Intro into the company

eXcentral is a forex and CFD broker, aiming to emphasize it’s inspiring reliability and professionalism. It does so by providing access to competitive trading costs, exceptional trading platforms, and plenty of educational resources, including free webinars.

A brand name of Mount Nico Corp Ltd, eXcentral is regulated by CySEC (license 226/14) and follows the MiFID II direction. Due to that, its target market is the European Economic Area and Switzerland.

Because it is well-regulated and in line with the latest European requirements, customers can benefit from a trusted trading environment, one that includes highly trained support representatives and a professional approach to trading.

There is fierce competition in the European trading field, so this eXcentral review will try to highlight some of the main benefits currently available with the broker and help you decide whether this is the right brand you should trade CFDs.

Trading Software

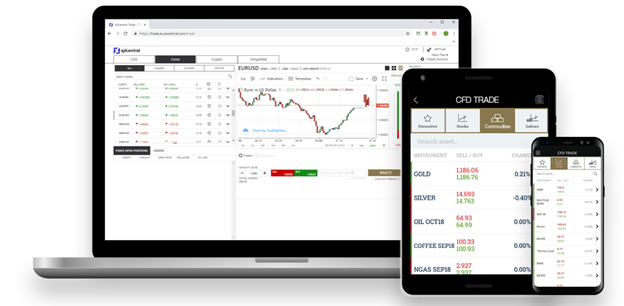

Although more than 15 years have passed since MetaTrader 4 was released, it continues to be a top choice among CFD traders. eXcentral relies on MT4 because it provides access to interactive charts, 30 built-in technical indicators, EA compatibility, a user-friendly interface, and plenty of other features.

At the same time, there are MT4 versions for Android and iOS, meaning traders will be able to use the platform on a smartphone or tablet without major hurdles. eXcentral continues to believe that highly-trusted trading software should be part of its offer, to build long-term trust and ensure stability.

Alongside Metatrader 4, eXcentral CFD traders will benefit from a proprietary web trading platform. Specially designed to improve the trading experience, the eXcentral WebTrader is a client-centric platform, integrating multi-view option, risk management tools, and can be accessed with any browser without downloading any software.

Mobile trading experience is ensured via the eXcentral trading app, the second choice traders have when trading via smartphone or tablet. They can benefit from multiple market execution, high mobility, complete transaction history, and assistance from a dedicated account manager.

Trading Features

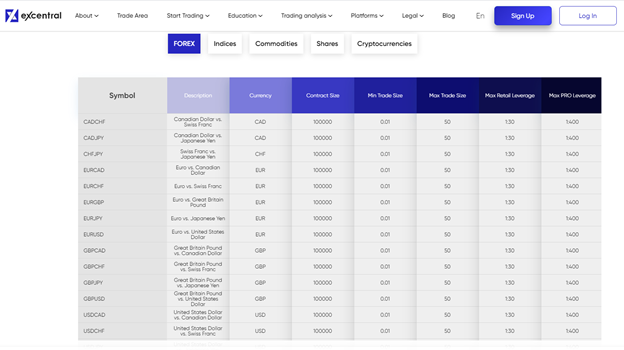

With eXcentral, traders can trade on a broad range of CFD instruments based on FX, indices, commodities, shares, and commodities. At the time of writing, there are around 160 different assets part of the offer, as the broker is focusing on the instruments that have proven to be popular among retail traders.

In terms of trading forex with eXcentral, there are around 50 different currency pairs currently available covering majors, minors, and exotics. The leverage will be different (1:30 for retail and 1:400 for professional accounts) based on the latest European regulation.

It does not matter the size of a trading account, because the minimum trade size is set at 0.01 (one micro lot) on all currency pairs available. The currency market had been more active in 2020 and with diverse coverage from eXcentral, traders have the opportunity to take advantage of price movements in different currencies.

The offer also includes some of the most popular shares, indices, commodities, and 5 top cryptocurrencies. Keep in mind that trading conditions will be different each, which is why it would be important to check the product’s specification page on the broker’s website.

Regardless if you will qualify as a retail or professional client, at eXcentral there are 4 different account types available:

- Classic

- Silver

- Gold

- VIP.

eXcentral supports some of the most popular payment methods, such as credit/debit card, wire transfer, Skrill, and Neteller. The minimum deposit is 250 USD/EUR/GBP, which means access to an account is convenient for most CFD traders.

Helpful Resources

Educating traders is one of the main preoccupations of eXcentral and because of that, the broker currently provides access to a tone of different resources. You can attend free live webinars, go through interactive courses, read trading eBooks, or watch comprehensive trading video tutorials.

Gold and VIP account holders will also benefit from the popular technical analysis tool Trading Central. At the same time, they will get assistance from a dedicated account manager, access VIP webinars, and get a full account overview.

Summary

There are no doubts over eXcentral’s reliability. As a CySEC-regulated entity and operating for European customers, this is a trusted trading brand that CFD traders can confidently work with. With so many different trading benefits, we think most of our readers could find plenty of advantages when trading with eXcentral. Especially if you want to trade CFDs on FX, the trading offer is very rich, with most of the currency pairs supported.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 79.65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

eXcentral Review

Product Name: eXcentral

Product Description: eXcentral is a forex and CFD broker, aiming to emphasize it’s inspiring reliability and professionalism. It does so by providing access to competitive trading costs, exceptional trading platforms, and plenty of educational resources, including free webinars.

Brand: eXcentral

Offer price: 250$

Currency: USD

-

Trading Platform

-

Assets

-

Spread

-

Support

Summary

eXcentral is a forex and CFD broker, aiming to emphasize it’s inspiring reliability and professionalism. It does so by providing access to competitive trading costs, exceptional trading platforms, and plenty of educational resources, including free webinars

Pros

- Online brokerage regulated by CySEC.

- Support for MT4 and a responsive WebTrader

- Plenty of educational resources available.

Cons

- Only 160 different CFDs are currently supported.

- Spreads for Classic accounts are relatively high.

- Only Gold and VIP account holders get to enjoy full benefits.