[ad_1]

You have probably heard a financial news presenter say something along the lines of “The central bank governor came out slightly hawkish today after bouts of strong economic data”. The terms Hawkish and Dovish refer to whether central banks are more likely to tighten (hawkish) or accommodate (dovish) their monetary policy.

Central bank policy makers determine whether to increase or decrease interest rates, which have significant impact on the forex market. Policy makers increase interest rates to prevent an economy from overheating (to prevent inflation from going too high) and they decrease interest rates to stimulate an economy (to prevent deflation and stimulate GDP growth).

Hawkish and dovish policies affect currency rates through a mechanism central bankers like to call “forward guidance”. This is policy makers trying to be as transparent as possible in their communications to the market about where monetary policy may be heading.

Keep reading to learn more about hawkish and dovish policies and how to apply this knowledge to your forex trades.

What does hawkish mean?

The term hawkish is used to describe contractionary monetary policy. Central bankers can be said to be hawkish if they talk about tightening monetary policy by increasing interest rates or reducing the central bank’s balance sheet. A monetary policy stance is said to be hawkish if it forecasts future interest rate increases. Central bankers can also be said to be hawkish when they are positive about the economic growth outlook and expect inflation to increase.

Currencies tend to move the most when central bankers shift tones from dovish to hawkish or vice versa. For example, if a central banker was recently dovish, stating that the economy still requires stimulus and then, in a later speech, stated that they have seen inflation pressures rising and strong economic growth, you could see the currency appreciate against other currencies.

Some words that could be used describing a hawkish monetary policy include:

- Strong economic growth

- Inflation increasing

- Reducing the balance sheet

- Tightening of monetary policy

- Interest rate hikes

Generally, words used that indicate increasing inflation, higher interest rates and strong economic growth lean towards a more hawkish monetary policy outcome.

What does dovish mean?

Dovish refers to the opposite. When central bankers are talking about reducing interest rates or increasing quantitative easing to stimulate the economy they are said to be dovish. If central bankers are pessimistic about economic growth and expect inflation to decrease or become deflation and they signal this to the market through their projections or forward guidance, they are said to be dovish about the economy.

Some words that could be used to describe a dovish monetary policy, include:

- Weak economic growth

- Inflation decreasing/deflation (negative inflation)

- Increasing the balance sheet

- Loosening of monetary policy

- Interest rate cuts

The table below compares dovish vs hawkish to highlight the differences between the two and how they impact currencies.

|

Hawkish monetary policies |

Dovish monetary policies |

|

Increasing interest rates to stem inflation pressures

|

Decreasing interest rates to stimulate the economy

|

|

Reducing the Federal Reserve balance sheet by selling mortgaged backed securities (MBS) and treasuries

|

Increasing the Federal Reserve balance sheet through quantitative easing (QE). QE is the purchasing of MBS and treasuries that increase the money supply in the economy to stimulate it.

|

|

Forward guidance from central banks include positive statements about the economy, economic growth, and inflation outlook.

|

Forward guidance from central banks include negative statements about the economy, economic growth, and signs of deflation.

|

How to trade a Hawkish or Dovish Central Bank

A slight shift in tone from a central banker could have drastic consequences for a currency. Traders often monitor Federal Open Market Committee meetings and minutes to look for slight changes in language that could suggest further rate hikes or cuts and attempt to take advantage of this.

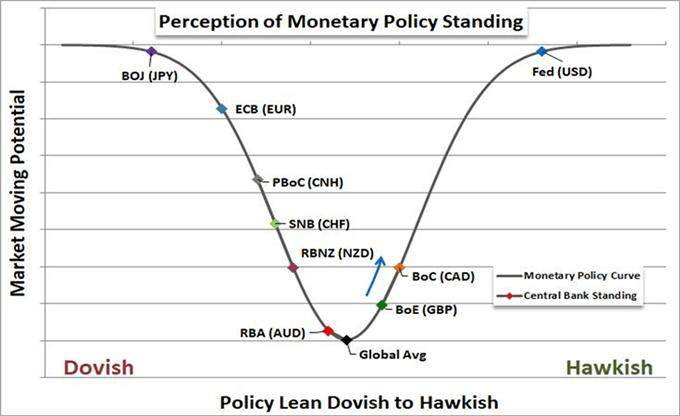

Monetary police standing as at 1 January 2019

The image above shows the different central banks current monetary policy stance. When a central banks’ monetary policy stance moves more towards the left (dovish) their currency could depreciate against other currencies. If the monetary policy stance moves more towards the right (hawkish) their currency could appreciate.

Trading a hawkish or dovish central bank isn’t as easy as buying a hawkish central bank currency or selling a dovish central bank currency. It has to do with changing interest rate expectations. Let’s look at two scenarios:

Scenario 1:

If a central bank is currently in a rate hiking cycle, the market will have already forecasted future interest rate hikes. It is the job of the trader to watch for clues and economic data that could shift the tone of the central bank to either more hawkish than currently, or to dovish. Currencies could move a large amount when the monetary tones shift from what they are currently.

Scenario 2:

Likewise, if a central bank is currently cutting rates and economic data has been negative, the market would have priced-in the current dovish monetary stance. Traders would have to watch the central bankers forward guidance and economic data, which you can find on an economic calendar, for clues to whether they may become more dovish than currently, or hawkish.

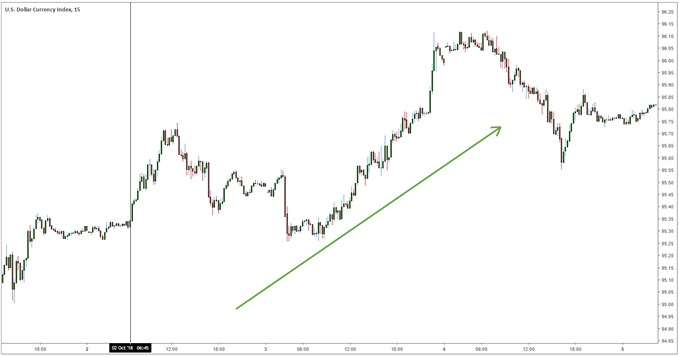

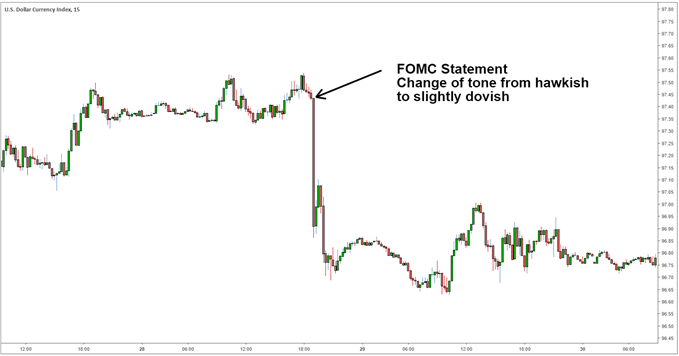

In late 2018 the federal reserve was quite hawkish. Federal Reserve Chairman, Jerome Powell, stated that “we’re a long way away from neutral at this point” which the market perceived as hawkish (2 Oct 2018). This implied that the Federal Reserve still had to hike rates many more times to get to the neutral rate. Then on the 28th of November, the FOMC released their statement of monetary policy in which Jerome Powell said he saw rates at “just below neutral”. This shift in tone is like scenario 1 above, where the central banks shifts tone from hawkish to slightly dovish. Leading to a depreciation of the currency- see the charts below that show what happened to the Dollar Index (DXY) on the October 2, 2018 and then on the November 28, 2018.

October 2, 2018 – Federal Reserve Chairman, Jerome Powell says “We’re a long way away from neutral at this point” leading to appreciation of the Dollar.

15min US Dollar index chart, vertical line indicating October 2, 2018.

November 28, 2018 Federal Reserve Chairman says that interest rates are “just below neutral” indicating a shift in tone from hawkish to dovish. Dollar depreciations.

15min USD Dollar index chart

Keeping up to date with central banks can be difficult. At DailyFX we have a Central Bank Weekly Webinar where we analyze central bank decisions and keep you up to date with central bank activity.

If you are just starting out on your trading journey it is essential to understand the basics of forex trading in our New to Forex guide. We also offer a range of trading guides to supplement your forex knowledge and strategy development.

Senior Analyst, Tyler Yell of DailyFX sat down with former Federal Reserve Advisor, Danielle Dimartino Booth in a podcast that covered global central bank developments and Danielle’s biggest lesson she learned as a Fed insider.

[ad_2]

Source link