[ad_1]

Bitmain announced its next-generation of mining ASICs for Bitcoin, Bitcoin Cash, and other SHA256 coins. The growing difficulty in manufacturing these computer chips raise concerns around network decentralization for these cryptocurrencies.

Bitmain is China’s second-largest fabless chipmaker and the world’s largest cryptocurrency mining hardware manufacturer. The company also boasts a huge mining operation, commanding anywhere from 3-15 percent of all Bitcoin mining.

Company Announces 17-Series Antminer with Improved 7nm Chips

Recently, the company announced an improved 7nm computer chip for mining which offers a purported 28.6 percent improvement in energy efficiency, as well as a higher hash rate than previous models.

The chip pushes the boundaries of what is possible in terms of transistor density, the physical part of a computer chip that defines how many computations it can perform. According to Yangxin, the product manager behind the 17-series Antminers:

“The driving force behind the development of next-gen miners beyond 7nm chips is slowing down due to physical limitations. With the nm size shrinking a quantum effect—when a device’s dimensions become very small due to scaling and other requirements—is very likely to take place. It is promising that TSMC (Taiwan Semiconductor Manufacturing Company) is already in the process of building 5nm chips. We will continue to follow the development of this technology but it is still early days.”

Yangxin, product manager for the 17-series Antminer, stated the indicators to look at when evaluating a new chip is energy efficiency and hash rate.

The exact specifications were not released, but CryptoSlate reached out to a crypto-hardware lab and will be receiving the exact performance of the 17-series once they receive test models from Bitmain.

Given the limitations of the upcoming 5nm chips, in terms of cost, 7nm will still remain the most economical:

“Considering the rapid pace of development in this area in the past few years, the industry would soon have to find what the next generation would be. For the near future, 7nm would remain the most preferred in terms of performance and economics,” said Yangxin

Extracting the Most Money from Miners

Yet, according to Kristy-Leigh Minehan, chief technology officer at Core Scientific and expert in mining hardware, the most important metric from their release is missing—price. According to her, “miners always measure in time-to-break-even.” Additionally, one source close to Bitmain said that the head of sales at the company has not settled on prices for the new models.

Unlike other hardware, which is usually priced via cost plus margin, cryptocurrency miners are priced based on how long it takes for those buying the hardware to break-even. According to Minehan, Bitmain aims to provide miners with a break-even point of 6-12 months.

“Right now, a used S9 is around 13 USD per TH/s. In order to be palatable to the current generation market, the S17 would need to be 14-15 USD per TH/s to justify the equipment switch. Because of the overflow of S9’s and 841’s in the market, and the current price of Bitcoin, the demand for newer equipment is much, much lower.”

Furthermore, Minehan goes on to elaborate on the glut of S9s, an older model of Bitmain ASIC, which miners could purchase instead of the newer model:

“Why would I replace my equipment and expose myself to a much longer ROI, when I could double-down and purchase a large amount of S9? Under Core Scientific, with our optimizations, we’re able to ROI [break-even] with an S9 in a mere 3-4 months.”

Finally, it’s necessary to compare the new S17 series with competing manufacturers:

“One also has to compare to MicroBT’s products—a M20S, for example, does 72 TH/s total, with 46W per chip. Bitmain will need to have a similar specification or ‘beat’ them entirely to ‘claim’ the throne back from MicroBT,” stated Minehan.

Centralization Concerns Around Bitmain

Producing competitive ASICs (application-specific integrated circuits) requires a huge amount of research, development, and manufacturing capital. Consequently, there are only a handful of profitable Bitcoin ASIC manufacturers.

As a result, only a few companies have direct access to profitable mining hardware for Bitcoin. This is a highly centralizing force when it comes to the distribution of nodes on the Bitcoin network. Bitmain is able to control who and where mining takes place and can continue to expand its share of the network hash rate if it so chooses.

Whether this poses a genuine risk to the Bitcoin network is another matter. If Bitmain were to 51 percent attack the network it would undermine the price of bitcoin, likely killing its business and rendering its ASICs near-worthless.

That said, 51 percent attacking other smaller coins in the SHA256 family is actually incentivized. Such a scenario was seen during the Bitcoin Cash hash wars. Bitmain, or another large miner, could ransack other SHA256 coin and switch back to mining Bitcoin, posing little risk to the miner.

Within the SHA256 algorithm, coins vulnerable to 51 percent attacks include Bitcoin Cash, Bitcoin SV, Litecoin Cash, and Peercoin. Due to this dynamic, holders of cryptocurrencies which are not the largest by hash rate within a given mining algorithm need to be aware of the risks associated with proof-of-work.

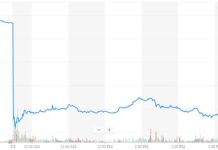

Bitcoin, currently ranked #1 by market cap, is up 0.84% over the past 24 hours. BTC has a market cap of $72.36B with a 24 hour volume of $11.05B.

Chart by CryptoCompare

Bitcoin is up 0.84% over the past 24 hours.

Filed Under: Bitcoin, Mining, Price Watch, Technology

Disclaimer: Our writers’ opinions are solely their own and do not reflect the opinion of CryptoSlate. None of the information you read on CryptoSlate should be taken as investment advice, nor does CryptoSlate endorse any project that may be mentioned or linked to in this article. Buying and trading cryptocurrencies should be considered a high-risk activity. Please do your own due diligence before taking any action related to content within this article. Finally, CryptoSlate takes no responsibility should you lose money trading cryptocurrencies.

[ad_2]

Source link