[ad_1]

Evaluating exchange traded funds? Understand the all-in costs.

If you’re a crypto enthusiast, you probably give traditional financial institutions a wide berth. But soon you might have reason to pause and gander at a crypto exchange-traded fund (ETF). After several false starts, the intriguing notion of a crypto ETF in the US is closer than ever to becoming a reality. Last month, ETHNews reported on two such funds now requesting permission from the SEC to go live.

While that process unfolds, let’s review the following: 1) the basics of ETF fees, 2) the costs that drive them, and 3) how to use fees to evaluate an ETF.

Fees Matter

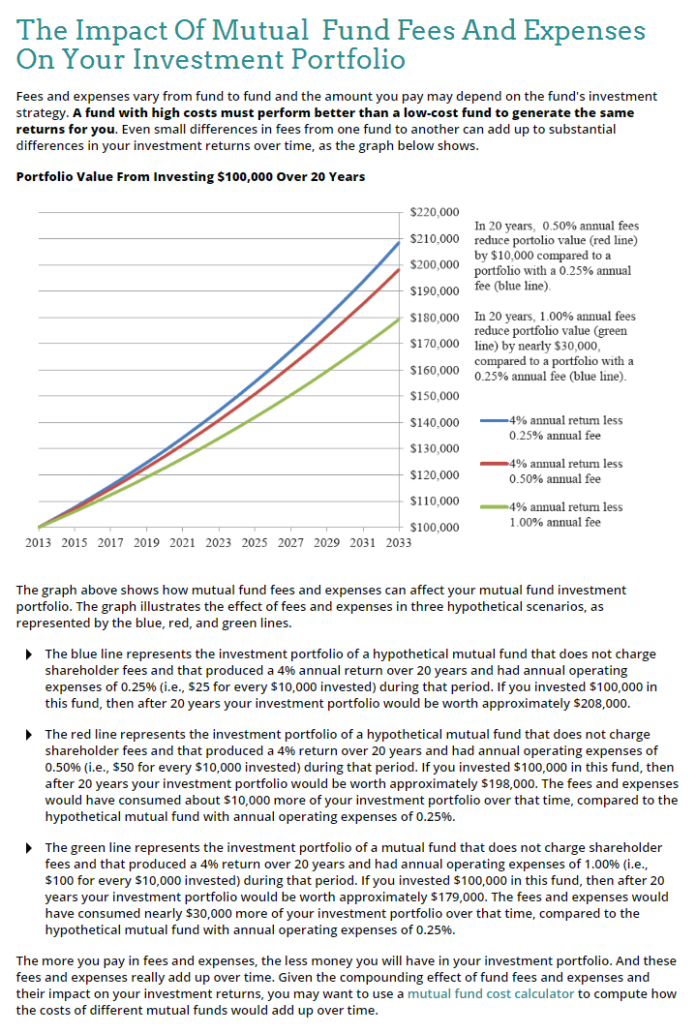

Personal finance gurus tend to emphasize investment performance over fees as the most important evaluation criteria. They’re right, but that doesn’t mean fees (referring herein to a fund’s operating charges, not brokerage fees to buy an investment) don’t matter. For the long-term investor, fees will make a discernible dent in performance over 5, 10, or 15 years. In crypto-land, the “hot money” investor who trades daily or even intra-day will likely care most about the risk/return gambit and the chance to score big. But the regular Joe and Jane investor will want to understand fees, both the obvious and the not-so-obvious. (Whether Joe and Jane should go anywhere near a crypto ETF in the first place is a topic for another day; the initial crypto ETFs will instead be for qualified investors.)

ETFs, in general, are known to impose smaller fees than traditional mutual funds. That’s because many ETFs are designed to reflect the aggregate performance of a securities index such as the S&P 500 Index. All things being equal, the index-based ETF, often considered a passive investment, will not trade its underlying securities as frequently as so-called actively traded mutual funds. As a result, index-based ETFs typically have low turnover, which means relatively low costs to go along with the benefits of broad diversification that appeal to so many people.

The first thing to understand involves expense ratios and the fact that ETF fees vary within their fund categories. The costs of operating funds also depend on investment strategy and fund size (a relatively small fund will have a higher expense ratio because the fund has fewer net assets over which to spread its expenses). Thus, a bond fund should be assessed relative to the average annual performance delivered by a grouping of similar bond funds. When it comes to crypto ETFs, which will proliferate if/when the first few get the SEC nod, it will be important to compare a bitcoin index fund to a group of bitcoin funds; and compare a diversified crypto fund with other diversified crypto funds. To make things even more fun, you’ll want to compare commodity funds with their brethren and currency funds with other currency funds.

Internal fund costs are generally passed on to shareholders through the expense ratio, which is the percentage of fund assets charged to cover operating costs such as fund accounting and periodic performance disclosures. For example, an expense ratio of 1 percent means you’ll pay $1 each year for every $100 you’ve invested; if the expense ratio is 0.75 percent, you’ll owe 75 cents. The investor’s total return is equivalent to the overall return of your investments (say, 5 percent) minus the charge that reflects the fund’s overall expense ratio (say 1 percent).

Below is a helpful illustration from the SEC that depicts the impact of fees.

The SEC reminds investors to look for a fund’s fees and charges that, by law, must be included in the fund’s prospectus under the heading “Shareholder Fees.”

Take this lesson to heart: ETFs and their mutual fund cousins should never be evaluated solely on cost structure, although it’s tempting to lean that way when bombarded by digital ads from big fund outfits that scream about rock-bottom fees. That nonsense is driven by competition. Don’t buy it. Performance matters most, but fees do bite.

Mary Driscoll covers finance and business trends as a staff writer for ETHNews. She formerly served as an editor for management and finance at the Economist Intelligence Unit and a research principal at APQC. In addition, she has written for The Wall Street Journal CFO Report, HBR-online, and strategy + business. Her book on corporate treasury management was published by John Wiley & Sons, Inc. Mary enjoys hiking and skiing in the Sierras with family. Her goal in life is to win big on Jeopardy.

ETHNews is committed to its Editorial Policy

Like what you read? Follow us on Twitter @ETHNews_ to receive the latest Exchange traded fund, Expense ratio or other Ethereum business and finance news.

[ad_2]

Source link