[ad_1]

The US stock market appears ready to extend Wednesday’s declines into Thursday, with Dow futures flashing triple-digit declines ahead of the opening bell. Prices remain flat in the cryptocurrency market, but even one rabidly-bullish strategist has warned that bitcoin could endure another sell-off within the near future.

Dow Futures Slide as Guidance Cuts Mount

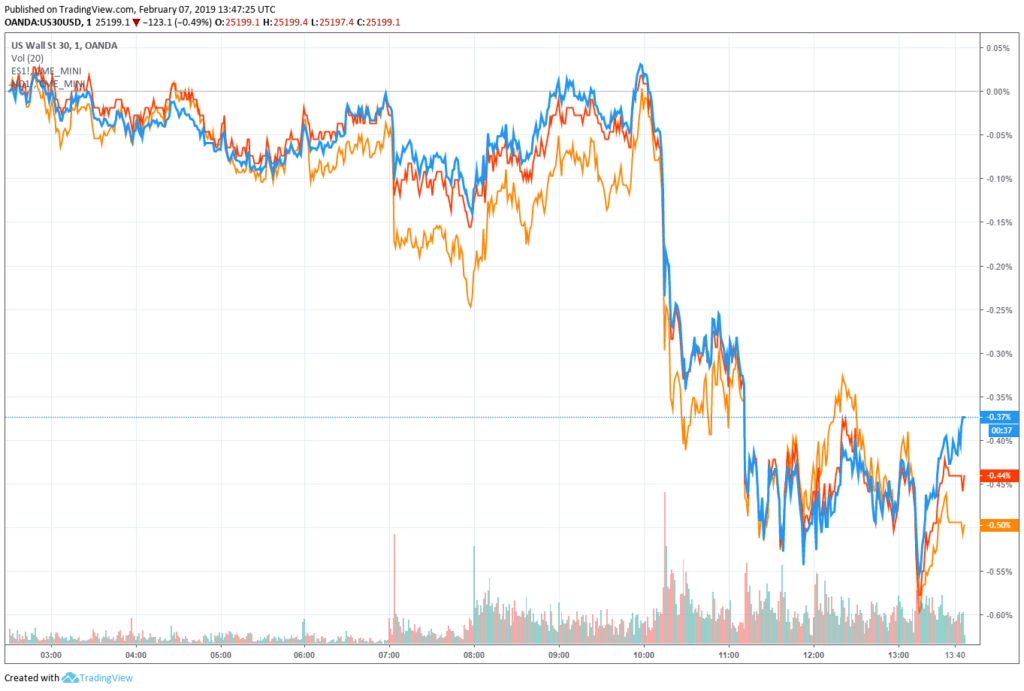

Futures tracking the Dow Jones Industrial Average (blue), S&P 500 (red), and Nasdaq (orange) saw steep declines on Thursday.

As of 8:59 am ET, Dow Jones Industrial Average futures had plunged by 133 points or 0.53 percent, implying an opening bell loss of 145.3 points. S&P 500 and Nasdaq outlooks returns were even worse, with futures tracking the two other major stock market indices declining 0.61 percent and 0.69 percent, respectively.

On Wednesday, Wall Street’s three major indices had all slumped into the red. The Dow declined 21.22 points or 0.08 percent to close at 25,390.30, the Nasdaq fell by 0.36 percent and the S&P 500 dropped 0.22 percent to break a five-session winning streak. Oil, gas, and gold prices were also down in what proved to be a disappointing day across the board.

Twitter Guidance Cut Highlights Growing Concern for Stock Market

One growing concern for stock market bulls is the rising number of major companies who are beating quarterly earnings estimates while also lowering guidance for 2019.

Before Wednesday’s opening bell, social media giant Twitter became the latest firm to join this bandwagon. The Jack Dorsey-led firm beat Q4 2018 revenue estimates by nearly five percent, recording 31 cents in adjusted earnings per share. However, the company reduced guidance for the current quarter to as low as $715 million, nearly $50 million less than the $764.9 million analysts had anticipated.

Twitter shares fell 7.29 percent in pre-market trading.

Nasdaq Not Ready to Exit Bear Market?

Meanwhile, as reported by the Wall Street Journal, the stock market rally has pushed the Nasdaq within a single percentage point of exiting bear market territory. If the tech sector can claw its way back to 7,431.504 from Wednesday’s closing mark at 7,375.28 within the next five days, the index will have closed the book on its second-shortest bear market in history.

However, given today’s pre-bell decline, it may be that the market isn’t quite ready to exit bear market territory.

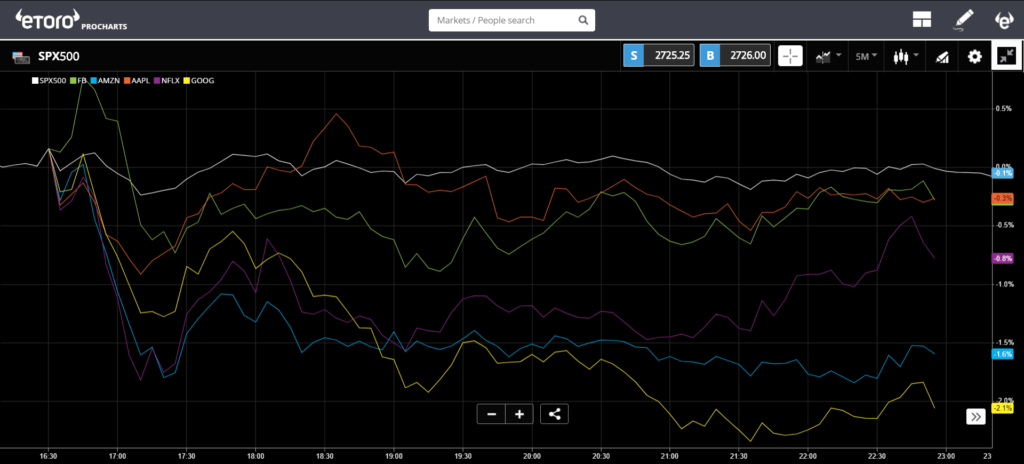

Writing in daily market commentary shared with CCN, eToro senior market analyst Mati Greenspan warned that popular stocks — e.g., FAANG — had “accumulated maybe a little bit more value than they’re actually worth.”

Similarly, Credit Suisse analysts expressed concern that slumping growth at FAANG companies Apple and Alphabet (Google) could drag down the performance of the S&P 500, even if other companies continue to do well.

Fundstrat Gives Bleak Short-Term Forecast for Bitcoin

The cryptocurrency market was largely flat heading into Thursday’s US trading session, though most coins saw minor gains over their previous-day levels. Unfortunately, the short-term forecast for the crypto market remains bleak, even if its long-term fundamentals are intact.

Writing in a Wednesday note to clients, Fundstrat — the Wall Street strategy firm most bullish on cryptocurrency — said that the technical outlook for bitcoin and most other coins “remains weak”

“The price structure for most cryptocurrencies remains weak and appears vulnerable to a pending breakdown to lower lows,” the firm wrote. Fundstrat’s advance/decline indicator “is at risk of breaking to new lows,” the note added.

Fundstrat said that the crypto market’s prolonged downtrend remains intact. | Source: Bloomberg/Fundstrat

Echoing outlooks from other technical analysts, Fundstrat strategist Robert Sluymer warned that if bitcoin breaks below support at $3,100 it will likely fall toward $2,270. For investors to be comfortable that the market has turned a corner, they would need to see the bitcoin price jump above $4,200, representing a 25 percent increase from its current level.

“A break below the fourth-quarter lows at $3,100 would imply a decline to $2,270, while a move above $4,200 is needed to signal Bitcoin is beginning to improve,” he said.

As of the time of writing, the bitcoin price was trading at $3,366 on Bitstamp, representing almost no movement from its previous-day level. Ethereum and EOS each rose around one percent, while bitcoin cash’s 2.18 percent increase was the largest among the top five cryptocurrencies. The only large-cap cryptocurrency to make a major movement was bitcoin sv, whose price leaped 8.95 percent to quickly reverse most of the losses the Craig Wright-backed coin had incurred over the past week.

The overall cryptocurrency market cap, which measures the combined value of all crypto tokens in circulation, currently stands at $112 billion, up nearly $600 million over the past 24 hours.

Featured Image from Shutterstock. Price Charts from TradingView.

[ad_2]

Source link