[ad_1]

By CCN: Grayscale Investments is starting a movement urging all investors to drop gold and replace it with the better store-of-value, bitcoin. In a Monday morning Medium post, the digital asset management group announced its new #DropGold campaign. Beyond a catchy hashtag, the anti-gold campaign includes a website, upcoming debate, and a television ad push.

Their commercial makes a compelling argument.

Why is #gold still in your portfolio? #DropGold

— Grayscale (@GrayscaleInvest) May 1, 2019

Branding Bitcoin as the New Digital Gold

Grayscale is attempting to paint bitcoin as the improved, digital form of gold with its new campaign. The company argues that although gold is good, bitcoin is better. Grayscale isn’t alone in its thinking, either. Venture capitalist Lou Kerner believes bitcoin is already on its way to replace gold as the top store-of-value selection.

Interestingly, the two share many of the same properties of “good money.” They’re both scarce, durable, verifiable, and accepted across borders. Bitcoin, though, has quite a few advantages over its precious metal counterpart.

You can easily divide bitcoin down to the eighth decimal place, a “satoshi,” giving it a property of divisibility. Gold, which is often in the form of a bar, doesn’t have this quality. Additionally, traveling with a cryptocurrency wallet is infinitely more plausible then lugging around a bunch of gold. Finally, verifying gold requires an expert with a keen eye while anyone can verify bitcoin on its public ledger.

You tell us which option is the superior choice.

Grayscale Continues to Push

Grayscale’s sudden push to drop gold comes shortly after a year in which it brought in a record high volume of investments. But, the position isn’t anything new. In 2017, Grayscale’s Michael Sonnenshein appeared on CNBC to discuss how they see bitcoin as gold 2.0.

The company had more than $359 million in investments throughout 2018, almost 300% higher than the previous year. Improvement of that magnitude demonstrates that even in a bear market, bitcoin interest is on the rise.

As part of the ‘Drop Gold’ campaign, Grayscale is hoping to see an influx of new customers purchasing its Grayscale Bitcoin Trust (symbol: GBTC). Unlike buying bitcoin directly, GBTC gives you exposure to price movements through a traditional investment vehicle. The trust is available across numerous popular brokerage platforms such as E-Trade, Charles Schwab, and Fidelity.

Is the Drop Worth It?

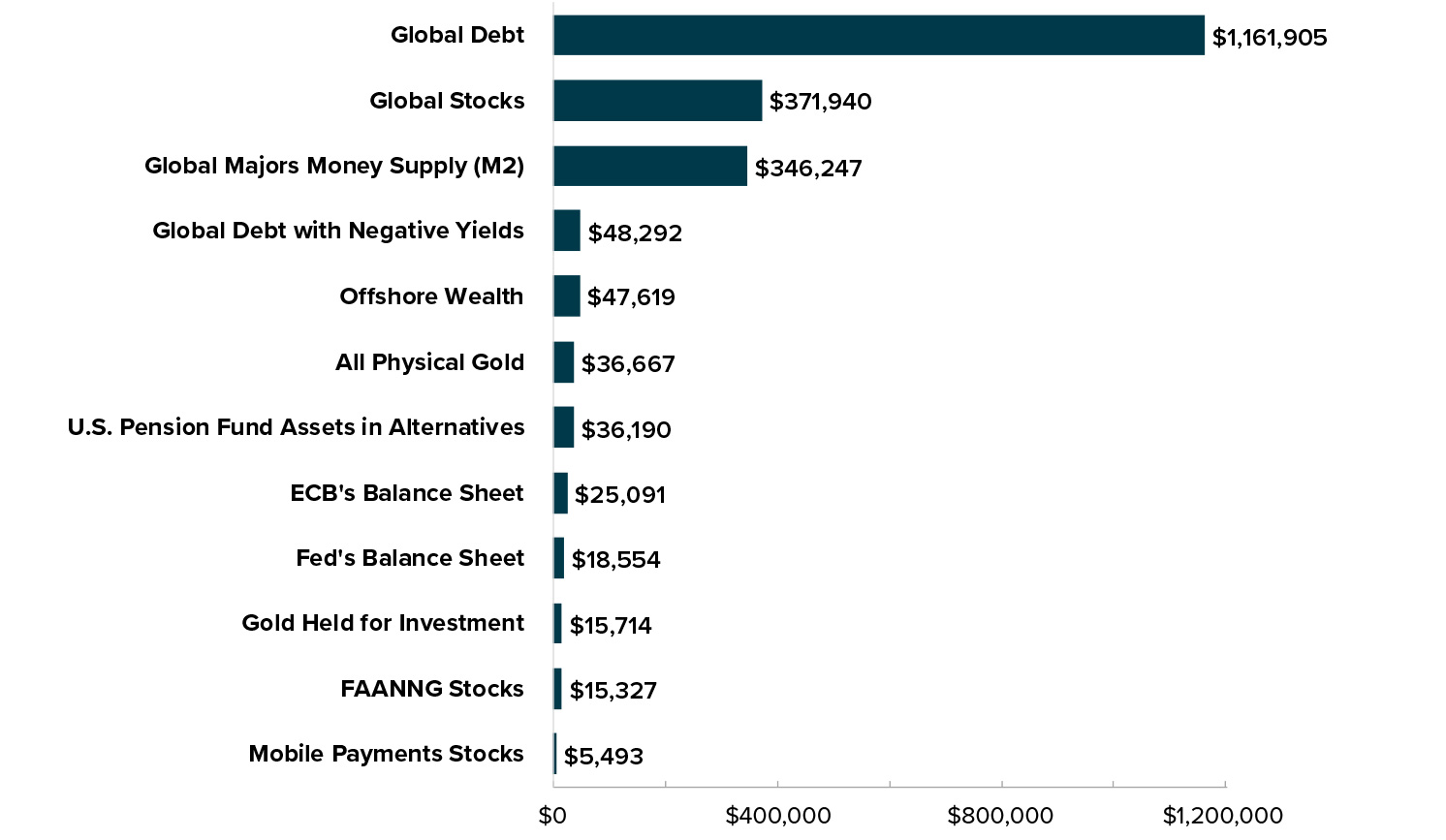

Additionally, Grayscale makes a valid argument that replacing gold in your investment portfolio with bitcoin will yield better results moving forward. Gold’s current market cap is around $7.7 trillion. Bitcoin? A measly $95 billion. It’s clear that the No. 1 cryptocurrency still has plenty of room to grow.

Even with a small amount of penetration, the bitcoin price would exceed $100,000. | Source: Grayscale

Getting 10% penetration in just a few financial markets would spur magnificent price jumps. Just taking 10% of the gold market would shoot the bitcoin price to more than $35,000. When you factor in portions of offshore wealth and the global money supply, that price has the potential to reach the hundreds of thousands.

If you’re a gold hoarder, replacing at least part of your stash with the digital alternative should be an obvious choice. Even though bitcoin still has its risks, it’s a solid hedge against the hyperinflation and debt cycles that currently plague countries around the world.

[ad_2]

Source link