[ad_1]

Crypto Market Sees Violent Move To The Downside, BTC Falls 4%

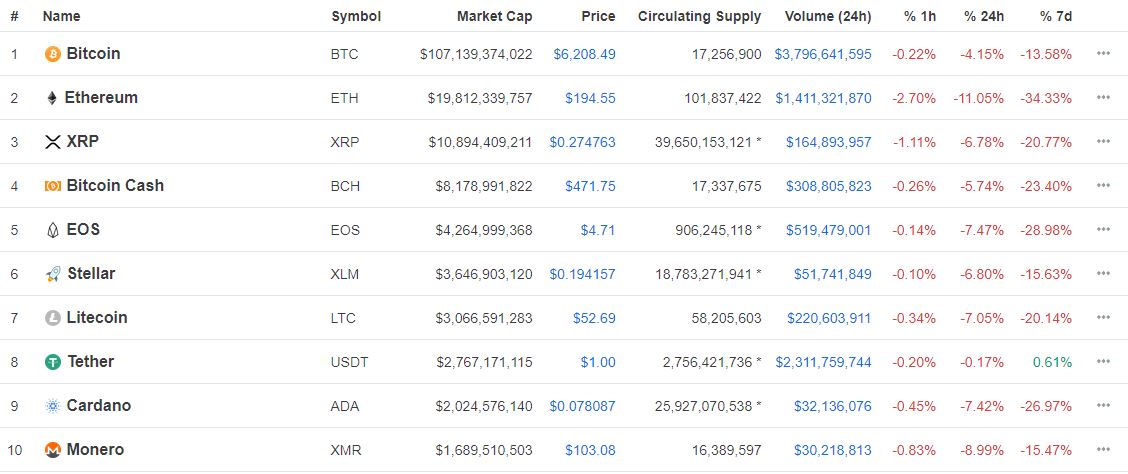

After days of sideways price action, on Saturday, traders awoke to a horrific sight, with the cryptocurrency market continuing lower due to a fresh bout of sell-side pressure across the board. So essentially, when optimists thought it couldn’t get worse, it did, and a whole lot worse at that. Within the span of a single hour, BTC fell from $6,420 to $6,140, as selling volume ramped up on a variety of exchanges.

As with other recent bearish movements, altcoins actually underperformed Bitcoin, with a majority of crypto assets posting losses of 6% or more, while Bitcoin sat at 4% down on the day.

In this move, however, there was one altcoin that stood out among the crowd of hundreds. As chart watchers are likely aware of, this sore thumb was Ethereum, or the price of ETH to be exact. For the first time in months, if not a year, ETH has fallen under the price of $200 and now sits at $192 and seems to be poised to move lower.

There wasn’t a clear catalyst for this continued bearish move, but many pointed out that the market weakness imposed by the previous move down likely incited Saturday’s drop. Analysts now have their eyes on the $6,000 and $5,800 support levels for BTC, which will both be points of interest if the market continues to post losses.

Some pessimists have pointed out that if Bitcoin closes under $5,800, that it could signal that this nascent asset class is ready to move into a multi-year bear phase. But for now, it remains to be seen whether this is just a baseless claim or a thought that holds credence.

Fundstrat’s Sluymer: “There Is No Strong Technical Setup For Bitcoin”

Following BTC’s drop from $7,100 to $6,300 on Wednesday, Robert Sluymer, a well-known analyst at Fundstrat Global Advisors, spoke with MarketWatch to discuss his opinions about how traders should deal with the market in its current state. The Fundstrat analyst stated:

That was a very damaging drop. There is no strong technical setup for bitcoin, we remain with lower lows and lower highs.

The analyst added that outside of day trading, it makes no sense to hold a long on ‘physical’ BTC tokens, as the indicators clearly show that BTC is evidently more bearish than it is bullish. However, there’s apparently even a risk for day traders, as Sluymer went on to point out, stating, “If you do [day trade], you have to have a tight stop.”

Oddly enough, the Fundstrat analyst’s sentiment is polar opposite from sentiment held by longtime Bitcoin bull Tom Lee, who is Sluymer’s co-worker. But this makes sense, as the former Fundstrat analyst is focused solely on technicals (which have been trending bearish), while Lee has his eye on fundamental indicators (which signal more positivity than technicals) and lesser-known and under-utilized technical indicators.

Photo by Alessia Cocconi on Unsplash

[ad_2]

Source link