[ad_1]

The cryptocurrency market once again featured almost nonexistent volatility on Tuesday, though the Bitcoin price continues to feel uncomfortably heavy.

The global average for Bitcoin pushed upward a slight amount, to $3,470, in the 24-hour period. Notably, it dropped on Bitfinex to $3,505. This is important because if Bitfinex pushes downward, the rest of the crypto market is likely to go lower.

For various reasons, Bitfinex trends higher than the rest of the market, as we’ve noted repeatedly in these daily round-ups.

Sometimes it creates a questionable arbitrage opportunity of up to $100. Litecoin broke through $34 mark on the global average side of things. EOS appears to want $2.50 pretty badly but stands at $2.39. Stellar’s now under eight cents, while Bitcoin SV keeps losing. Read on for more details on each market.

Bitcoin Price Briefly Dips Below $3,400

Last night’s Coinbase trading brought Bitcoin down to $3,399 briefly, before a rebound which coalesced in the price by press time: $3,424.

Over at Bitfinex, which seems to set the tone for much of the market (if it’s high, others are not quite as high, and if it’s low, others are lower), BTC/USD had a negative True Strength Indicator going on.

One trader thinks this mid-week will probably lead to a massive break-up of the monotony in recent Bitcoin trading .

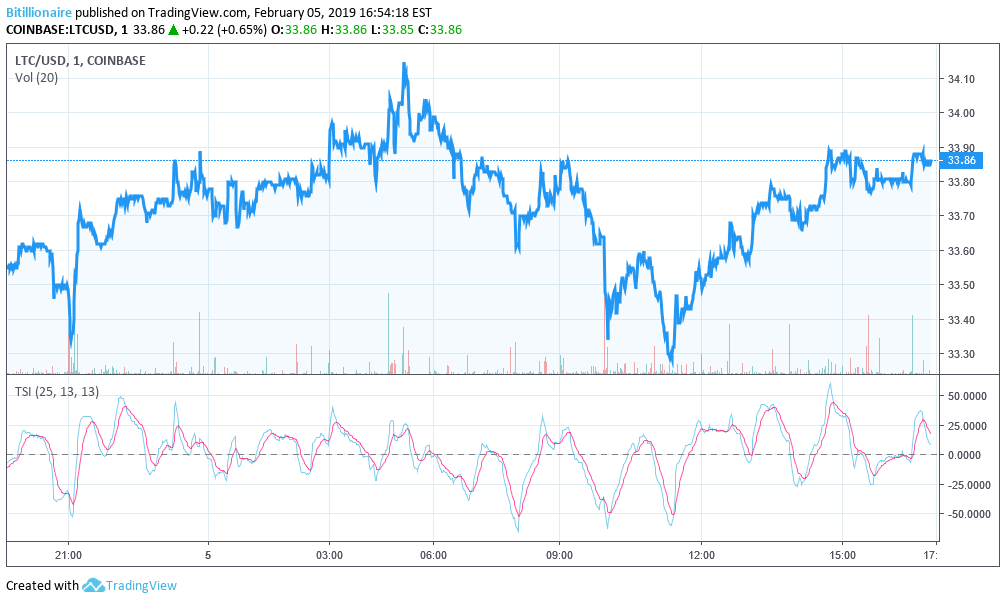

Litecoin Price Breaks Through $34

Litecoin has finally broken through the $34 barrier it’s been eyeing for a week.

If the expectation of a downturn in Bitcoin proves true, and Litecoin continues to push upwards, we may be entering a new phase of the altcoin-Bitcoin relationship.

We like to use Coinbase charts because they’re reflective of the retail market, rather than the strict trading market. Litecoin is a bit under $34 there, but it did spend part of the day as high as $34.11.

As has been the case for several days now, Litecoin’s volume topped $700 million – more than XRP or EOS, both of which have higher market capitalizations at this point.

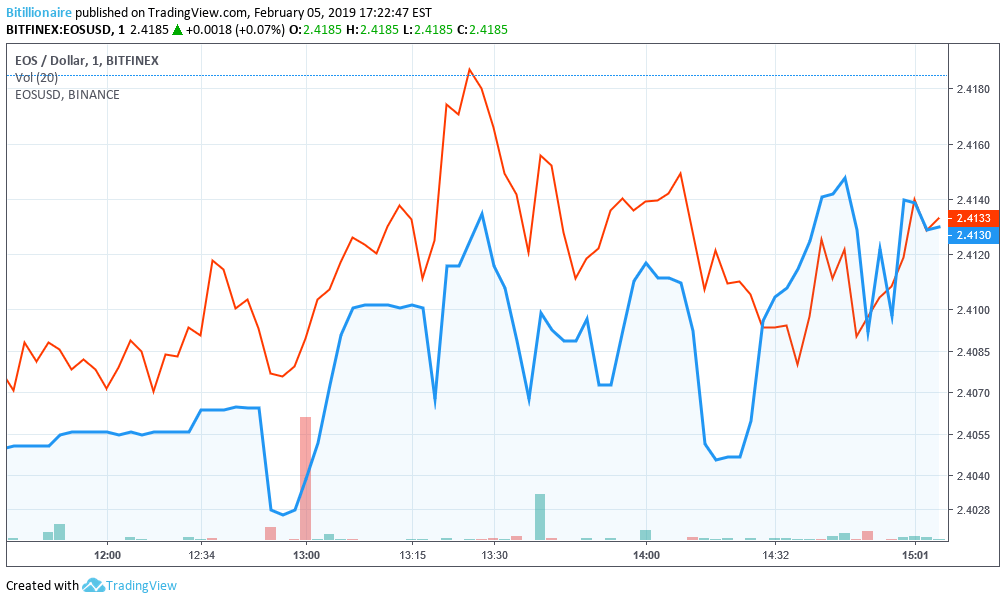

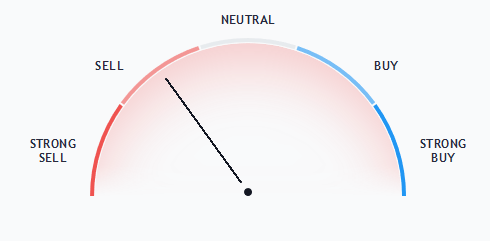

EOS Eyes ‘Neutral’ Indicator

As stated before, EOS traders would likely love to see a round figure such as $2.50 this week.

However, it seems every time EOS gets back above $2.40, sell pressure presents itself. Still light years away from its double-digit highs, EOS is at least pushing back toward “neutral” on the buy/sell rating indicator scale.

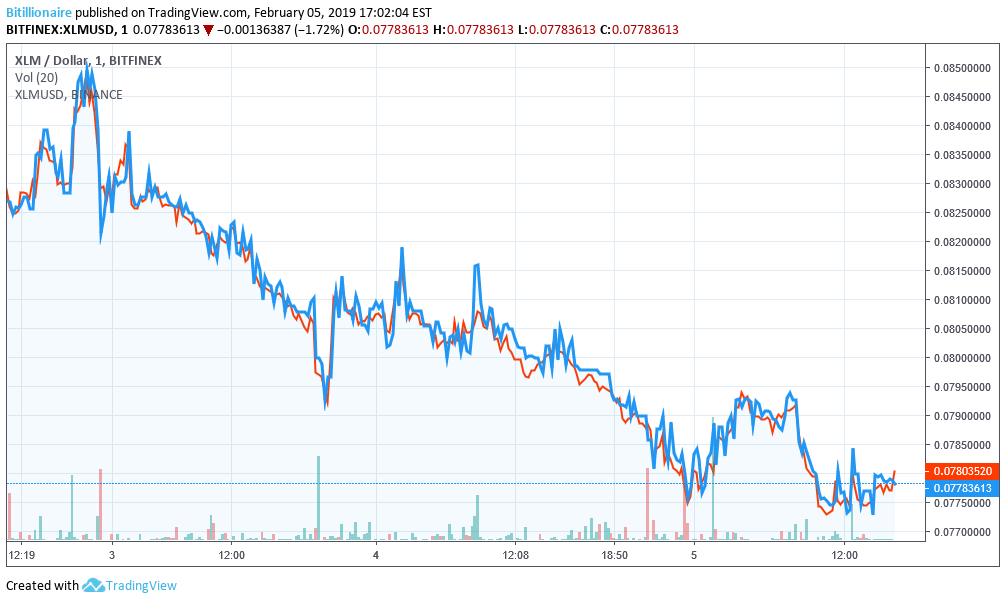

Stellar Price Continues to Slide

Stellar found its way into the 7 cent range today. The last time we mentioned it in this column, it was solidly above $0.10. The dip is not relative to XRP, which is maintaining its $0.30 price despite this reporter’s feeling that a round $0.25 is likely on the cards for it.

That’s likely an interesting buy opportunity for Stellar at this point, to be clear. XLM was getting a “sell” recommendation by press time, but the company has a habit of releasing news that floats the market.

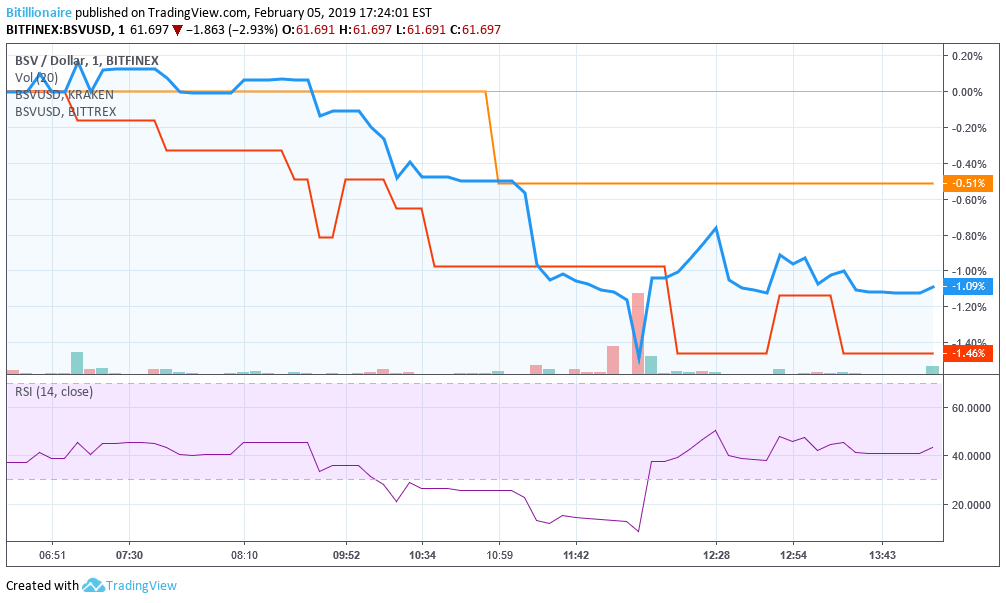

Is Bitcoin SV on its Last Legs?

If Bitcoin SV keeps this up, it could find itself knocked smooth out of the top 10.

Much more flat lines in the Bitcoin SV markets than most crypto trading pairs. It saw a volume of just $48 million today. Litecoin, by contrast, once again topped $700 million.

The Bitcoin fork, which has an interesting development community actively building projects not possible with smaller blocks, hasn’t gone a day without losing some value in the past few weeks.

Just made https://t.co/8KiQh4RZn1 so it’s easy for you to use files stored on the blockchain.

Demo website – 100% on chain: https://t.co/iveDET8HDR

1000 thanks to @_unwriter for inspiring to create more.

— Rangel Wulff (@rangelwulff) January 29, 2019

It started life with a surprisingly high valuation across markets. Gradually, though, it’s working toward becoming worth half as much as the original Bitcoin Cash chain. Neither chain has managed to recapture the value lost beginning in November. A success story it is not, so far. The antics of community leader Craig Wright haven’t helped much:

The irony is I am a cult hero to Anarchists after having designed a system that helps stop piracy, that tracks money transfers and allows privacy and NOT anonymity.

— Dr Craig S Wright (@ProfFaustus) February 5, 2019

Let’s hope, for the sake of those deep in $100+ SV coins, that we’re not writing about a $50 BSV next week. However, if the Bitcoin shakeout takes place this week, we could be doing just that with ease.

Featured Image from Shutterstock. Price Charts from TradingView.

[ad_2]

Source link