[ad_1]

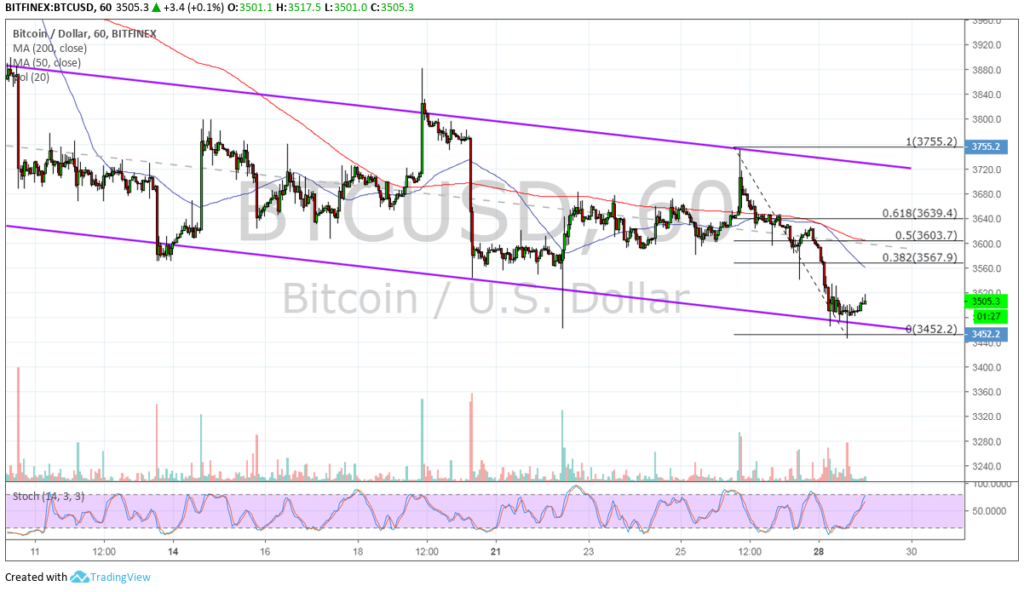

Bitcoin found support at the bottom of its descending channel on the 1-hour time frame and looks due for a pullback to the top. Applying the Fibonacci retracement tool shows the next potential resistance levels.

The 50% level is close to the mid-channel area of interest at the $3,600 level and the 200 SMA dynamic inflection point. For a shallow pullback, the 38.2% Fib might be enough to keep gains in check since it lines up with the 100 SMA dynamic resistance.

On the subject of moving averages, the 100 SMA is below the longer-term 200 SMA to confirm that the path of least resistance is to the downside. In other words, the downtrend is more likely to resume than to reverse. A higher retracement could last until the 61.8% Fib at $3,639.4 or the channel top closer to the $3,700 mark. If any of the Fibs are able to hold as a ceiling, bitcoin could resume the drop to the swing low at $3,450 or lower.

Volume remains supported as bulls are currently defending the support level, but a break below this could spur a sharper selloff. Stochastic is pointing up to show that buyers are regaining the upper hand, but the oscillator is also closing in on the overbought zone to reflect exhaustion. Turning lower could indicate that sellers are back in control.

Bitcoin has had a rough ride in the past few days as the failure to sustain upside breaks was followed by a pickup in bearish momentum. Sellers are likely taking advantage of how traders are being extra cautious in booking profits quickly off small rallies and at key inflection points.

Investors continue to hold out for big news that might sustain rallies, even as there have been minor positive updates. By the looks of it, downbeat commentary on how bitcoin has yet to bottom out has been dampening hopes that a major rebound is underway.

[ad_2]

Source link