[ad_1]

The bitcoin price on Wednesday depreciated as much as 2.56 percent on the back of a stronger US dollar. Paradoxically, that might not be such a bad thing for the crypto market.

The bitcoin-to-dollar exchange rate (BTC/USD) bottomed at $3,340 on an intraday basis, while retesting the low of January 29 trading session. There was a little attempt from bulls to reverse the price action with the bearish bias intact. Nevertheless, the pair consolidated above $3,340, which served as an opportunity to reclaim $3,400 in the near-term.

Bitcoin’s Six Triangles

In our previous analysis published Monday, we had predicted a bitcoin dump as the cryptocurrency’s volatility and volume went lower than normal. We also noted a strikingly similar pattern between bitcoin’s current and previous price actions. In this analysis, we aim to elaborate on the same to predict where the next bitcoin move could be.

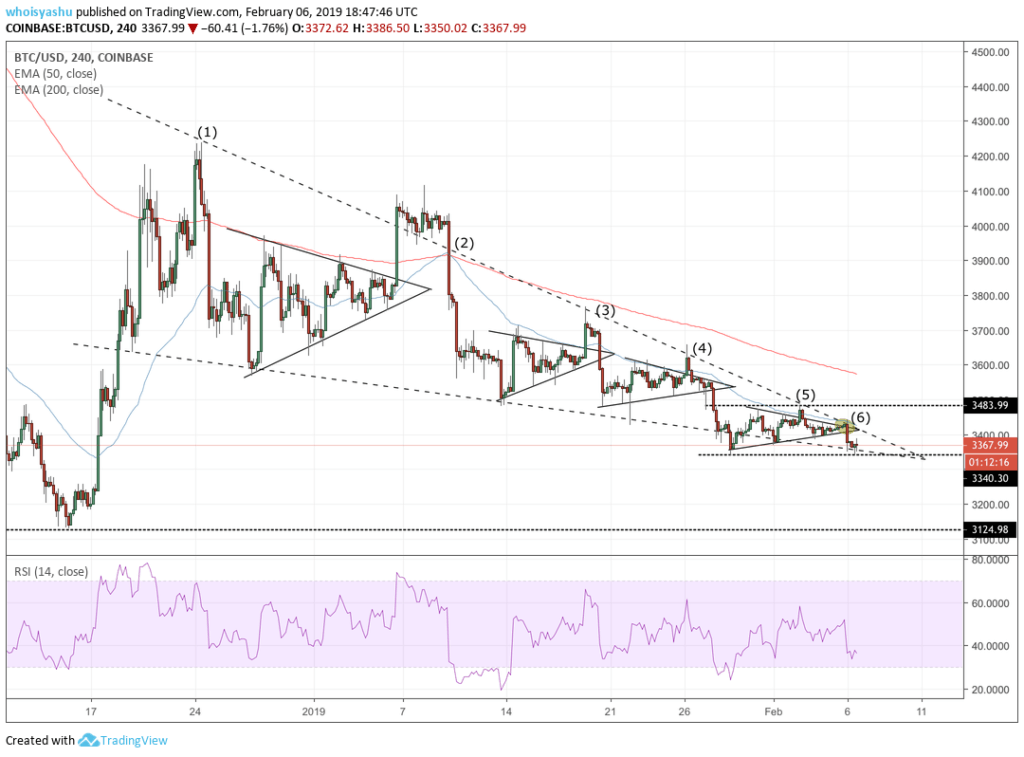

In the Coinbase chart above, we can see bitcoin trending lower inside a falling wedge formation. Inside the wedge, the price consolidated inside a small symmetrical triangle (1). It attempted a breakout that eventually failed to blossom. The price reversed and formed a large bear flag, then continued to consolidate again inside a new symmetric triangle (2). The price action repeated four times, excluding the current scenario (6) which has yet to mature.

A Closer Look at the Bitcoin Price

Let’s have a closer look at the same chart.

As period 6 develops, bitcoin could form a smaller symmetrical triangle as it attempts to retest the falling wedge resistance to the upside (depicted as a dotted falling trendline). Meanwhile, the price would keep pressure on $3,430 to remain its interim resistance. Based on the previous price actions, bitcoin should continue its downside momentum. However, as we are reaching the apex of the falling wedge, the price should technically attempt a strong upside breakout action.

As we wrote in our previous analysis:

“Technically, a falling wedge pattern is a bullish indicator. It begins broadly at the top but squeezes as the asset moves lower while forming reaction highs and reactions lows that eventually converge. Upon closing in towards the cone’s apex, the asset undergoes a resistance breakout to find a new support area.”

Consequently, there is a strong chance for bitcoin to break above its wedge pattern on the next upside move. Traders should watch out for reversal indicators such as a doji — which occurs when a candle has an open and close at the same price — coupled with a spike in trading volume.

Conversely, an extended downside action would push the bitcoin price towards $3,100 – the current bottom level.

Featured Image from Shutterstock. Charts from TradingView.

[ad_2]

Source link