[ad_1]

Japanese billionaire Masayoshi Son made a huge bet on bitcoin at the top of the market. And lost. The SoftBank Founder reportedly cut a loss of $130 million of his own money by mis-timing the historic cryptocurrency bubble in late 2017.

It is not known exactly how much Masayoshi Son, worth an estimated $24 billion, poured into bitcoin. But he appears to have bought in late 2017 as the bitcoin price approached a record high of $20,000. He sold early in 2018 as the price collapsed, taking a $130 million loss.

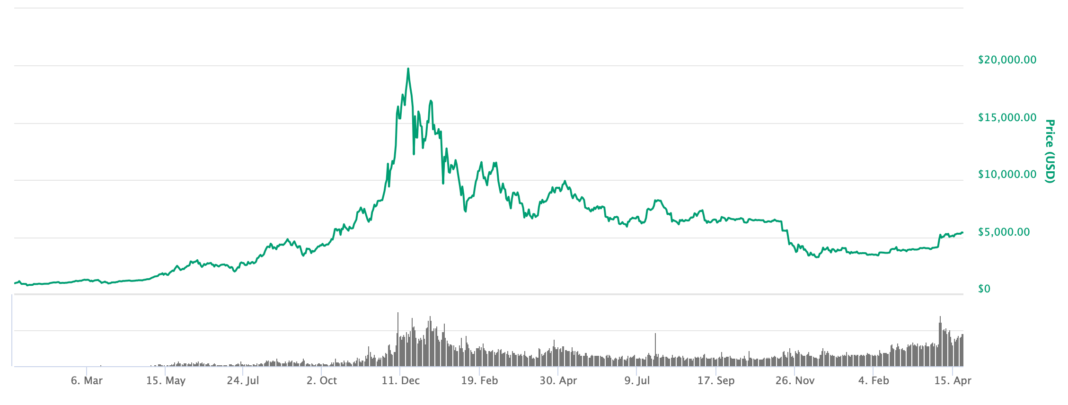

The bitcoin price climbed ten-fold to $20,000 in 2017 before crashing back to $3,200 at its lowest point. Source: CoinMarketCap

Buying the Top of the Bitcoin Bubble

Masayoshi Son, who is the second-richest man in Japan, was convinced to invest in bitcoin by his colleague Peter Briger. Briger’s Fortress Investment Group has been sitting on bitcoin reserves since 2013 and was bought out by SoftBank in 2017.

The advice came back to haunt him as bitcoin’s epic 2017 bull run failed to keep up the momentum. By the end of 2017, bitcoin’s value had increased by almost 2,000 percent. As a successful investor, Masayoshi Son must have known this was a precarious time moment to invest.

In January 2018, bitcoin shed half its value, falling back to $10,000. What followed was a brutal “crypto winter,” which may not yet be over.

Even Successful Investors Get Bitcoin Wrong

Masayoshi Son is, by all accounts, a phenomenal investor. His $100 billion SoftBank Vision Fund is the largest venture capital fund on the planet. He made early bets on Uber and WeWork, helping to propel them to the global powerhouses we know today.

He has an eye for talent too. Masayoshi Son invested in Alibaba after just five minutes with CEO Jack Ma. As of last year, that $100 million bet on Alibaba is now worth $132 billion.

Another Crypto Winter Victim

Masayoshi Son isn’t the first investor to get burned as bitcoin plunged from its all-time highs. Prominent bitcoin investor Peter McCormack lost $1 million in the bitcoin bear market.

“As excitement built, more and more people got involved, forming the conditions for a bubble. But many of us were too caught up in the hype to exercise caution… I wish I had taken everything out before the bubble burst.”

One rookie investor told CNN he put $120,000 into bitcoin in November 2017. He shifted money into bitcoin cash and ethereum in an attempt to stem the bleeding when the bubble popped, but he ended up with a 96 percent loss.

“It was devastating, quite traumatic, really. I’ve seen stories on the news of billionaires going bankrupt, and you think how can that be? How on earth did you lose that amount of money? And yet, here I am in that position.”

Bitcoin Price Finally Recovering?

Masayoshi Son’s loss is a stark reminder that trying to time bitcoin’s price movements is an impossible task. Even seasoned investors get it wrong.

For now, bitcoin has shown signs of recovery, touching a 2019 high in today’s trading session. The bitcoin price has climbed 40 percent this year alone with analysts suggesting a 95 percent chance the bottom is in.

[ad_2]

Source link