[ad_1]

By CCN: The Dow Jones Industrial Average is on the verge of setting a new all-time high, and soaring fund inflows could push the stock market bellwether over the finish line.

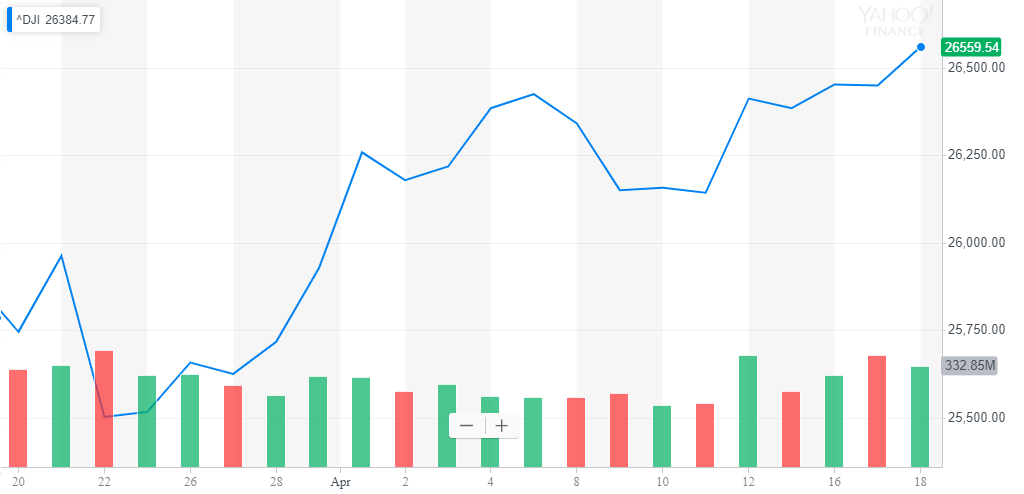

Dow Poised to Jump Above All-Time High at 26,828.39

At present, the Dow sits at 26,559.54, less than 300 points below the record 26,828.39 mark it closed at on October 3, 2018.

The U.S. economy is in an ideal position to grow with the unemployment rate at a 50-year low and the financial sector recovering from last year’s struggle.

According to reports, equities-focused funds are showing an appetite for stocks once again as a result, for the first time since September of last year.

Nearly $1.9 billion flew into the U.S. equities market from funds in the past week. According to FT, this was the first time that funds had seen positive inflows for two straight weeks in a staggering seven months.

The Dow’s late 2018 correction was primarily caused by the sell-off in the equities market by retail investors and individual traders as geopolitical risks arising from the U.S.-China trade war intensified.

Max Gokhman, Pacific Life Fund Advisors head of asset allocation, said that several uncertainties that existed throughout the latter half of 2018 are being eliminated from the market.

The Fed’s patient stance, significant progress in the U.S.-China trade deal, and the Mueller report‘s publication have contributed to the overall rise in productivity in financial markets.

“Broadly speaking, some uncertainties that hovered over the markets since the end of 2018 are being removed,” Gohkman stated.

He added that more funds and retail investors are beginning to find an appetite for funds targeting equities as the sentiment around the Dow Jones, S&P 500, and the U.S. stock market, in general, improved.

“We have seen the appetite for these kinds of products just increase. More of the folks becoming ready to invest, such as millennials and Generation Z, are more interested in having a dual purpose in their investments: do good and generate returns,” Gohkman added.

Larry Fink, the CEO of BlackRock, the biggest asset manager in the global market, said earlier this week that the firm saw an inflow of $65 billion in the first quarter of 2019.

“There’s too much global pessimism. People are still very underinvested. There’s still a lot of money on the sidelines, and I think you’ll see investors put money back into equities,” Fink said.

Kaplan: Fed Comfortable with Current Rate Regardless of Economic Outlook

The Federal Reserve’s patient stance on rate hikes has helped fuel the stock market’s recovery. | Source: Shutterstock

Some strategists feared that as the U.S. economy began to show signs of growth, the Federal Reserve would reconsider raising interest rates, which it had said would likely remain steady through 2019.

However, on Thursday, Dallas Fed President Robert Kaplan said that he does not see a reason to adjust the Fed’s short-term interest rate – even if the U.S. economy continues to improve.

Speaking to the Wall Street Journal, Kaplan said that the Fed might hold the benchmark interest rate “in the neighborhood of where it is for some period of time,” regardless of the pace of the growth of the U.S. economy.

A strong stimulus from fund inflows – coupled with a patient Federal Reserve and ongoing trade deal progress – should be sufficient to tilt the Dow to an upside movement considering that most fundamental factors in the stock market remain strong.

[ad_2]

Source link