[ad_1]

By CCN: Ridesharing company Lyft launched its $2 billion IPO to much fanfare, and investors piled into Uber’s largest competitor ahead of its own massive IPO. Since then, however, Lyft’s stock price has fallen off a cliff and just keeps on dropping, seemingly with no bottom in sight.

Why is the market rejecting Lyft, and should investors go anywhere near it anytime soon?

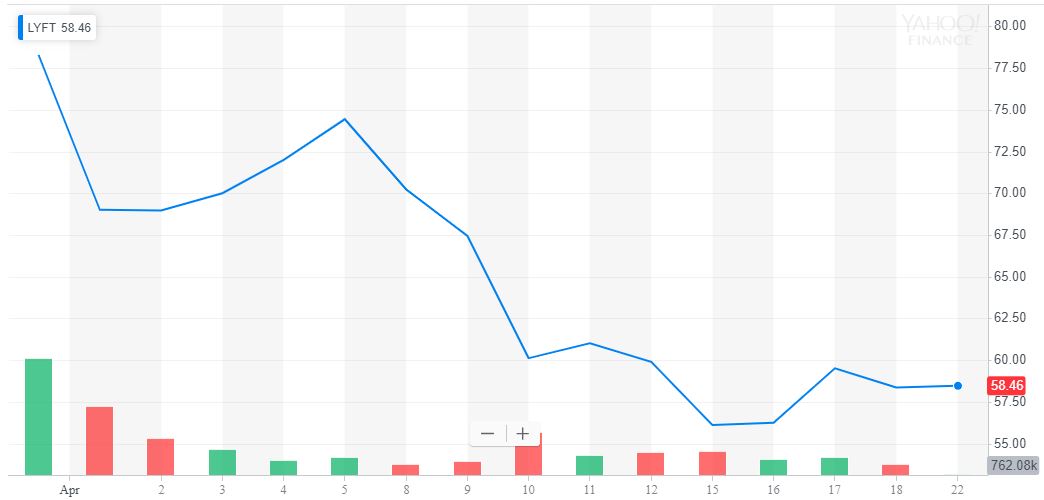

LYFT Shares Keep Hitting Lower Lows

Unfortunately for Lyft investors, it does seem that a sub-$60 share price is here to stay. Its price chart shows a series of brief bounces culminating in lower lows each time, and there is nothing to suggest that the trend is over.

Lyft stock has not done shareholders any favors since the company’s high-profile IPO. | Source: Yahoo Finance

Its current price level just above $58 is $14 lower than its IPO price, and this could get worse. Already, CCN reported earlier this month that seasoned investors cleaned out less-experienced retail investors who bought into the hype and invested in Lyft stock immediately after the IPO. Since then, a good number of retail investors have decided to cut their losses and exit the market, driving Lyft’s price down further.

Disgruntled investors have already filed a lawsuit against Lyft for allegedly overhyping the IPO.

Why Investors Can’t Dump Lyft Stock Fast Enough

To put it bluntly, Lyft suffers from a balance sheet problem. Like so much of Silicon Valley, the company has long prioritized user growth over actual revenue and profitability. The rationale is that with sufficient user numbers, there will always be an opportunity to monetize, regardless of how much money the company is making at the moment.

This approach worked for many startups, notably Amazon – which did not turn a profit for several years – and Facebook, which had IPO investors initially worried about its business model for mobile advertising.

In the case of Lyft, however, the market is looking beyond user number and asking fundamental questions about its long-term profitability. Clearly, the answers have not been satisfactory.

It probably does not help that Lyft itself in its IPO prospectus said:

“We have a history of net losses and we may not be able to achieve or maintain profitability in the future.”

In other words, Lyft has not promised investors that it will ever become a viable business, and they are being told to make an investment decision based on nothing more than a leap of faith. Investors are voting with their feet.

Finance Prof: Investors Finally Seeing Past Rideshare Hype

Lyft stock is reeling because starry-eyed investors have sobered up.| Source: REUTERS/Lucy Nicholson

Speaking exclusively to CCN, Robert Johnson, Professor of Finance, Heider College of Business, Creighton University said:

“If a financial advisor approached you and said you should invest in a company that has a history of net losses and whose management admits may not be able to make money in the future, you would no doubt be looking for a new financial advisor. Yet, that describes Lyft. I believe Lyft’s stock is tanking because the early hype is over and investors recognize that the firm must eventually make money. And, that path to profitability is unclear.”

Despite its rapid revenue growth, Lyft’s losses are only getting bigger as Uber continues to gobble up real estate in the rideshare market space – and plots its own mammoth public offering.

In the words of Dr. Johnson:

[ad_2]

Source link