[ad_1]

By CCN.com: Bitcoin bull and the CEO of digital assets merchant bank Galaxy Digital, Michael Novogratz, has warned that the hacking suffered by the world’s largest cryptocurrency exchange Binance could invite more investor scrutiny. In Novogratz’s view, this can only be bad for the industry.

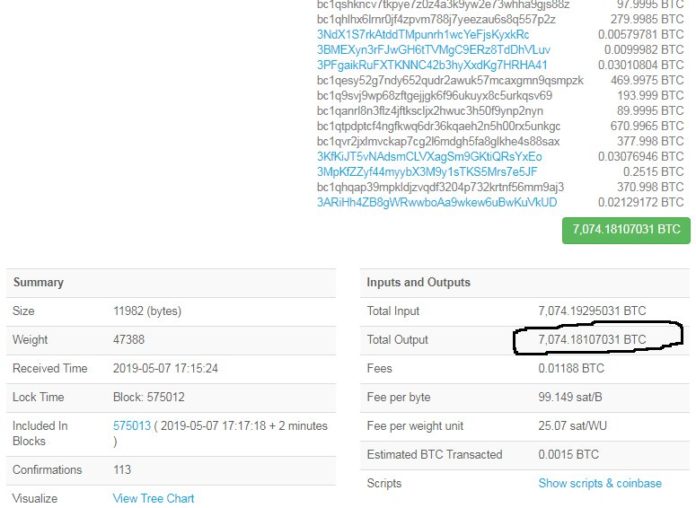

Binance Loses 7074 Bitcoins

The crypto bull was reacting to Binance’s statement that the attackers had targeted the exchange’s bitcoin hot wallet. The exchange lost about 2 percent of its total bitcoin holdings.

2 percent is a lot when your the worlds largest crypto exchange. No way to spin this as good. Will certainly bring more scrutiny from regulators. https://t.co/uqFH3tStCp

— Michael Novogratz (@novogratz) May 7, 2019

The security breach occurred on Tuesday. The entire 7,074 bitcoins stored on the exchange’s BTC hot wallet were stolen.

Using a variety of techniques including viruses and phishing, the hackers were able to obtain privileged information. This included user API keys and 2FA codes, per a statement released by the exchange.

Bitcoin Bull Novogratz Is Right – Look at What Happened in Japan

Among the countries with high cryptocurrency adoption rates, Japan has suffered more than its fair share of crypto exchange hackings. As evidence of what Novogratz is afraid of, last year’s hacking of Coincheck unsurprisingly resulted in increased scrutiny and actions by Japan’s regulator Financial Services Agency (FSA).

For instance, the FSA’s Virtual Currency Exchange Services Study Group has proposed several measures aimed at protecting investors. This includes requiring cryptocurrency exchange to maintain reimbursement funds. These funds would be used to compensate users in case their digital assets were stolen from a hot wallet.

Specifically, the group proposed that the fund contain the same digital assets as those that were deposited by users. This means that for every bitcoin deposited online, the exchanges would be required to hold another bitcoin offline.

Bitcoin Exchanges Raided, Restrictions Placed on Hot Wallets

The regulatory actions and scrutiny did not stop with proposals, however. Just last month Reuters reported that crypto exchanges will be required to enhance internal oversight of cold wallets.

“Japan to require crypto exchanges to bolster internal oversight: source” – https://t.co/l5LPaHoXIZ

— NoahT (@ThaoNgu21073825) April 21, 2019

This came after the regulator had restricted the use of hot wallets. This was after the FSA determined that the risks of internal theft remained in the case of offline storage.

More evidence of enhanced regulatory scrutiny and actions emerged last month when the FSA raided two bitcoin exchanges. These were Fisco Cryptocurrency Exchange and Huobi Japan Inc. The FSA was investigating their internal oversight measures such as anti-money laundering controls and customer protection.

Binance: Funds are SAFU

Novogratz’s main worry seems to be that the regulators will be motivated by the need to protect investors. In the case of Binance, the CEO, Changpeng Zhao, has indicated that users will be compensated fully.

Thanks for the support, really appreciate it. But currently no need. We will cover the loss from the #SAFU fund, there is enough. We are hurt, but not broke.

We are working hard to resolve the issue, so that everyone can deposit and withdrawal again. Will take some time. https://t.co/0j4J0fk99W

— CZ Binance (@cz_binance) May 8, 2019

Not all users of cryptocurrency exchanges have been fortunate though as history shows. After the hacking of Mt Gox in 2014, the exchange had stop operations. Five years later, users are still waiting to be compensated.

And even though it wasn’t a hacking, recently the Canadian crypto exchange QuadrigaCX ceased operations placing user’s funds in limbo. This was after the firm’s CEO allegedly died making it impossible to retrieve cryptocurrencies held in a cold wallet only he had access to. Again users are still waiting to be compensated and they may never get their crypto assets back.

[ad_2]

Source link