[ad_1]

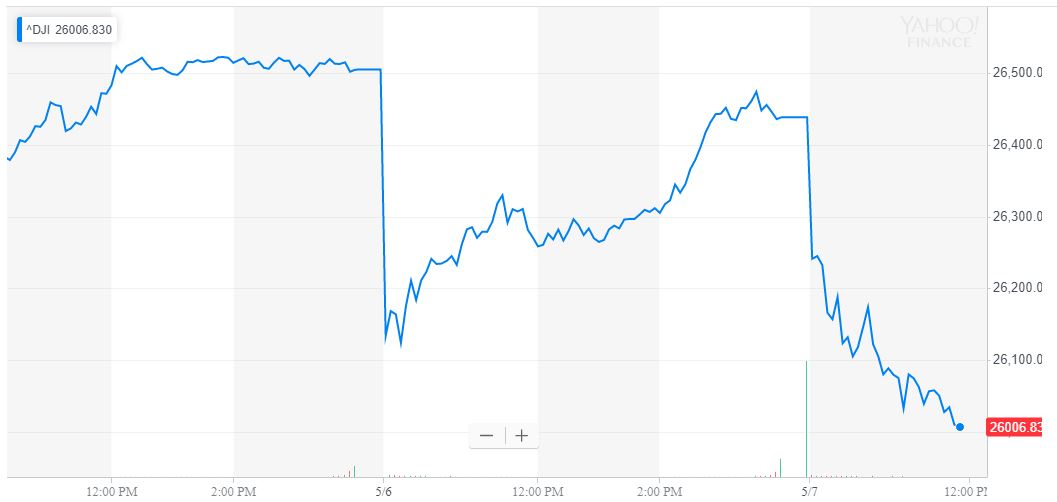

By CCN: Despite embarking on a stunning recovery on May 6 to turn a brutal 471 point loss into a muted 67 point pullback, the Dow Jones Industrial Average plunged back into decline on Tuesday to deal investors a 435 point loss.

Dow Slides More Than 400 Points After Stunning May 6 Comeback

Strong fundamental factors such as steady jobs growth and the Federal Reserve’s reluctance to raise its benchmark interest rate have led some analysts to ignore the trade war-induced volatility.

“I think it’s a short-term hiccup in a longer-term move up from the market,” Michael Arone, chief investment strategist at State Street Global Advisors, told CNBC.

However, on Monday, Federal Reserve Bank of Philadelphia President Patrick Harker said that in the medium-term, he expects the benchmark interest rate to rise, emphasizing that tariffs are not a “healthy thing” for the economy.

Interest Rate Hike Could Add Further Pressure to Stock Market

Earlier this month, Fed Chairman Jerome Powell said that the committee is unlikely to readjust the central bank interest rate unless a strong case is presented.

“Overall the economy continues on a healthy path, and the committee believes that the current stance of policy is appropriate. We don’t see a strong case for moving [rates] in either direction,” Fed Chairman Jerome Powell said at the time.

Fed Chair Jerome Powell alleged a rate hike is unlikely in 2019, but one Fed president predicts the central bank will levy one anyway. | Source: AP Photo/Susan Walsh

Less than a week later, Philadelphia Fed President Patrick Harker suggested the possibility of one rate increase by the year’s end.

He said:

“I suspect some of the recent weakness is transitory. So I still see it running slightly above our 2% target for the medium term, but that projection is nowhere near written in stone; more like a dry-erase board.”

“If any component of the outlook were to affect my view on the appropriate path of monetary policy, it would be inflation… I, therefore, continue to see one increase at most this year; possibly one, at most, next,” he said.

Harker is currently not a voting member of the Federal Open Market Committee and does not have an impact on the committee’s decision on adjusting the interest rate.

But, during a period in which the U.S. stock market and investors within it are on edge due to the intensifying trade dispute between the U.S. and China, the prospect of a rate hike could fuel uncertainty in the market.

Dow on Pins & Needles as Trade Deal Hangs in Balance

President Trump accused China of trying to renegotiate the trade deal, and some strategists have suggested that it relates to the efforts of the U.S. government to protect the intellectual properties of U.S. companies operating abroad.

Robert Lighthizer, the U.S. Trade Representative, said that the Trump administration has seen a lack of commitment by China in the past week.

“Over the course of the last week or so, we’ve seen an erosion in commitments by China, I would say retreating from commitments that have already been made, in our judgment,” Lighthizer said.

The uncertainty around the trade talks has led firms to reconsider market conditions and the state of the equities market.

Fundstrat, for instance, said that despite the intensifying trade dispute, stocks remain at reasonable prices for investors, echoing the sentiment of Warren Buffett at Berkshire Hathaway.

“Key lesson from 2019 (so far) is dips need to be bought, even trade-related. Does this change our near term or even YE thesis for equities? No. While the timeline is certainly in doubt, equity prices ultimately ‘look through’ near term uncertainty,” the firm said.

Click here for a real-time Dow Jones Industrial Average price chart.

[ad_2]

Source link