[ad_1]

The CEO of Three Arrows Capital, Su Zhu cooked up a storm on Twitter after

asking for a vote to answer his query:

“Bitcoiners, someone gives

you 10k USD. Would you rather hold it for 5years as ETH, BCH, and USD or just

spend it?”

As far as digital assets are concerned, it appears as if most voters

would settle on (ETH) than Bitcoin Cash (BCH). From his Twitter pool, final

results revealed that ETH had 69 percent of the vote compared to 11 percent of

Bitcoin Cash.

Earlier, Roger Ver, Bitcoin.com’s CEO argued that Bitcoin Cash (BCH) price would surpass Ethereum (ETH). But the controversial “Bitcoin Jesus” didn’t stop there. He asserts that BCH was better placed and would gain global recognition faster than Ethereum (ETH) and even Bitcoin.

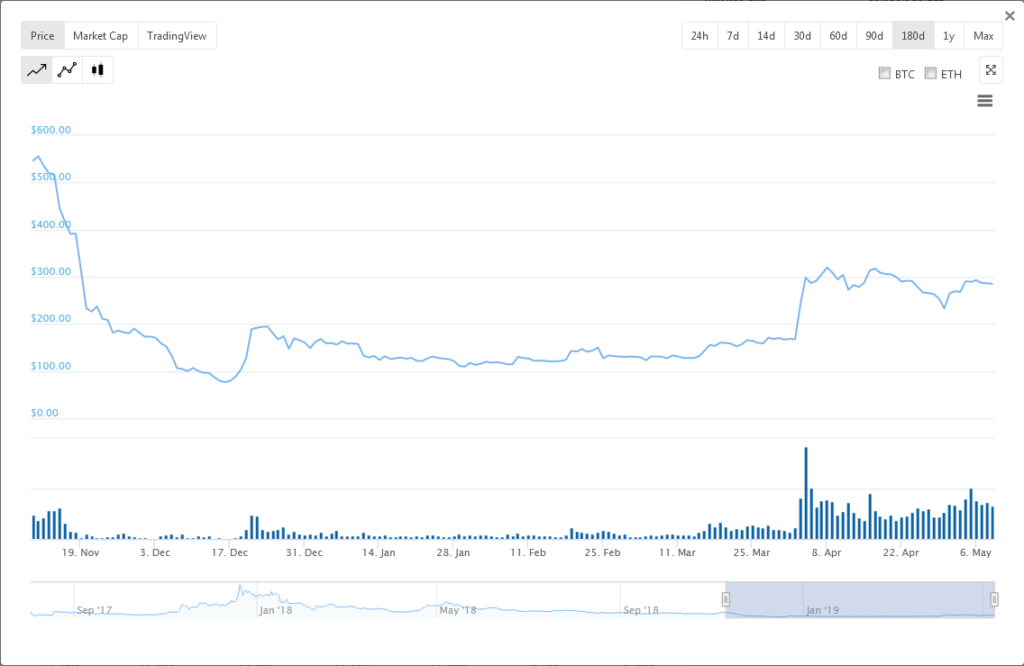

Despite the result, Bitcoin Cash performance in Q1 2019 was

impressive. It surged, expanding five folds after bottoming in Dec 2018 when it

crashed to $75. At spot rates, the coin is trading above $270 making it one of

the top performing coins in the top-10. Perhaps

a trigger to this demand was not only recovering Bitcoin prices but the

introduction of Bitcoin Cash based derivatives.

According to data from Crypto Facilities, more than $50 million

of the Bitcoin Cash contracts have so far been closed. Sui Chung, the Head of

Indices and Pricing Products at Crypto Facilities said:

“We began to onboard Kraken users … [and] that’s basically given us better exposure to the communities around Litecoin and Bitcoin cash, and I think what we’re seeing is those communities have a pretty strong interest in trading derivatives for Litecoin and Bitcoin cash, respectively. The volumes have gone up pretty appreciably”

Ethereum (ETH) Versus Bitcoin Cash (BCH)

Ethereum is the market’s second largest cryptocurrency as far as market cap is concerned, and its enthusiasts claim that it can only be rivaled by BTC in terms of its importance to the crypto world at large. Because of what Ethereum brings to the blockchain table, the crypto world has moved from pure crypto trading and investing to designing and unleashing applications and solutions based off the internet. If anything, it is a development platform that has stayed true to its calling to bring on the blockchain revolution.

Thanks to Vitalik and founders’ improvement of the core, the

platform is the to-go to network for smart contract projects, ICOs and dApps

launching. Despite the competition Ethereum has faced, it is unique and has

therefore held its ground against the sudden gush of competing altcoins. At the

same time, Ethereum (ETH) is on a growth spurt breaking its previous resistance

level of $150 and would likely close above $200 in days ahead.

Even so, Ethereum bulls say that comparing ETH to BCH is akin to comparing apples and oranges, for obvious reasons. At first glance, both are desirable assets but Ethereum is more of a development platform as aforementioned. Therefore, its native currency, ETH, is a utility than a text book definition of a “currency”.

Meanwhile, Bitcoin Cash is a Bitcoin fork but with different

ideas on the best way to scale the network. Although fast with plans of

integrating Schnorr Signatures, improving privacy and hard forking in days

ahead, Bitcoin Cash has a long way before it catches up or even replace Bitcoin—the

most valuable coin.

[ad_2]

Source link