[ad_1]

A forex economic calendar is useful for traders to learn about upcoming news events that can shape their fundamental analysis. This piece will explore the DailyFX economic calendar in depth, offering tips on how to read a forex economic calendar to plan ahead, manage risk, and execute strategic trades.

What is an economic calendar?

An economic calendar is a resource that allows traders to learn about important economic information scheduled to be released. Such events might include GDP, the consumer price index, and the Nonfarm Payroll report. In today’s environment of fiscal cliffs and central bank intervention, it can be very helpful to know the date of the next central bank meeting or major news announcement.

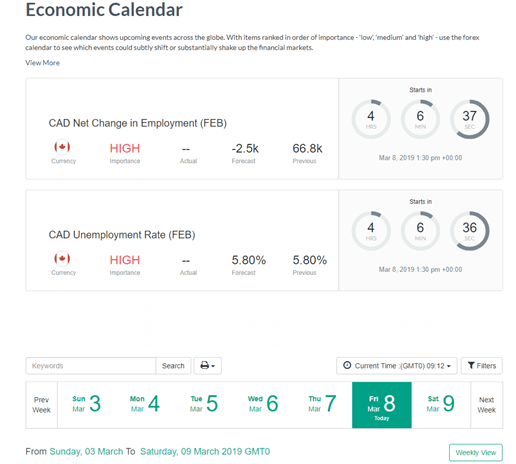

The events on the calendar are graded low, medium and high, depending on their likely degree of market impact. This is what the DailyFX economic calendar looks like.

Example of the DailyFX forex economic calendar

How to read the forex economic calendar

Knowing how to read the forex economic calendar properly is important to maximize your trading prior to and following the most important releases. Checking the calendar every morning will allow you to familiarize yourself with the upcoming events that matter.

In default mode, the calendar will show you every piece of economic news coming out for the major economies. For many, that will be information overload, so you may want to customize the look.

Customising your forex economic calendar view

In order to customize the economic calendar, it’s advisable to change the time frame to what you’re most comfortable with. For most, it will be Eastern Standard Time. Next, click the ‘Filter’ button to look at the events that are of importance to you. This will be determined by country and importance.

For example, if you’re trading EUR/USD, you’ll want to focus on news coming out of the Eurozone and United States that is of high importance. Your filter would look like this:

Example of the use of a filter in the forex economic calendar

Once you select ‘Apply Filter’, you should only see Eurozone and US news announcements that have a high propensity to move the market should the news surprise traders and institutions.

Example of the results of a filter on the forex economic calendar

Also, when using the economic calendar for forex trading, you are informed on what most news announcements cover as well as the date of every central bank announcement.For example, if you’re not familiar with the German ZEW Survey, you can click the notes icon and get a breakdown on what is covered, as shown in the image below.

Example of how to use the notes icon on the forex economic calendar

Top Benefits of Using a Forex Economic Calendar

The top benefits of using the DailyFX forex economic calendar include:

- Being able to manage risk effectively

- Being in a position to plan ahead

- Having access to extra, helpful features for customisation

Risk Management

Being able to plan your trades based on economic calendar events means you can ready yourself for potential turbulence in price. When an event listed on the calendar occurs, there may be expected a period of volatility if data is released well above, below or in line with expectations.

Understand the principle of risk management in regard to these trades. Risk is the difference between your entry price and stop loss price, multiplied by the position size. Traders should aim for this percentage to be less than 2% of account equity.

Planning ahead

The forex economic calendar allows for planning ahead. For example, if a Nonfarm Payroll report is set to be released, traders will know that this indicator has the potential to move FX markets substantially, so awareness of the timings means they can plan their forex trades accordingly.

Benefiting from features on the DailyFX forex economic calendar

The forex economic calendar provided by DailyFX offers the added benefit of special features such as the customization option mentioned above, offering the facility to select specific timeframes, set alerts and apply filters to make it more relevant to your specific trading strategy. DailyFX also offers free trading webinars to help you plan around major news releases.

Other resources to help you trade the forex market

Learn more about using news and events to trade forex and improve your knowledge of how fundamentals move currency prices.

It can also be helpful to understand the differences between Fundamental and Technical Analysis in forex trading, and how to apply them to your trades.

[ad_2]

Source link