[ad_1]

The Dow crept higher leading into the morning trading session, as the US stock market eyed a recovery from its April 9 pullback. However, this so-called “Super Wednesday” threatens to leave investors with a sour taste in their mouths.

Dow Plots Recovery After 190 Point Plunge

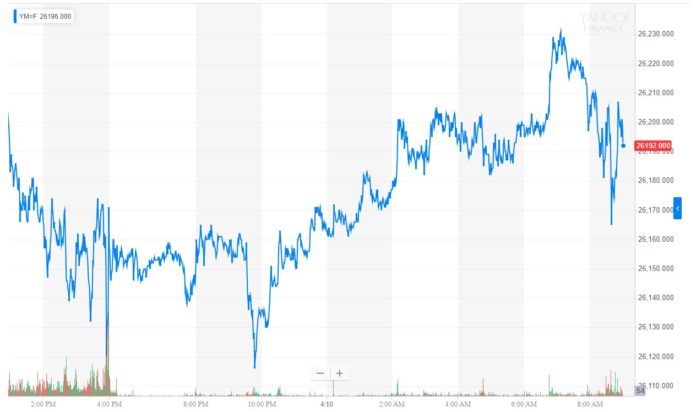

Shortly before the opening bell, Dow Jones Industrial Average futures had gained 37 points or 0.14 percent, implying a 38 point gain. S&P 500 futures rose 0.2 percent, and Nasdaq futures climbed 0.18 percent as Wall Street struck a cautiously optimistic tone.

On Tuesday, the Dow plunged by 190.44 points or 0.72 percent as Wall Street wrestled with deteriorating trade relations between the US and EU. The S&P 500 lost 17.57 points or 0.61 percent. The Nasdaq declined 44.61 points or 0.56 percent as the US stock market bellwethers took a collective step down.

Today, the Dow must defend the 26,000 mark, a feat it has struggled to accomplish since first regaining that level earlier in the year. The index is well on its way, with futures implying a push toward 26,200 at the open as traders priced in moderately positive outcomes on a variety of fronts.

Will ‘Super Wednesday’ Turn Sour?

“Super Wednesday,” as it has been dubbed, will provide investors with a veritable buffet of data points. Federal Reserve minutes, inflation data, and European Central Bank (ECB) interest rate policy explanations will all make an appearance – not to mention a key Brexit summit. And more corporate earnings.

As expected, the ECB left interest rates unchanged. Mario Draghi touted the resilience of the domestic economy but warned that the bank expects a growth slowdown to continue throughout the near future.

Draghi’s comments follow the International Monetary Fund’s shocking decision to slash its growth forecast for the third time in six months. At 3.3 percent, the IMF’s current forecast has not been this bearish since the financial crisis, raising serious questions about the strength of the market recovery that saw the Dow post its best quarter in a decade.

Commenting on a broad based downward revision to its global growth forecast for this year to 3.3 percent, Gita Gopinath, the #IMF’s Research Department Director, writes that the institution #now “projects a slowdown in growth in 2019 for 70 percent of the world economy.” #economy

— Mohamed A. El-Erian (@elerianm) April 9, 2019

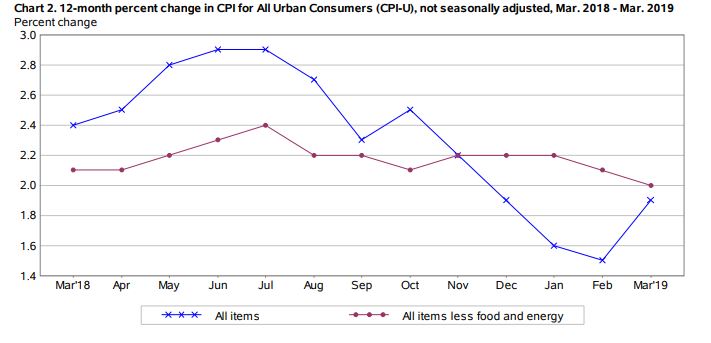

The Federal Reserve will also release its March policy meeting minutes. Coupled with today’s Consumer Price Index Reading, these minutes should enable investors to obtain a fuller picture of the Fed’s reading of the economy and decision to punt on interest rate hikes through the remainder of the year.

With a data buffet this large, bulls and bears alike shouldn’t have a difficult time finding juicy metrics to chew on. Just look at the Consumer Price Index. According to the Bureau of Labor and Statistics (BLS), the CPI jumped to 4.1 percent, its largest increase in 14 months. However, discounting volatile energy and food categories, “core” prices rose just 0.15 percent.

Given the fevered temperature of the market, one would not be surprised to see Wall Street sweep the negative data under the table. However, David Rosenberg, the chief economist and strategist at Gluskin Sheff, warned that equities bulls have failed to reckon with what damage that the IMF’s “hatchet” could wreak, not only on the Dow but also on the global market as a whole.

The permabull trollers may have missed this, but the IMF just took another hatchet to its 2019 global growth forecast, down to the slowest pace for the cycle. In just two words, the Fund politely concluded that we have reached a “delicate moment”

— David Rosenberg (@EconguyRosie) April 9, 2019

And don’t forget about what many analysts fear could be a “brutal” earnings season.

[ad_2]

Source link