[ad_1]

Coinbase CTO Talks Coinmine, Crypto Mining

Just days ago, Coinmine, a lesser-known crypto upstart, unveiled its first product — the fittingly named Coinmine One. For those who aren’t in the loop, the device, which resembles a tabletop gaming console or DVR, is a hardware cryptocurrency miner that is aimed at the common Joe. Coinmine, which has been backed by Anthony Pompliano, Product Hunt co-founder Ryan Hoover, the current Coinbase CTO, and others, believe that their piece of hardware can bring cryptocurrencies to the mainstream. A Coinmine investor told Coindesk:

Coinmine will democratize access to becoming a miner in a fun and approachable way that almost feels like playing a video game.

The innovative device has garnered so much attention that Coinbase CTO Balaji Srinivasan, a former crypto mining savant, cut out some time to discuss Coinmine and his investment/involvement in the startup.

Over recent history, ASICs have dominated crypto’s mining scene, with such machines generating a majority of hashrate on Proof of Work-enabled networks. Although this has drastically improved the security of blockchain networks, some would argue that the presence of ASICs has made mining an inaccessible task for average consumers, centralizing networks and increasing the risk of 51% attacks and similar security vulnerabilities.

Srinivasan, seemingly touching on this point, told Coindesk that “decentralized mining,” a name likely given to operations undertaken by one individual/small group, could be returning to prominence. He explained:

The big difference with decentralized mining in 2018 is that there are now so many different coins and tokens out there that it’s almost certainly possible to make a profit – or at least mine a decent amount of some crypto – via a decentralized home mining device like Coinmine.

The Coinbase executive went on to explain that as the number of cryptos continues to swell, profitability will increase for decentralized miners, as Bitcoin (BTC) now isn’t the only minable coin on the cryptocurrency block, so to speak.

Still, Srinivasan noted that new cryptocurrencies won’t directly revive the independent mining subset of enthusiasts, due to the fact that some crypto assets may be maintaining too-lofty valuations. Instead, the Earn.com founder then noted that the arrival of ASIC-resistant networks will propel Coinmine’s business, also touching on the fact that the growing availability of Proof of Stake (PoS) consensus mechanisms could make consumer-centric mining operations feasible.

Not Everyone Is Convinced

While Srinivasan painted a pretty picture for the future of cryptocurrency mining and the Coinmine One, not everyone is convinced. Rob Paone, better known as CryptoBobby, explained that he “love[s] the concept,” but the profitability offered by Coinmine’s first product makes such a purchase uneconomical.

Love the concept, but….

ETH profitability ~$5/month

XRM profitability ~$5/month

ZEC not profitable

Unit price of $799… Sounds like it’s more of a fun/hobby purchase than a purchase for expected return https://t.co/RDPYB7HS2q— Crypto Bobby (@crypto_bobby) November 14, 2018

Even in the graphics card (GPU) mining scene, profit prospects aren’t much better for consumers.

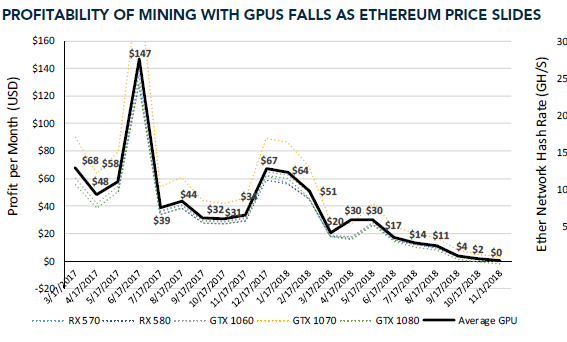

Per data compiled by Susquehanna, relayed through CNBC, the average Ether (ETH) focused graphics card (GPU) miner has seen their profits dwindle to $0 in the month of November, down from approximately $150 last summer. This collapse in profitability can be attributed to the rise in the Ethereum Network’s hashrate, which has more than doubled in the past 12 months, and the ever-growing presence and viability of EthHash ASIC machines

Susquehanna representative Christopher Rolland explained that even with Nvidia’s flagship GPU, the GTX 1080, the return-on-investment (ROI) provided shouldn’t make financial sense, especially in the long run. And as such, at the current trajectory that profitability is heading, GPU-enabled miners, even those who are looking to accumulate crypto assets for the long-term, will likely flunk out of mining entirely.

Title Image Courtesy of Marco Verch via Flickr

[ad_2]

Source link