[ad_1]

The Stock Exchange of Thailand (SET) announced Wednesday in a statement that plans are underway for the development of a digital asset platform ready to roll out in 2020.

SET is working along with several third-party financial collaborators to develop the software platform that it envisions “leveling up investment experiences for more convenience and higher speed” for its clients as well as offering exchange services for digital assets.

These include FundConnext’s mutual fund platform, which will be linked with a global fund processing platform operated by Clearstream named Vestima.

Join CCN for $19.99 per month and get an ad-free version of CCN including discounts for future events and services. Support our journalists today. Click here to sign up.

SET President Pakorn Peetathawatchai said:

“SET strongly believes that the collaboration with all stakeholders in enhancing the existing infrastructures that are a backbone of the current ecosystem and in building the new digital asset ecosystem will be a turning point that will take the Thai capital market to the next level.”

In addition to offering Thai investors a more robust platform for trading global securities, including cryptocurrencies, SET is going completely paperless, allowing clients to open paperless accounts digitally through electronic identification verification

The Thai stock exchange reportedly had a three-year plan for the cryptocurrency platform but scrapped it in favor of a 2020 target for supporting crypto trades on the SET.

The plans are similar to those of some major European securities exchanges in Germany and Switzerland that announced upcoming crypto exchanges of their own last month.

Thai Government Regulators Are Both Heavy-Handed and Friendly to Crypto

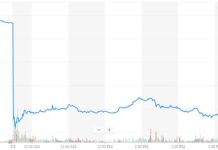

Thai financial regulators want to create a welcoming environment for digital assets to grow the country’s wealth, but they haven’t been welcoming to the cryptocurrencies they outright banned.| Source: Shutterstock

Thai securities regulators, which have already approved a dedicated initial coin offering (ICO) portal, are cooperating with the crypto industry with the hopes of attracting direct foreign investment by making Thailand a crypto friendly jurisdiction.

At the same time, Thailand’s Securities and Exchange Commission has been heavy-handed and draconian about picking winners and losers in the cryptocurrency industry instead of allowing the market to work.

Ostensibly these rather odious strictures on digital commerce in Thailand are for the protection of investors, but the Thai SEC has outright banned bitcoin cash (BCH), Litecoin (LTC), and Ethereum Classic (ETC) from initial coin offerings, investments, and base trading pairs with other currencies on digital asset exchanges.

Although Thailand is nominally a parliamentary democracy, it has been under the de facto rule of a military junta since 2014, yet the country is making remarkable strides in economic development, such as SET’s exchange modernization, which is now charging full steam ahead amid political instability and troubled elections.

[ad_2]

Source link