[ad_1]

Over the past several months, some of the biggest crypto mining centers and facilities in Europe and Asia have closed amidst lowering cryptocurrency prices and a decline in overall market activity.

This week, according to FT, Bladetech, a startup that emerged in March to create the largest Bitcoin mining facility in the U.K. has put its plans on hold due to the 85 percent correction of the cryptocurrency market.

No Profit in Crypto Mining

Aron van Ammers, the founder and chief technical officer at Outlier Ventures, said that the current price of Bitcoin at around $4,000 has squeezed out the profits from the miners in the global sector.

Some researchers estimated that miners have been mining Bitcoin and other major crypto assets at a loss since mid-2018 as the value of cryptocurrencies dropped below the breakeven cost for miners.

BitMEX Research, for instance, a research arm of cryptocurrency exchange BitMEX, claimed that Bitmain, a cryptocurrency mining equipment manufacturer reportedly valued at $15 billion, sold most of its mining equipment at a loss earlier this year.

This analysis implies Bitmain are currently loss-making, with a negative profit margin of 11.6% for the main S9 product and a margin of over negative 100% on the L3 product. In reality costs are likely to have declined so the situation may not be as bad, however we think it is likely Bitmain are currently making significant losses,

the researchers said, adding that the company had too many miners in its inventory.

The research suggested that the company struggled to sell a large portion of its Antminer S9 miners, its flagship mining equipment, possibly due to the decline in demand for Bitcoin mining.

The researchers added:

Another reason for these low prices and apparent losses may be that Bitmain has too much inventory on the balance sheet. As at March 2018 Bitmain had $1.2 billion of inventory on the books, equal to 52% of 2017 sales. Bitmain may therefore have had to suffer inventory write downs, which could have generated further losses in addition to the loss making sales.

In a period in which the world’s most dominant cryptocurrency mining corporation is finding it challenging to generate profits, smaller mining centers, and individual miners are expected to suffer even bigger losses.

One cryptocurrency bank executive said that miners are struggling so bad that “they are hating life,” and miners will not be able to generate profits until either the price of Bitcoin increases or the hash power of the Bitcoin network declines, ruling out the competition.

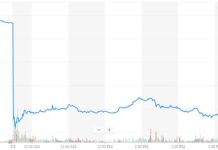

The hash power of Bitcoin has declined to July levels, to around 45 exahash. In consideration of the fall in the Bitcoin price, the hash rate has not dropped by much.

Miners Will Likely Continue to Mine at a Loss

The minimal decline in the hash power of the Bitcoin network also suggests that miners are mining at a loss looking to generate profit as the price of the asset goes up in the future, as a long-term play.

Currently, it is difficult for miners to completely shut down their facilities and shift away from mining because all of the mining equipment they’ve acquired and the contract with electric grid operators are established as long-term agreements.

Featured image from Shutterstock.

[ad_2]

Source link