[ad_1]

As storm clouds continue to gather over Donald Trump’s presidency, new data released by the U.S. government on Wednesday provided a rare moment of respite, with news that the country’s trade deficit has narrowed with imports falling faster than exports.

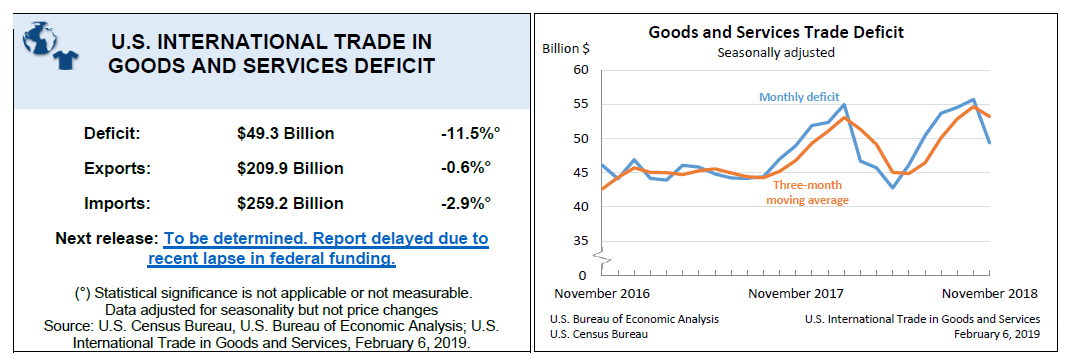

Figures released by the Department of Commerce show that the difference between exports and imports dropped by 11.5 percent to $49.3 billion from $55.7 billion in October.

This fall is primarily due to a fall in imports of consumer goods. While a drop of this magnitude would normally be a cause for concern as it signifies a drop in domestic demand, the data also show that the drop was preceded by a 5-month increase in imports which experts attribute to sellers stockpiling products due to fears over an escalation of the ongoing U.S.-China trade war.

New data shows that the U.S. trade deficit shrunk at a faster than expected rate in October | Source: Department of Commerce

Of course, Trump’s tariffs alone are not the sole reason for the reduced import figures. Lower global prices for crude oil and petroleum imports are also responsible for the lower than expected deficit. Crude oil imports stood at $23.1 billion compared to the $41.8 billion predicted by experts. US exports of oil-based products boomed, surging 5.4 percent which drove the US oil deficit to $11.4 billion – a reduction of 25 percent, which is the lowest the deficit has been in the last 11 years.

Regardless, Trump will definitely take the credit for the reduced deficit, with the Commerce Department eager to make the point that the president’s insistence on rebalanced trade agreements has achieved its intended goal. While the Department has a history of issuing politically motivated communication including a recent study aimed at discrediting man-made climate change, the figures certainly make for compelling reading.

Speaking to CNBC about the report, MUFG Chief economist Chris Rupkey said:

The sharp slowdown may reflect increasing caution given the unpredictable outcome of the administration’s current trade talks, the good news is this will temporarily boost real GDP in the fourth quarter.

Trump’s Protectionism Seeing Fruits?

In an effort to slow narrow the gap between imports and exports, the Trump administration has embarked on a tariff hike spree which saw new charges slammed on a number of items originating from some of its biggest trading partners including a 25 percent tax on steel and a 10 percent tax on Aluminum. The most visible outcome of the new tariff regimes has been a series of tit-for-tat moves by the U.S. and China as trade talks between both countries drag on.

Mainstream economists generally agree that Trump’s trade policies will not reduce the country’s trade deficit seeing as Americans do not produce as much as they buy, but Trump – who ran for office on a deficit reduction campaign – thinks otherwise. To this end, his approach so far has resulted in what to the casual observer, would seem to be a series of seemingly pointless and possibly unwinnable fights in pursuit of a protectionist ‘America First’ economic agenda.

CCN recently reported that following trade disputes with Canada, Mexico and China, Trump also looks set to embark on a trade war with the EU, which is the world’s largest trading bloc. According to Rupkey such fights have already started to negatively affect global trade, and the jury is very much out on whether or not they will end up being a good thing for America in the long run. For the time being, however, it would seem as though Trump’s ‘crazy’ plan to tariff his way out of the deficit just might be working.

Donald Trump image via AP Photo/Susan Walsh.

[ad_2]

Source link