[ad_1]

According to WSJ tech editor Scott Austin, Benchmark, a San Francisco-based venture capital firm, invested $9 million in Uber’s Series A round in 2011. At the proposed IPO price of $55 a share, the $9 million investment would soon be valued at $6.9 billion.

The $6.9 billion figure excludes Benchmark’s sale of its $900 million worth of Uber stock to SoftBank, which paid more than $7.7 billion last year for its share of Uber.

Where Does Benchmark’s Uber Investment Rank in All-Time Best VC Bets?

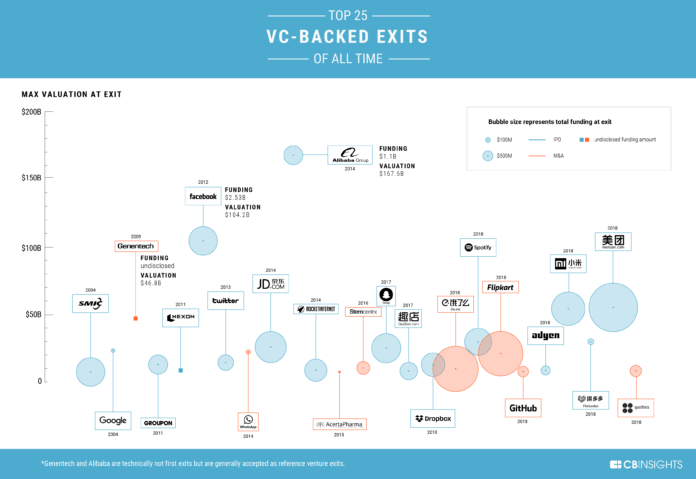

Some of the all-time best venture capital deals involve companies like Facebook and Whatsapp.

When Facebook conducted its IPO at a valuation of $104 billion, Accel Partners, which invested $12.7 million with Peter Thiel in 2005, saw a $9 billion return in 2012.

Sequoia Capital, which invested $60 million in the early days of Whatsapp, saw a $3 billion return when Facebook acquired Whatsapp for $22 billion.

While both deals were in the multi-billion dollar range, Accel’s investment in Facebook saw a 708-fold return while Sequoia saw a 50-fold return.

Based on Uber’s $55 per share IPO, Benchmark’s Series A investment in Uber would result in the company a staggering return of 766-fold, which would place it as one of the best venture capital deals in modern history.

Is a $100 Billion Valuation For Uber Justified?

If Uber goes public at the targeted valuation of $100 billion, it would make it the third biggest VC-backed exit behind Alibaba and Facebook.

The risks in Uber include competition with companies like Lyft and the expected increase in operating costs.

“Our workplace culture and forward-leaning approach created operational, compliance, and cultural challenges and our efforts to address these challenges may not be successful,” read a section of the filing entitled “Summary Risk Factors.”

According to the S-1 filing of Uber Technologies, gross bookings have increased by 45 percent since 2017 and revenues from other areas have risen as well.

More importantly for investors, Uber recorded a net income of $1 billion in 2018, rebounding from a $4 billion net loss in 2017.

“In 2018, Gross Bookings grew to $49.8 billion, up 45% from $34.4 billion in 2017. Over the same period, revenue reached $11.3 billion, up 42% from $7.9 billion in the prior year. Core Platform Adjusted Net Revenue was $10.0 billion in 2018, up 39% from $7.2 billion in 2017. Net income (loss) was $1.0 billion in 2018 and $(4.0) billion in 2017. Adjusted EBITDA was $(1.8) billion in 2018 and $(2.6) billion in 2017,” the filing read.

With more than 91 million monthly active platform customers and its gross bookings up substantially in the past year, the expectations of investors towards a successful Uber IPO remain strong.

A Change in VC Ecosystem

In late 2018, the NY Times reported that in 2017, investors participated in 273 mega-rounds, which are typically considered as venture capital rounds that exceed $100 million.

In the first 7 months of 2018, 268 mega rounds were completed and in July, a new monthly record of deals worth $15 billion was achieved.

At the time, Benchmark Capital managing partner Bill Gurley said that the VC market has become highly competitive for startups. If startups are not aggressive in securing $100 million+ deals, it may be run over by startups that do.

“If your competitor is going to raise $150 million and you want to be conservative and only raise $20 million, you’re going to get run over,” Gurley said.

Some ppl call VC a bubble.

If this really is the new normal, I can’t say it’s necessarily a bad thing. For the first time in history, the most talented and motivated seek to start businesses as soon as possible. When I graduated, everyone wanted to work at Goldman and McKinsey.

— Su Zhu (@zhusu) April 12, 2019

Upon the completion of the Uber IPO, the appetite for venture capital firms in seeking for the next big deal is likely to increase, which may further fuel activities in the VC ecosystem.

[ad_2]

Source link