[ad_1]

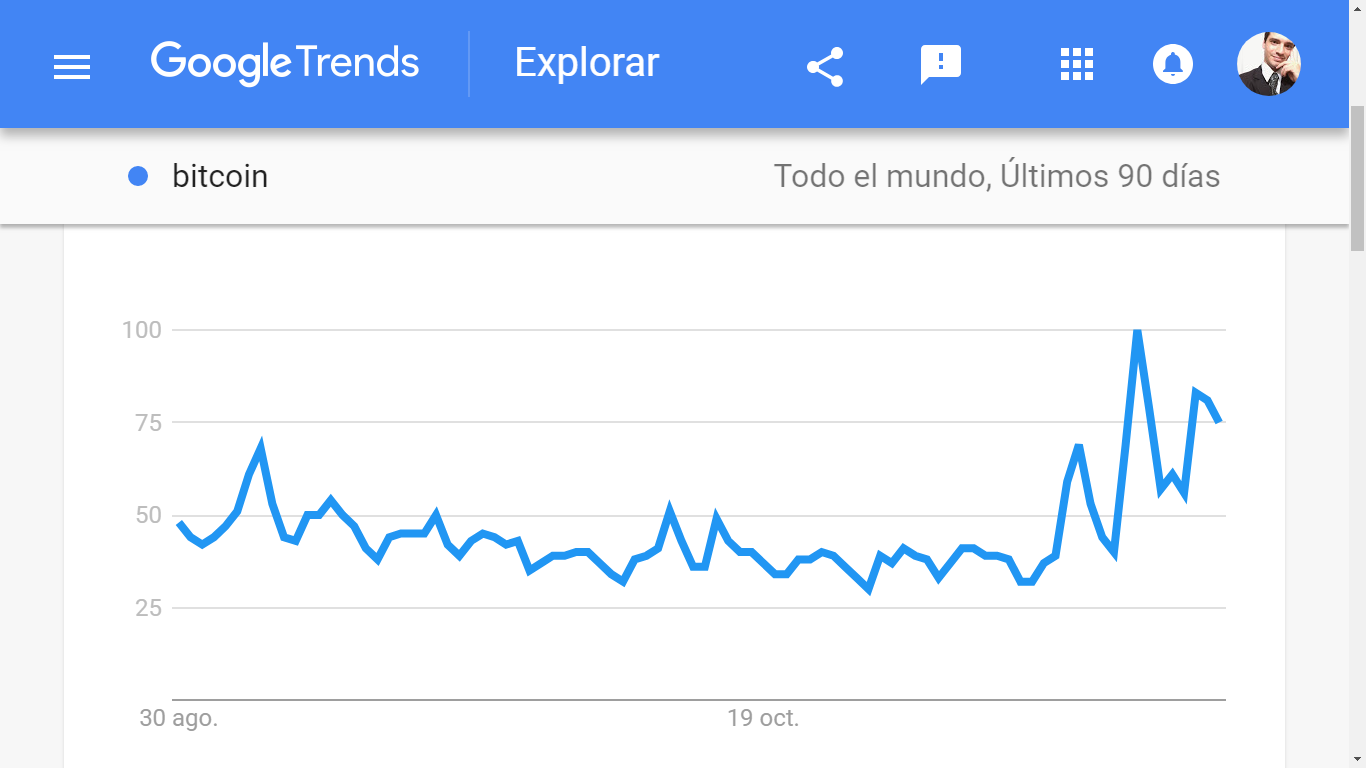

After an important recovery from a sharp fall in prices, public interest in Bitcoin rose dramatically to a 4-month high. According to Google Trends, the highest level of interest for this period was recorded a week ago, and since then, the trend has remained above normal levels.

Google Trends bases its statistics on the number of searches related to a given word. During 2017, the term “Bitcoin Price” was one of the most searched terms in the “news” section in the United States.

For its part, “How to buy Bitcoin” was positioned as the fifth most important search in the section “how to…”. Also, “What is Bitcoin” was the second most important search in the “what is” section.

The countries showing the most interest in Bitcoin are Nigeria, Ghana, and South Africa, with scores of 100, 92 and 78. As a reference, the United States, Canada, and the United Kingdom have scores of 33, 38 and 36.

Are Google Trends Really That Important?

These figures are important because they show how interested the public is in the use of Bitcoin, which may suggest that at present there is a high possibility of attracting new investors.

According to a theory that seeks to establish the relationship between Google trends and the behavior of Bitcoin prices, the connection between the two is directly proportional, so an increase in prices generates a stimulus in the community to look for causes, updates, opinions, and various aspects related to this trend. This, in turn, attracts new people to evaluate news and searches, increasing the interest of new users in acquiring cryptocurrencies.

To illustrate this example, a study by Yale University states that trends in bitcoin-related searches generally lead to similar returns on its price behavior.

“The second factor strongly influencing cryptocurrency is the measure of investor attention. We asked the following: If there is an abnormally high number of mentions of the cryptocurrencies we studied in either Google search or on Twitter, will their returns go up? It turns out that they will. At the same time, we found that negative investor attention, such as an increase in the use of the search phrase “Bitcoin hack,” will generate negative returns for cryptocurrencies.”

However, other studies have determined that while there may be a relationship, an increase in searches does not actually cause an increase in prices :

“Correlation is not Causation. Therefore, it doesn’t mean that the more we search ‘Bitcoin’ on Google, the higher the Bitcoin price will become. And there could be something else that influences both the Bitcoin prices and Google Trend Scores. For example, if Bitcoin price hits 10,000 USD, which is considered as a big milestone, then that news itself can make more people search ‘Bitcoin.’ Or, if a major country or company endorsed or disapprove of Bitcoin, then that news will make many people search ‘Bitcoin’ on Google and also make more people buy or sell Bitcoin, which can increase or decrease the price”.

Positive Reactions

At the end of the day, the appreciation is merely subjective. However, it is undeniable that this bullish streak has ignited a small spark in the community, encouraging traders and hodlers to become more involved in the ecosystem.

Several users have reacted positively to this increase in searches. Mati Greenspan, eToro’s acclaimed analyst, tweeted

….and we’re back!

Google searches for #Bitcoin are trending up again. pic.twitter.com/aNPY2nnIFp

— Mati Greenspan (@MatiGreenspan) November 29, 2018

Tom Lee commented that this behavior was “interesting” to him.

The popular Twiter XRP News account commented

Google trends for “Bitcoin” in an uptrend. #btc #eth #xrp #crypto pic.twitter.com/1mi5ZTdCtH

— xrp_news ⚡ (@xrp_news) November 27, 2018

Technical Analyst “Crypto Wolf” also dedicated a tweet to this particular phenomenon:

Meanwhile bitcoin on Google trends… 🤔 pic.twitter.com/BFUfzCS2Zd

— CryptoWolf (@IamCryptoWolf) November 22, 2018

[ad_2]

Source link