[ad_1]

Latest Bitcoin (BTC) News

Commentators emphasis that the success of any cryptocurrency project is mostly about reception and its value proposition. Bitcoin as one of the most valuable digital asset in the space and the pioneering blockchain application is an alternative to government issued fiat.

Read: Don’t Listen To Crypto Critics, Bitcoin “Really Is Money”

It is also slowly but surely evolving into a settlement layer where value can be stored thanks to its immutability, scarcity and lack of central point of control. Everything is mathematics and behind their cryptography, suggestions are being put forth to improve on the current signing scheme–the ECDSA.

The system, Blockstream say, has been shaping and while it helped secure the network in the last decade or so, there are some inherent limitation with the signing algorithm. However, this is not to say the network is insecure. The problem is the divergence between what the system can do in theory and what has been demonstrated.

Also Read: Multi-Billion-Dollar Store, Domino’s Pizza Now Accepts Bitcoin

Technically, with ECDSA algorithm, users have no control of their private keys, cannot track what people can do with their addresses and it has been found that key generation is not as random. Their new signature scheme, MuSig, promises to be an improvement of the ECDSA with improvements as Session IDs and protection against Replay Attack in place.

Bitcoin (BTC/USD) Price Analysis

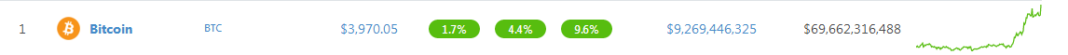

The trend is up and BTC bulls are deep in the green. With impressive performance over the last few days, Bitcoin is up 9.6 percent in the last week and 4.4 percent in the last day. At this pace, it is likely that prices will rally towards the $4,500 mark and eventually to $5,800–$6,000 support line as buyers recover losses of Oct–Nov 2018.

Trend and Candlestick Arrangement: Bullish and Breakout Pattern

As laid out in our last BTC/USD price analysis, our main reaction zone is the $5,800–$6,000 level. While is our ultimate target, it is also the bear breakout level of the last wave of bears that plunged BTC prices to $3,200. Therefore, as optimistic as we are, it is also of prime importance that bulls retest and even close above this mark as the classic bear breakout pattern is nullified. Such a move will allow buyers to flow back and that demand alone will likely propel prices back to $10,000–$12,000 zone. In the short-term, buyers are clearly in charge and pumping BTC prices are swelling market participation levels. Since prices are trending above $3,800, risk-off traders can search for undervaluation in lower time frames and aim for $4,500 with decent stops at $3,500–the lower limit of our support zone when we draw market data from BitFinex.

Volumes: Bullish

Pumping prices to spot rates are above high volumes above recent averages. Note that Feb 17 bar had 37k which was above Feb 8 of 32k and those of Jan 10 of 35k. It did confirm buyers of Feb 8, signalling Dec-Jan 2019 bull continuation. As a result of this resurgence, it is likely that BTC will clear the $4,500 as Bitcoin (BTC) inch closer to $6,000.

All Charts courtesy of Trading View–BitFinex

This is not Investment Advice. Do your Research.

[ad_2]

Source link