[ad_1]

Dow futures traded lower ahead of Wednesday’s opening bell, signaling that traders may put the brakes on the US stock market’s multi-day winning streak. The bitcoin price, meanwhile, careened below the $3,400 mark and risks plowing through the critical support level that has stabilized the cryptocurrency market in recent weeks.

Dow Steels itself for Opening Bell Losses

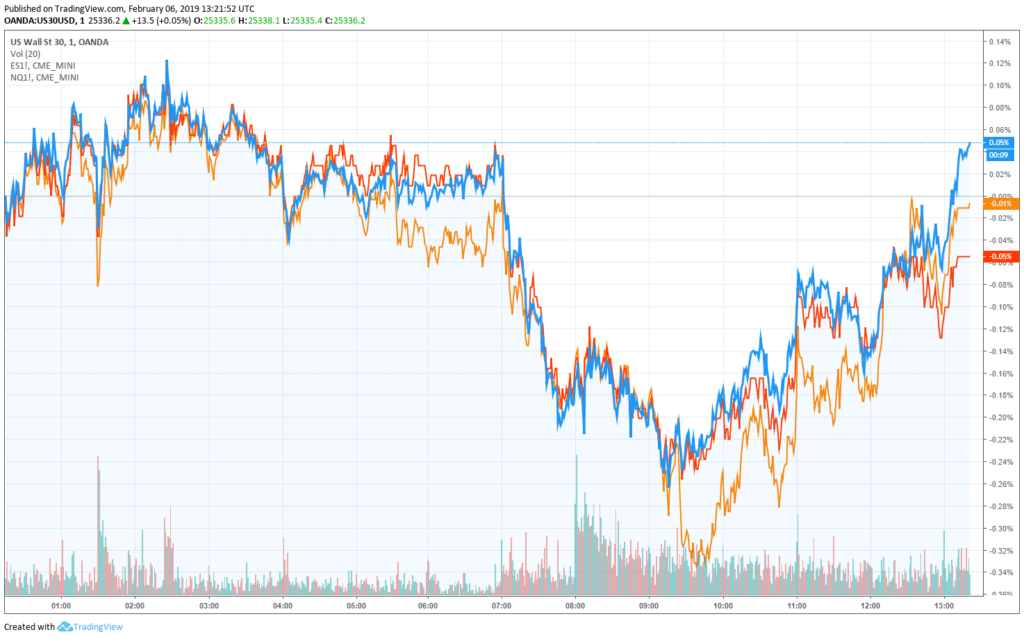

As of 8:42 am ET, futures tracking all three major US stock market indices had recovered from moderate losses to trade in the green, with the Dow up 13 points, the S&P 500 up 1.25 points, and Nasdaq futures rising by 14.5 points.

However, the stock market remains poised to decline at the opening bell, with Dow futures implying losses of 22.52 points, S&P 500 futures anticipating losses of 3.95 points, and Nasdaq futures signaling a 2.77 point decline.

Futures tracking the Dow Jones Industrial Average (blue), S&P 500 (red), and Nasdaq (orange) recovered ahead of the opening bell after taking steeper losses earlier in the pre-market session.

On Tuesday, the stock market had raced to another banner day as the Dow rose 172.15 points or 0.68 percent, the S&P 500 climbed 12.83 points or 0.47 percent, and the Nasdaq hopped 54.55 points or 0.74 percent.

Wall Street Reacts to Trump’s State of the Union Address

Today, Wall Street will digest what can be gleaned from US President Donald Trump’s 82-minute State of the Union address, which featured an impromptu rendition of “Happy Birthday” as well as renewed calls for a wall on the US-Mexico border.

Crucially absent, though, was a declaration of a national emergency, which Trump backers say would allow the president to reappropriate executive branch funds to build the wall without congressional authorization.

An emergency declaration would plunge the Trump administration into a pitched legal fight, and it’s not clear how the stock market would respond. However, the declaration would likely help the federal government avoid another shutdown. That in itself should be enough for Wall Street to breathe a sigh of relief, given that Moody’s and other analysts have warned that a second shutdown would pinch economic growth to a harsher extent than the previous one.

Mnuchin: US-China Trade Talks ‘Very Productive’

Steven Mnuchin | Source: Flickr/International Monetary Fund

Also this morning, US Treasury Secretary Steven Mnuchin praised the progress that the Trump administration and China had made toward ending the trade war that has stymied the world’s two largest economies and stands to grow worse once more tariffs kick in on March 2.

Speaking on CNBC, Mnuchin said that the US-China trade negotiations had been “very productive” and revealed that he will personally lead a US delegation to China next week so that the two sides can tackle key hurdles that continue to separate them. Notably, though, Trump has said he will not sign a trade deal until he and Chinese President Xi Jinping have a face-to-face discussion about the agreement’s more “difficult” points.

Stock futures pared losses following Mnuchin’s statement but continued to signal opening bell declines as of the time of writing.

Bitcoin Price Makes Sharp Drop But Dorsey Gives Hodlers Something to Cheer About

The mood is worse in the crypto market where it looks like the bitcoin price may finally be breaking to the downside.

Bitcoin Fails to Hold $3,400

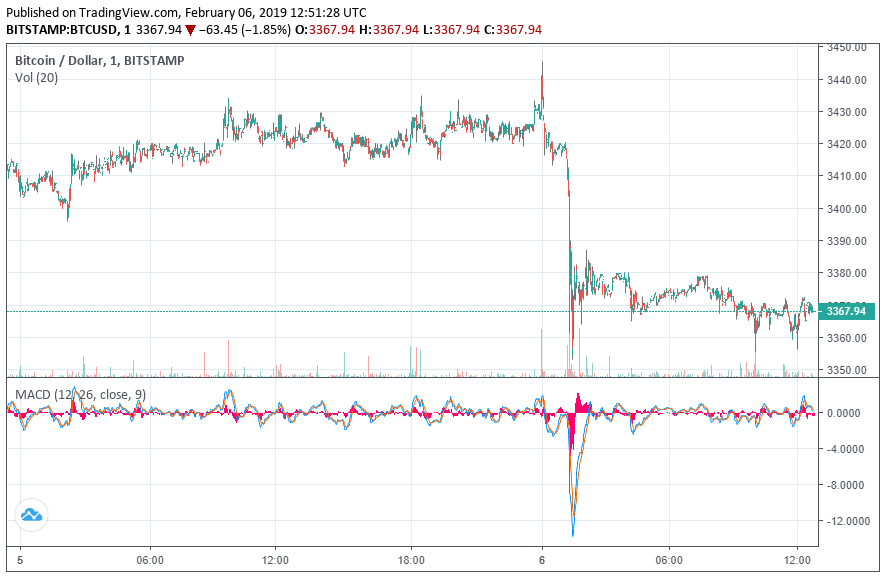

Early this morning, the flagship cryptocurrency endured a sharp drop from the ~$3,425 level at which it had been trading and sunk as low as $3,353 on crypto exchange Bitstamp.

EToro Senior Market Analyst Mati Greenspan says that the bitcoin price is reaching the point of another descending triangle. | Source: eToro

The bitcoin price has since made a minor recovery to $3,370, but as the asset moves closer to the point of another descending triangle, it looks like bulls may take further losses before things turn a corner.

Twitter CEO Experiments with Lightning Network

It wasn’t all doom-and-gloom for hodlers, though, because Twitter CEO Jack Dorsey once again took time to not only praise bitcoin in front of his more than 4 million followers but also participate in the Lightning Network “pass the torch” experiment.

lnbc28600u1pw9n7g7pp5enjn8exsyymyl6mlxmcvy7fdcwuh04z96swfmtasznppglgdyvsqdqqcqzysc8rve6vdwuvketcn7yp8gu3ltvq29vj588erp3at9z2msqj0yhhjdwsf7qtfy5lwf8favm6u3wr5qklvprlhrz89pknpdfxnc55wy6sqnrxjh7

— jack (@jack) February 5, 2019

Dorsey has long been a bitcoin bull, and he continues to pound the table on the cryptocurrency even 13 months into its longest-ever bear market.

He even revealed that Square — the digital payments firm he founded — is “working” on allowing Cash App users to send and receive bitcoin from within the platform. Cash App users can already buy and sell bitcoin, but transactions are restricted to KYC-compliant users withdrawing funds to external crypto wallets.

Dorsey, notably, did not reserve any praise for the more than 2,000 altcoins competing for the attention of cryptocurrency investors. “Nah,” he replied when one follower told him to add more cryptocurrencies to Cash App. “Hell no,” he said to another who suggested that he was actually talking about bitcoin cash rather than the original bitcoin.

The altcoin markets, incidentally, have endured even worse losses than bitcoin this morning, with only one top-15 coin recording a better 24-hour performance than the dominant cryptocurrency. However, that token — binance coin — has surged 11 percent against the US dollar to ram its way into the top 10.

Featured Image from Shutterstock. Price Charts from TradingView.

[ad_2]

Source link