[ad_1]

Binance Margin Trading May Be Around The Corner

When the now-popular crypto exchange Binance unveiled its whitepaper in 2017, it promised its angel investors a stellar platform that would support much under the Bitcoin (BTC) sun. Although the startup has delivered on much of its original promises, Binance’s whitepaper mentioned “margin trading” as a part of its “feature rollout.” But, as you know, leverage, even for Bitcoin is unavailable. Moreover, the firm has kept its mouth mostly shut on the matter.

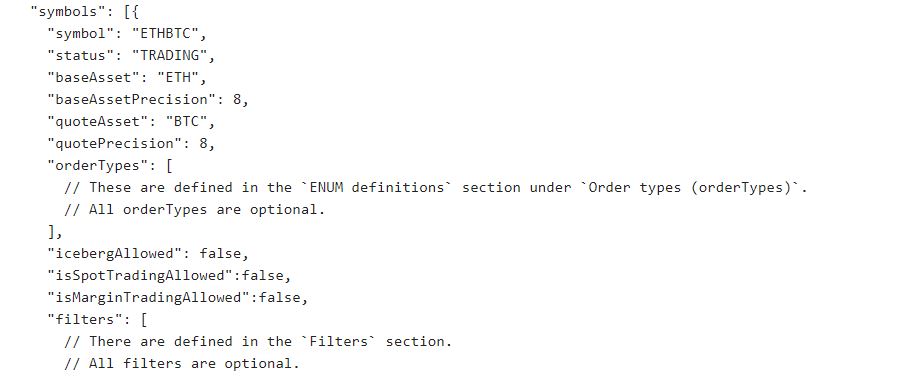

But as we reported in late-march, an exclusive from The Block revealed that the renowned trading platform was on the verge of offering its clientele margin. And Code found by a pseudonymous programmer seemingly confirmed the rumors that the Malta-registered exchange is looking into margin trading. The user, going by the moniker “enriquejr99,” noted that Binance has “silently included” two booleans that are as follows: isSpotTradingAllowed and isMarginTradingAllowed. These two lines of code were first spotted in Binance’s Ethereum-Bitcoin pair. Enrique added that upon further analysis of Binance’s 482 crypto trading pairs, he discovered that margin was mentioned but was then disabled.

Changpeng Zhao, the chief executive of the exchange, came up to quell the rumors remarking that Binance’s attempts to “future proof” its “API framework” resulted in the margin trading booleans appearing. He added that he was unable to give dates on the release of margin, keeping details on the matter scant and affirmations nebulous.

But as spotted by Enrique, it seems that the isMarginTradingAllowed flag has been enabled for a number of trading pairs on Binance. In a recent Reddit update, the user notes that nine pairs, including BTC-USDT, BNB-BTC, ETH-BTC, TRX-BTC, and XRP-BTC, have margin enabled. The Binance UI has yet to be altered to reflect the change.

There is a chance that regulatory concerns are currently plaguing Binance, as BitMEX has notably been targeted for offering margin trading for a global audience. The exchange has since hired a prominent regulator for compliance.

Trying To Catch Up To Bitcoin Giant BitMEX?

This all begs the question: Why exactly is Binance trying to launch margin trading? Well the answer is quite simple, it is trying to provide its users with the best features, all while ensuring its bottom line is upheld.

Tom Lee of Fundstrat estimated in a keynote that BitMEX raked in $1.2 billion in fiscal 2018, making the crypto exchange more profitable than Hong Kong Exchanges & Clearing and Nasdaq, even while Bitcoin is just a decade-old creation. Lee isn’t fully speculating either. On multiple days throughout 2018, BitMEX posted upwards of 1,000,000 Bitcoin worth of nominal trading volume, securing dozens of millions in trading fees in the process. It can be assumed that Binance is looking to take some of that cake, capitalizing on its massive user base and talented staffers to do just that.

But regardless if Binance is looking to catch up to its peers or not, the company has had a stellar 2018 and early-2019 so far. As reported by Ethereum World News previously, the firm secured $78 million in profit in Q1 and $446 million in all of 2018, ousting even what notable Silicon Valley startups bag.

Title Image Courtesy of Marco Verch Via Flickr

[ad_2]

Source link