[ad_1]

The bitcoin headlines and commentary seem all doom, gloom, and despair:

Bitcoin is about to do something it has never done before — hint: it’s not good –MarketWatch

Bitcoin Is Now Officially In Its Longest Bear Market Ever –CoinDesk

Bitcoin [BTC] creates new record; continues downward spiral for the sixth consecutive month. –AmbCrypto

Market analyst Jani Ziedins told Market Watch: “There are cases like the dot-com bubble where the revolution was legitimate, the investors just got excited a little too early. Will bitcoin do the same in 10 years? I have my doubts.”

That is exactly what has been happening with bitcoin leading up to and since the glorious heights of the speculative bubble that drove the world’s first cryptocurrency to a price of $20,000 USD per 1 BTC on Dec 17, 2017 before the bubble popped.

As with technology stocks in the late 1990s, excitement about the technology’s possibilities led to an early rush of over-investment.

Investors knew there would be a lot to gain from being a part of the Internet revolution, but they invested too much, too early, and sunk their wealth in technology start ups that had high hopes, but weren’t able to manifest them before running out of cash.

This happened for three reasons:

1) The Internet had not yet reached scale.

Investors, along with entrepreneurs and the computer and software engineers who were leading the way, understood the enormous potential of the Internet, and quite correctly knew that it would form the basis for a global economic and cultural revolution unlike anything before it. They knew the opportunities for commerce would exist on an unheard of scale.

And so they devoted the resources to it that were commensurate with the scale of the opportunities for profit, but although it inevitably would in a few years, the Internet had not reached that scale yet, and so too much money was chasing after not enough opportunities.

Gary Vaynerchuk: “The Internet Has Reached Scale” (6:40)

With cryptocurrency, which is the Internet of money, we are currently in that earlier stage of platform development and market adoption, somewhere between the “lunatic fringe” and the “visionary” stage. Capital is chasing after a potential that has not yet reached the scale that the visionaries have good reason to believe it will.

It is important to note that for each new major technological paradigm shift over the last 200 years, the time to mass market adoption decreases. Building on the opportunities and connectivity of the previous paradigm shift, each new one reaches scale faster than the last. So it will likely not take as long for crypto to reach scale on an Internet that already has.

2) Investors didn’t understand what they were investing in.

Hope is not as strategy. Luck is not a factor. Fear is not an option. -James Cameron

They invested too early, and they invested too carelessly. They invested as if the rising tide of technological progress would raise all boats, but this is not how it works. When the tide goes out, as Warren Buffet likes to say, you find out who was swimming naked.

Because dot com investors in the late 90s gave into the temptation to be lazy, to believe that they could get profits without doing the work of learning more and thinking harder, they wasted their money on hyped companies that didn’t have a substantive business plan.

They weren’t conscientious and painstaking enough to learn enough about the nascent technologies to distinguish between hype and substance.

And flush with cash, many of these tech startups also gave into the belief that progress was inevitable, that they couldn’t lose, maybe even that they deserved all the newfound capital that had infused their company with cash along with the rest of their industry, that they had already earned it, that they had arrived.

In the 1990s many software developers and tech enthusiasts reviled Bill Gates as a monopolist who threatened the principles their tech revolution stood for. But a major reason for his success was Bill Gates was very conservative about growing Microsoft.

(As he explains on this interview with Ellen, many of his employees were older than he was and had families to support. He was very cautious about hiring within the business’s means because he never wanted to miss payroll or layoff employees who had kids.)

Other tech entrepreneurs weren’t so prudent, and so they burned through capital on lavish expenses for their business. They hired too many people too fast. They rented nicer offices than they needed. Cash is king. When your startup runs out of cash it’s game over.

So it went with the cryptocurrency industry up until the bubble popped in Dec 2017.

3) It’s hard to time exponential growth

As Ray Kurzweil noted in his seminal 2005 book, The Singularity Is Near: Technological progress, especially information technology, advances at an exponential rate.

Ray Kurzweil is Google’s chief engineer and the planet’s foremost authority on artificial intelligence (he’s the man who taught computers how to read by viewing a page of text through the lens of a digital camera, and to do so he had to deconstruct how the human brain recognizes letters from the signals sent to it by our eyes).

An exponential growth rate is one that tracks much like a linear growth rate at first.

Or put in more plain terms: exponential growth is change that happens slowly at first, then suddenly- all at once! Rates of adoption for information technologies that prevail always follow this exponential trajectory.

Timing your tech start-up’s venture into an emerging industry presents a unique challenge when the growth in opportunities is exponential.

Partially because the hunter-gatherer brains we have inherited from our recent apex predator ancestors evolved to anticipate and respond to linear changes.

The ancient hunter’s brain calculated:

“If this gazelle is running in this direction at a relatively fixed, constant, linear rate, and I run in this direction at a linear rate, we’ll meet over there and I’ll get close enough to hurl this spear at a fixed, constant, linear rate through the air to connect with my family’s dinner.”

Exponential rates of change are unusual to us and defy our intuitions. But this limitation can be overcome with more intelligence– with a critical analysis of our industry and competitors, and by checking our intuitions against what the data tell us is happening.

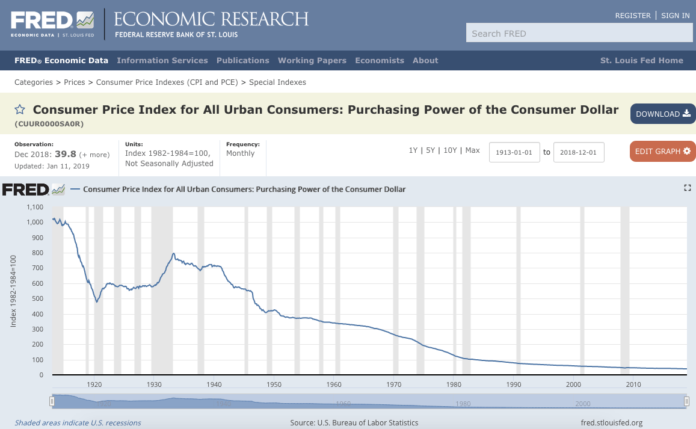

Bitcoin Price’s 6 Month Bear Market Has Nothing On The U.S. Dollar’s 79 Year Slide Into Monetary Oblivion

Let’s just keep it real okay:

Bitcoin experienced a bubble for the reasons outlined above, and its value against the U.S. Dollar is still adjusting as a result of it, but Bitcoin was designed in such a way so that the graph of its value over the long term will chart a path in the exact opposite direction of the inflationary USD. Rocketship rides are always bumpy during liftoff.

[ad_2]

Source link