What is INFINOX?

INFINOX is an FX and CFD broker founded in 2009, currently known for its social trading benefits and attractive tools. Based on the company’s claims, the brand was founded on values like integrity, ambition, inspiration, and excellence, aiming to serve the modern trader.

On top of that, users need to know that INFINOX is a multi-licensed brokerage and has authorization to operate across multiple regions around the world. Since many traders might be eligible to open an account, the first useful thing would be to know more about the services provided.

INFINOX instruments

When it comes to asset coverage, INFINOX is a place where traders can diversify their portfolios with over 900 instruments. Currently, 45+ FX pairs, 750+ equities, major indices, commodities, futures, and cryptocurrencies are part of the offer for customers.

You can trade volumes as low as 0.01 lots, meaning even those with small accounts can engage in the markets. Leverage is flexible and can go up to 1:1000, but in this case, you should consider what asset class you want to trade.Some traders naturally have preferred instruments which they stick to, while others tend to switch according to trends and changing market conditions. Either way, with INFINOX both types of traders can have the upper hand.

Platforms

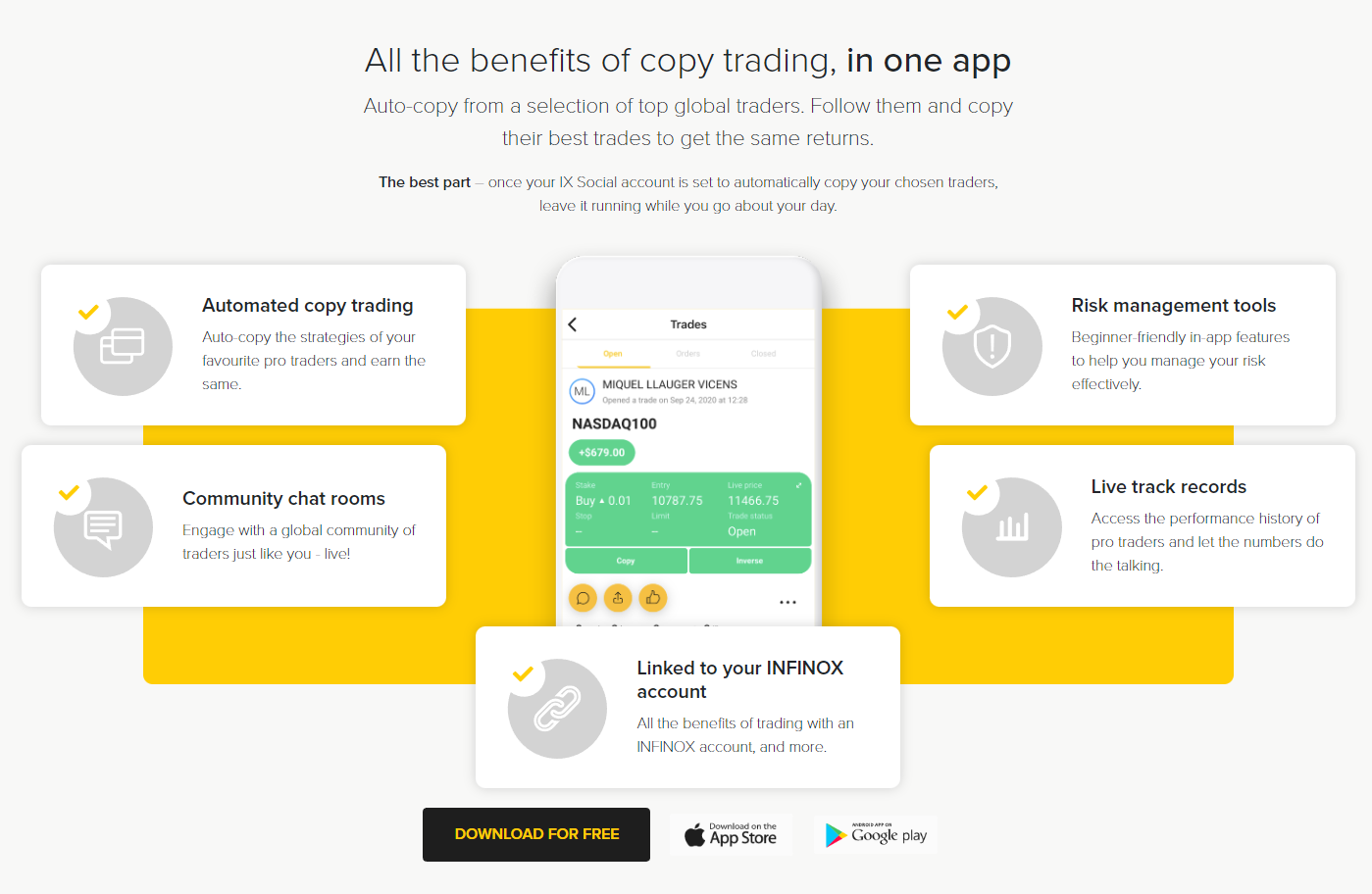

IX Social is a social trading platform designed by the broker, currently serving more than 7000 monthly active users. This is a copy trading tool that facilitates trade automation for any customer that is registered with the broker. Learning to use the software is not an issue, as INFINOX offers detailed guides on its website.

Common platforms are also part of the offering, namely MetaTrader 4 and MetaTrader 5. These solutions have been around long enough to build a solid reputation. Trading is kept simple and secure when using either of them and that’s certainly good news. There’s also some talk of a new feature called IX One coming up, but we don’t have enough information on that at this point.

Trading with INFINOX

In terms of account types, the broker seems to stick to its diversification approach. STP and ECN are the main individual accounts a new customer can open. On top of that, you can trade with a partner by using a joint account.INFINOX is addressing corporate trading needs by facilitating access to an account that allows you to trade using your company entity, for hedging purposes or other financial benefits.

To find out more about the funding options available, the best way is to check the broker’s website where there is a dedicated section. All you need to do is select your country of residence and the list of supported solutions automatically pops up. Bank transfers, credit card payments, Astropay, Skrill, Neteller, ZotaPay, and SticPay are just some of the many options.

Conclusion

INFINOX is a CFD broker regulated by SCB, FSC, and FSCA, meaning it complies with trading-related laws that promise transparency and security. At the same time, the social trading features, as well as the attractive conditions, make up for an offer that shouldn’t be overlooked. Markets are constantly changing, yet INFINOX manages to cope with them and remain competitive.

INFINOX overview

-

Trading Platform

-

Assets

-

Accounts

-

Customer Satisfaction

Summary

INFINOX is a CFD broker regulated by SCB, FSC, and FSCA, meaning it complies with trading-related laws that promise transparency and security. At the same time, the social trading features, as well as the attractive conditions, make up for an offer that shouldn’t be overlooked. Markets are constantly changing, yet INFINOX manages to cope with them and remain competitive.