[ad_1]

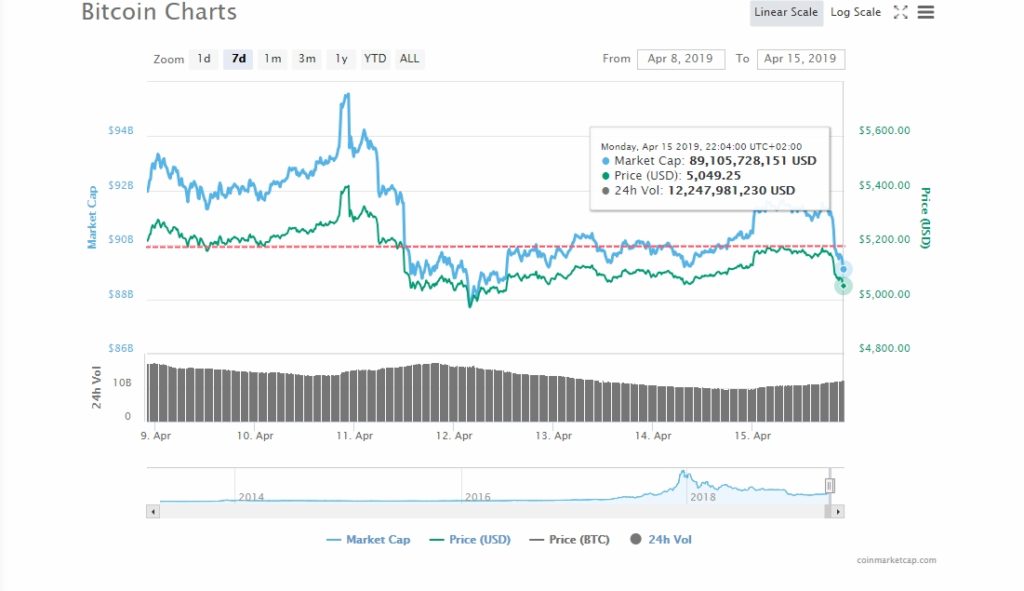

For a second time this week only the pair BTC/USD is being pushed downward by the bears to the lows of $5,000.00 as per time of writing it is changing hands at $5,030.77 with a market cap of $88.7 bln and a rising volume transaction of $12.3 bln for the last 24-hours. Clearing below the important support of $5,200.00 which followed-up after not being able to overcome $5,400.00 opened gates for more losses during the week and tiring of buyers.

With Bitcoin’s native token price BTC against the US Dollar making it above $5,000.00 for the first time since end of 2018 [mid Dec] a wave of ‘rocketing’ predictions and positive sentiment took over the crypto-industry. Below a summary of the newest piece around BTC.

The Mayer Multiple, a measure conceptualized by diehard Bitcoin investor and evangelist Trace Mayer, seems to be signaling that BTC might have bottomed.

In a recent post on crypto hedge fund Ikigai’s blog, Kana and Katana, Wences Casares of Xapo, described by many as ‘Patient Zero’ (he spread the Bitcoin bug), laid out his reasoning for such a prediction.

He claimed that while he believes that the experiment-esque BTC has a 20% chance of failing, its 10 years of operation, with “60 million and rapidly growing holders,” and the continual use in the real world (movement of $1 billion in value/each day), Bitcoin has a good chance of succeeding. [Covered by Nick Chong].

In today’s world where every asset seems priced for perfection, it is hard, if not impossible, to find an asset that is so mispriced and where the possible outcomes are so asymmetrical.

[ad_2]

Source link