[ad_1]

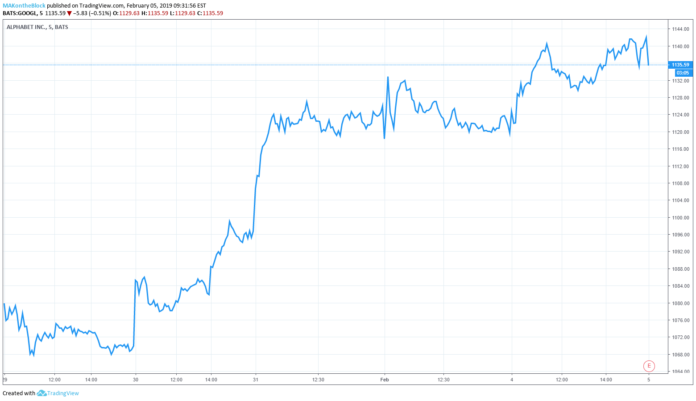

Google delivered higher than expected revenues and earnings per share in its fourth-quarter 2018 results. Yet Google stock dropped 3% in after-hours trading and fell over 2% in premarket trading.

Google’s Profit Margin Tightens

Analysts hoped that google-parent Alphabet would deliver $31.33 billion in revenue and earnings per share of $10.86. The internet behemoth delivered $31.85 billion and earnings per share above expectations at $12.77.

Concerns grow over how Google, and others, use our data and share it with advertisers. The number of internet users choosing alternative browsers and engines, with less advertising, like Brave, is growing. But Google’s advertising revenue still rose hitting $32.6 billion compared to the third-quarter of 2018 at $28.95 billion. Mobile search advertising revenue is Google’s largest driver of growth.

Google earnings report beats expectations, but rising costs could weigh on the company. Insights via @CMEGroup. pic.twitter.com/39L6YMgzmv

— TicToc by Bloomberg (@tictoc) February 5, 2019

Spending is Worrying Investors in Google Stock

Capital expenditure for Alphabet increased from $5.66 billion to $7.08 billion and profit margins tightened. It says this consists of “investments in office facilities, data centers and servers.” Early 2018 also saw significant real estate purchases.

R&D spending has risen 40% and Alphabet’s total headcount has increase by 4,000 going into the last quarter of 2018.

The company saw revenue growth in hardware sales, Google Play, G Suite subscriptions and Google Cloud. However, Alphabet’s “Other Bets” including Waymo, Google Fiber, Verily and its investment divisions reported operating losses of $1.33 billion on a relatively low revenue figure of $154 million.

Robert W. Baird & Co senior analyst Colin Sebastian speaking of Google’s stock performance after its earnings report told Business Insider that:

Stock was weak due to lower than anticipated operating profit and much higher levels of capital expenditures.

Staying Ahead of the Game

Ali Mogharabi, a senior analyst at Morningstar agreed echoing Google’s drive to “consistently invest in the long run” as being behind capital expenditure increases. Mogharabi thinks that content acquisition for YouTube and increasing R&D headcount will pay off for Google:

If they want to stay ahead of the game, they’re going to need to continue to invest.

Alphabet CFO Ruth Porat worked to allay any concerns saying capital expenditure growth will “slow meaningfully” over time but explained that:

We continue to invest in both compute requirements and for office facilities.

Data center growth, for example, is vital for Google to achieve its cloud provision plans competing with the likes of Amazon, Microsoft, and IBM. By early 2018 cloud computing was reportedly already a $1 billion per quarter revenue generator for Alphabet. Though the recent earnings report did not breakdown cloud revenue. Artificial intelligence (AI) developments are also likely to drive future growth for Google and a source of at least some of its R&D expenditure.

As the leading digital companies face maturing market segments and challenges to their monopolies, the likes of Google, Apple and others must look to new markets to retain their success. JPMorgan is speculating this week that Apple’s cash stockpile could lead it to buy into other markets, like streaming, with an acquisition of Netflix.

With yesterdays after trading activity and premarket moves, Google stock could go either way today.

[ad_2]

Source link