Ex-Cap Review

Ex-Cap is a retail trading brand that offers access to hundreds of crypto-denominated instruments, or CDIs. More specifically, if you hold crypto and would like to use it for online trading, this might be the right place for you – let’s find out more.

Customers trade with crypto directly, and that makes a lot of sense in today’s digital world. That’s why we decided to check this brand out. The results are here in our 2023 Ex-Cap review, so you can judge for yourself.

Assets to trade

The CDI list currently available with the brand includes many popular instruments. You are not limited to crypto trading only, because Ex-Cap covers all major markets. Currencies, metals, indices, shares and energy are just a few examples.

Stable pricing and low trading commissions are part of the broker’s commitment to its client, and it seems to not only talk the talk, but also walk the walk. Margin trading is also possible, meaning you can enhance your purchasing and trade larger amounts. The diversity of assets puts traders in a favorable position, as they can trade forex and gold, for example, using a single account. Naturally, you are free to decide on the most appropriate instruments for you, based on current market conditions.

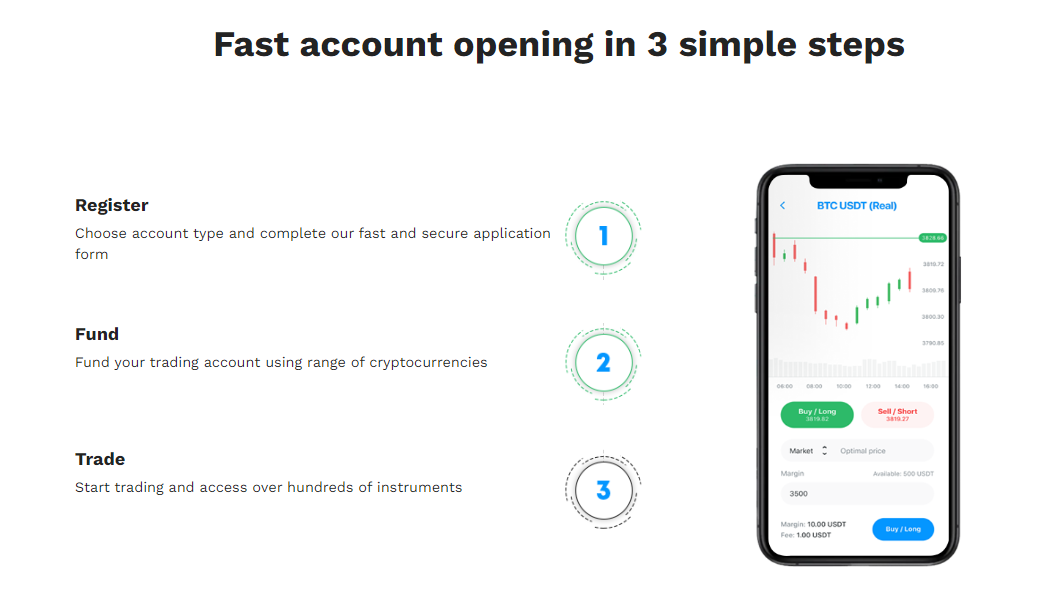

Registration

Ex-Cap also promises a fast and easy account opening process. This means you can easily join the broker, even if you have no background in online trading. You should first choose your account type, though, and then proceed to completing the application form. At this stage, you are asked to provide some personal details, but that shouldn’t take you long

Once the account is set and you have passed verification, the next step is to make your first deposit. As already mentioned, Ex-Cap offers CDI trading, so you can fund the trading account using a range of popular cryptocurrencies.

Types of accounts

Speaking of account types, Ex-Cap offers three different choices: Basic, Classic and Individual. After analyzing the comparison table provided by the broker, it seems like these accounts differ in terms of spreads, commissions and access to premium support.

Take the Basic account for example, where you have to pay a 5 USDT commission and spreads start from 1.5 pips. With Classic and Individual accounts, there are no commissions charged and spreads drop to as low as 1.0 pips and 0.0 pips, respectively.

Classic account holders benefit from premium support, while Individual accounts are the only ones eligible for a dedicated account manager. Maximum leverage is 1:200 for all customers and there are also no limitations in terms of access to trading instruments.

Traders can trade the markets via web, desktop, mobile and tablet thanks to the software designed by Ex-Cap. You have access to advanced charting, risk management tools and an easy-to-use interface.

Conclusion

Ex-Cap provides a viable alternative for crypto holders interested in trading online without having to exchange digital assets for fiat. CDI trading means that you can deposit crypto and trade hundreds of instruments at attractive costs. This broker looks attractive and you might certainly want to take a closer look at what it has to offer.

Ex-Cap Overview

Product Name: Ex-Cap

Product Description: Ex-Cap is a retail trading brand that offers access to hundreds of crypto-denominated instruments, or CDIs. More specifically, if you hold crypto and would like to use it for online trading, this might be the right place for you - let’s find out more.

Brand: Ex-Cap

-

Trading Platform

-

Assets

-

Accounts

-

Customer Satisfaction

Summary

Ex-Cap provides a viable alternative for crypto holders interested in trading online without having to exchange digital assets for fiat. CDI trading means that you can deposit crypto and trade hundreds of instruments at attractive costs.