[ad_1]

The Asian trading session is one of the best time of day to trade forex, as explained in the DailyFX Traits of Successful Traders series. Also known as the Tokyo session, the Asian trading session is often overlooked as it is not as liquid and volatile as other major trading sessions; but these characteristics are exactly what makes the Asian session attractive to those who know how to trade it.

This article will walk through the nuances of this trading period – listing the Tokyo forex market hours and providing ideas and strategies for traders to consider when ‘Trading Tokyo’.

What are the Tokyo forex market hours?

The Asian forex session starts off the trading week on a Monday morning at 09:00 and closes at 18:00 in Japanese Standard Time (JST). In London, traders will have to be up at 00:00 (GMT) in the early hours of the morning until 09:00 (GMT) if they wish to follow the Asian session in real time.

Keep in mind that the FX market trades 24 hours a day, so official starting times are subjective. But it is generally accepted that the Asian session begins when Tokyo banks come online due to the volume of trades they facilitate. New Zealand and Sydney, Australia are technically the first, reasonably sized, financial hubs to start the trading day.

Below is a summary of the different times traders will be able to trade the Asian session in their respective time zones:

Asian trading times in major trading locations

Trading location | Major market | *Hours (in local time) |

Asia | Tokyo | 09:00-18:00 JST |

Europe | London | 00:00-09:00 GMT |

United States | New York | 19:00-04:00 ET |

*These times are subject to change with daylight savings changes

Major economic centres in Europe and the US are not at work for the majority of the Tokyo session, which contributes to the thin trading volumes experienced.

Top 5 things to know about the Tokyo session

The Tokyo forex session is typically known to adhere to key levels of support and resistance due to the lower liquidity and volatility experienced. The Asian session is characterised by:

- Low liquidity

- Low volatility

- Clear entry and exit levels

- Ideal for sound risk management

- Breakout trade opportunities after the close

1) Low liquidity

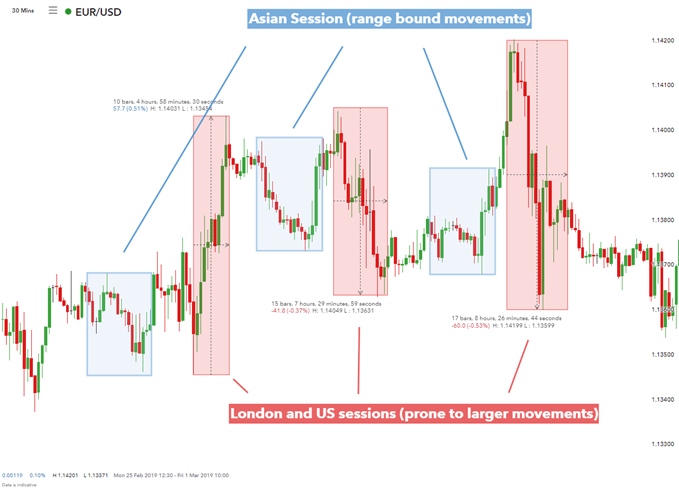

With lower liquidity, non-Asian markets such as EUR/USD,GBP/USD and EUR/GBP are less likely to make large moves outside of generally observed trading ranges. The chart below shows this effect with the Asian session depicted in the smaller, blue boxes, while the London session and US session are depicted in the larger red boxes.

2) Low volatility

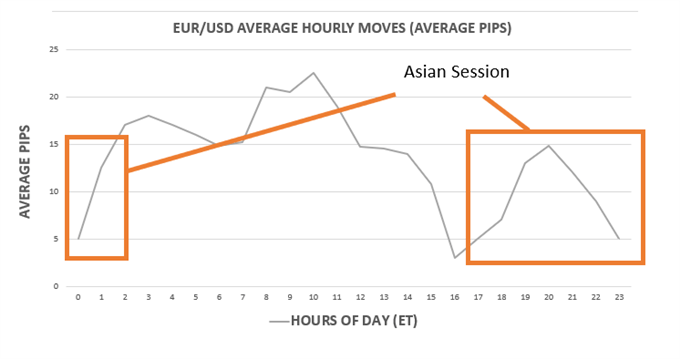

Because the primary liquidity coming into the market is from Asia, movements – in general – can be quite a bit smaller than what will be seen during the London or US sessions. The image below provides an indication of how volatile currencies can be throughout the day. The chart shows higher peaks (more volatile movements) outside of the Asian session.

EUR/USD as a proxy for volatility

Source: DailyFX Traits of Successful Traders research (2010-2012)

3) Clear entry and exit levels

Levels of support and resistance assist traders with opportunities to enter or exit trades. Combining this with signals from indicators further increase the probability of entering a good trade.

4) Ideal for sound risk management

The quiet nature of the Asian session may allow traders to manage their trades better. The slow nature of the market can potentially allow for more thorough analysis of risk and reward. Essentially, it is easier for traders in the Asian session to spot levels of support and resistance as they are generally well-defined and coincide with the trading range.

5) Breakout opportunities after the close

As the Asian trading session comes to an end it overlaps with the start of the London session. More liquidity instantly becomes available and traders often witness breakouts from established trading ranges.

What currency pairs are best to trade during the Tokyo session?

The best currency pairs to trade during the Tokyo session will depend on the individual trader and strategy employed. Traders looking for volatility will tend to trade Japanese Yen, Singapore dollar, Australian dollar and New Zealand dollar crosses.

Traders looking for less volatile currencies include non-Asian currencies, mainly: EUR/USD, GBP/USD and EUR/GBP to list a few.

How to trade ranges during the Asian session

Range trading is particularly suited to the Asian trading session as support and resistance levels are adhered to more frequently than during the more liquid London and US sessions.

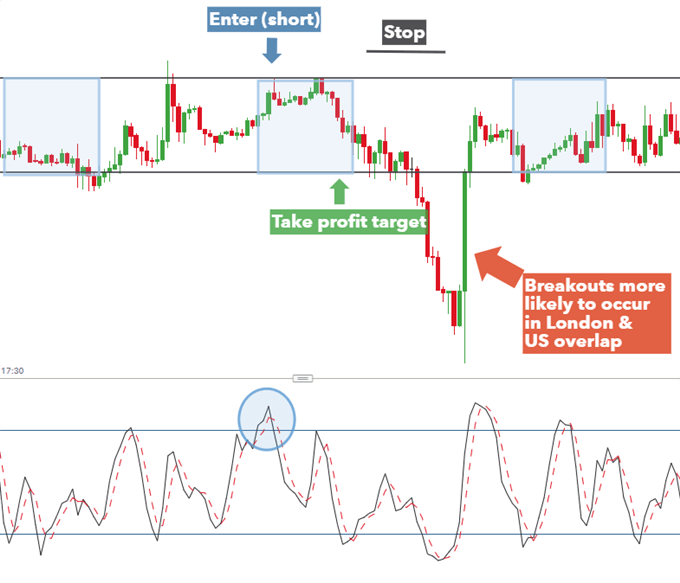

The two most common strategies in the Tokyo forex session involve breakouts or range trading. Below is an example of a short position when trading ranges but the same logic can be applied to long positions:

Trade set up: One way to trade ranges is to look for sell signals when price trades near resistance while setting an initial take profit level near the bottom of the range. Traders will often enlist the help of oscillators such as the RSI and Stochastic indicators to provide buy and sell signals. The Asian session takes place in the blue blocks on the chart.

Entry point: Using this particular strategy, traders should be looking for signals to buy when price approaches support and to sell when price approached resistance. The stochastic indicator displays when the market is in overbought territory, providing a sell signal (circled in blue). To get further confirmation, price has reached the level of resistance and this presents the opportunity to enter the short trade.

Stop loss: A Stop can be placed above the level of resistance as historically this is the level that prices have bounced off of.

Take Profit: Professional traders always look for more pips in their favor, compared to what they could potentially lose if the trade moves against them. This is referred to as a risk to reward ratio and should be at least 1:1. With this said, if the market moves from the top of the range to the bottom of the range the trader is targeting 80 pips while risking 30 pips, representing a 1:2.67 risk to reward ratio.

Range trading is likely to be less effective when the London and US sessions flood the market with liquidity. The chart reflects this, with the large breakout towards the downside before recovering back within the channel. Range traders make use of stops and limits to maintain their exposure within the channel.

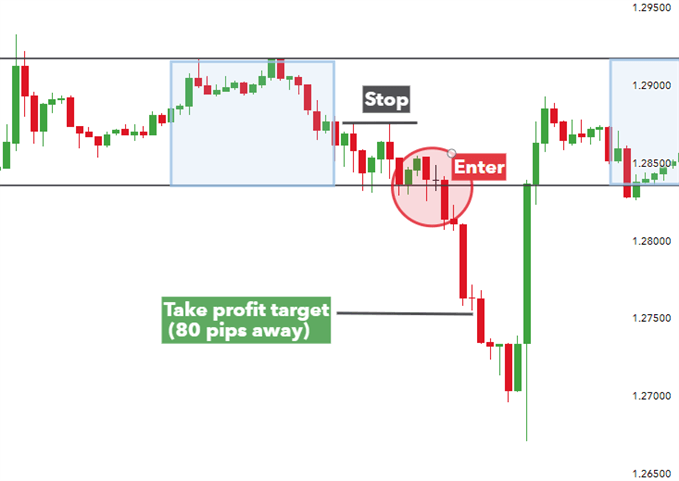

Asian breakout strategy

The Asian breakout strategy aims to take advantage of sudden sharp movements in price when the London trading session comes online at 00:00 GMT (04:00 ET). The influx of liquidity can lead to breakouts that traders can anticipate.

On a small timeframe (five – 30-minute chart) traders can wait to see a candle close above or below the trading range witnessed in the Asian session. If price breaks below the range, traders can enter the trade placing a tight stop at the recent swing high. When setting a target level, traders can take in to account the number of pips from the top to the bottom of the trading range range and place a target an equal distance away from the entry level (in this example 80 pips away).

Further reading to navigate forex trading sessions

[ad_2]

Source link