[ad_1]

The

Wall Street Journal underestimated

ICO raised investments in 2.5 times. This information has been reprinted in

several world Media.

When comparing the first quarter of the 2019

year with the same period last year, the WSJ informs about the fall of the

volume of attracted ICO funds in 58 times.

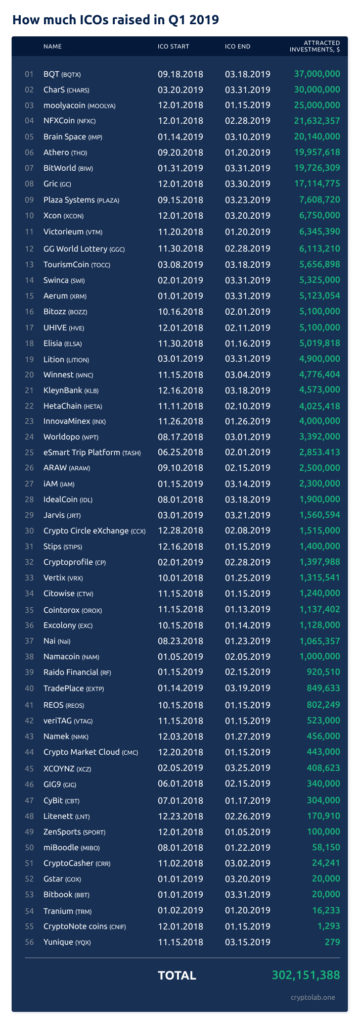

International Analytical Resource “CryptoLaboratory” has revealed a serious error in the WSJ’s calculation. The problem is that The Wall Street Journal used incomplete data. For the first quarter of 2019 year ICO attracted not 118, but 302 million dollars. You can check these numbers directly on the CryptoLaboratory resource, which is keeping record of all ICOs since 2018.

Thus,

in the quarterly comparison, the ICO market really met with a fall, but not in

58 times, as claimed by The Wall Street Journal, but in 22.8. That is, the WSJ exaggerated

the depth of the fall in 2.5 times. CryptoLaboratory reported about this error

to the editor of The Wall Street Journal and to the author of the publication

immediately after the publication of the article. However, there was no response.

Most

likely, the media simply became a victim of the information chaos that reigns at

the crypto market, – Dmitry Bogdanchikov, CEO of CryptoLaboratory, says. –

There are many resources in the Internet, which try to provide analytics. They

are mostly created by enthusiasts, who usually do not have enough time or

opportunities to gather complete information. As a result, such a serious media

as the WSJ can become a victim of misinformation. We strive to correct this

situation by creating analytics for qualified users who are not afraid of

professionally built tables.

CryptoLaboratory is an blockchain industry

analytical resource that tracks the rates of cryptocurrencies and ICO/STO investments.

Analysts

of CryptoLaboratory fix the slightest movement of the crypto market. All

collected data are systematized in convenient tables, which can be managed by

ordering data by dozens of parameters.

Speaking

specifically about ICO – each of the projects is analyzed on 52 parameters.

There are the weighted average rating (determined by the sum of ratings of 14

leading agencies), product use area and investments among them. You can learn

in a few minutes the dynamics of any selected period by ordering investment by

date. CryptoLaboratory can state of having the most deployed ICO-analytics due

to the volume and accuracy of the collected information.

The

aim of the project is to create a clear and convenient information and

analytical resource about blockchain-industry. We strive to create a global

platform where everyone can find the necessary information on any topic related

to this area. The Project is constantly developing and is preparing the world’s

first analytics of blockchain platforms.

You also can contact with CryptoLaboratory

via social media: Facebook, Twitter and

Telegram.

[ad_2]

Source link