looking more likely after the stock market rout Friday) — the next question is who killed the cat?

Let’s hope, as with Schrödinger’s cat, that we are still in the superposition of states before the waveform collapses into one state or the other, dead cat bounce, or fat cat rally.

The cat is in the bag.

The bag is in Donald Trump’s hand.

He’s heading for the river.

Let’s hope he relents for his own best interest in 2020.

Or that Congress stops him.

Disclaimer: The views expressed in the article are solely those of the author and do not represent those of, nor should they be attributed to, CCN.

Donald Trump Image from AP Photo / Andrew Harnik

[ad_2]

Source link